Updated at 1pm PT on 12/16/21: Updated my Discover It Credit Card link with a new $100 referral link.

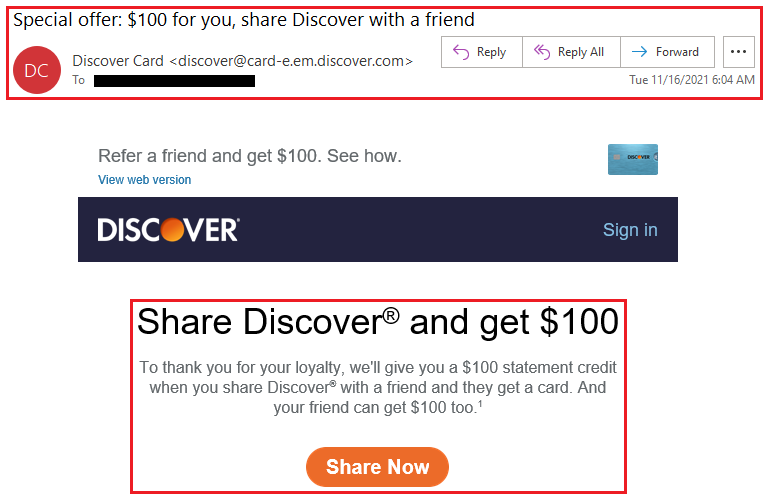

Good afternoon everyone. This morning, I received an email from Discover regarding a targeted referral bonus on the Discover It Credit Card. If you received this email, you can create a special referral link that has a $100 sign up bonus after first purchase and you will also receive a $100 referral bonus. The standard offer is $50 for both the sign up bonus and referral bonus, so this is an increased offer that is good through December 31, 2021. The subject line is “Special offer: $100 for you, share Discover with a friend.” If you didn’t receive the email, you can see if you are targeted by signing in here and going to the referral page.

Here are the terms and conditions from the bottom of the email. You can earn a maximum of $500 in referral rewards.

1. You will receive a $100 statement credit referral reward if your friend applies for the specific offer you send via the link provided and is approved now through December 31, 2021. During the offer period you may earn a maximum of $500 in referral rewards. You are not eligible to refer a friend if you have a Discover it® Secured Credit Card, or Discover it® Business Card. Your account must be in good standing to receive your referral reward. Each eligible friend will receive a $100 statement credit after making a purchase that posts to their account within three months of opening a new Discover account. Existing Discover cardmembers and those who have opted out of receiving marketing communications from Discover are not eligible referrals. You will not be notified whether a specific referral was approved or declined. Please allow up to 1-2 billing periods for the statement credit to post to your account after each referral is approved. Statement Credits you receive may be taxable to you. Please contact your tax advisor. Offer may not be combined with any other introductory offer.

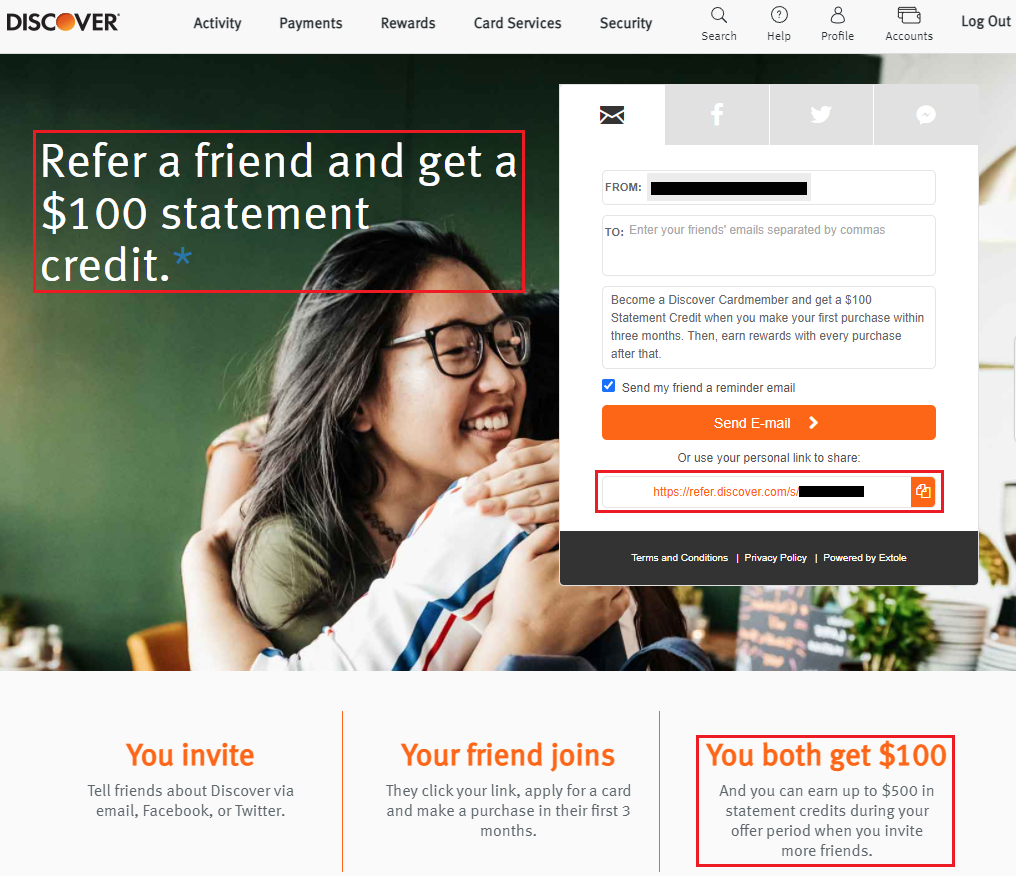

If you are targeted for the $100 sign up bonus and referral bonus offer, you will see the message that says “Refer a friend and get a $100 statement.” You can copy your unique referral link or send an email from that page.

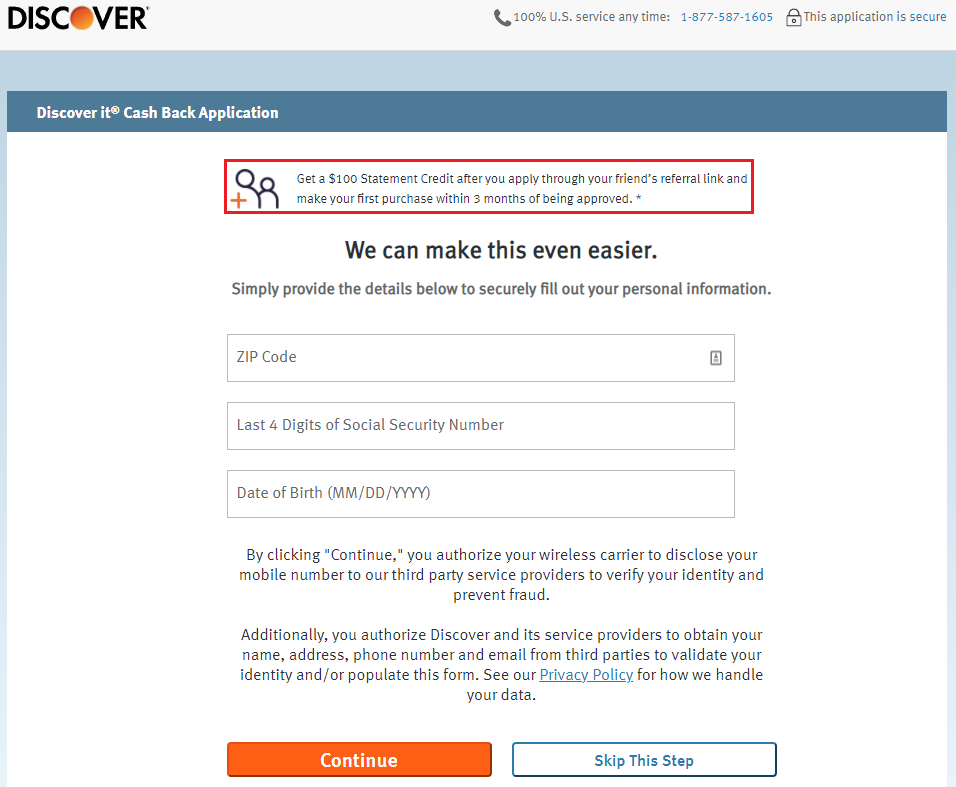

When your referee clicks the link, they will see the message at the top of the application that shows the $100 sign up bonus after first purchase.

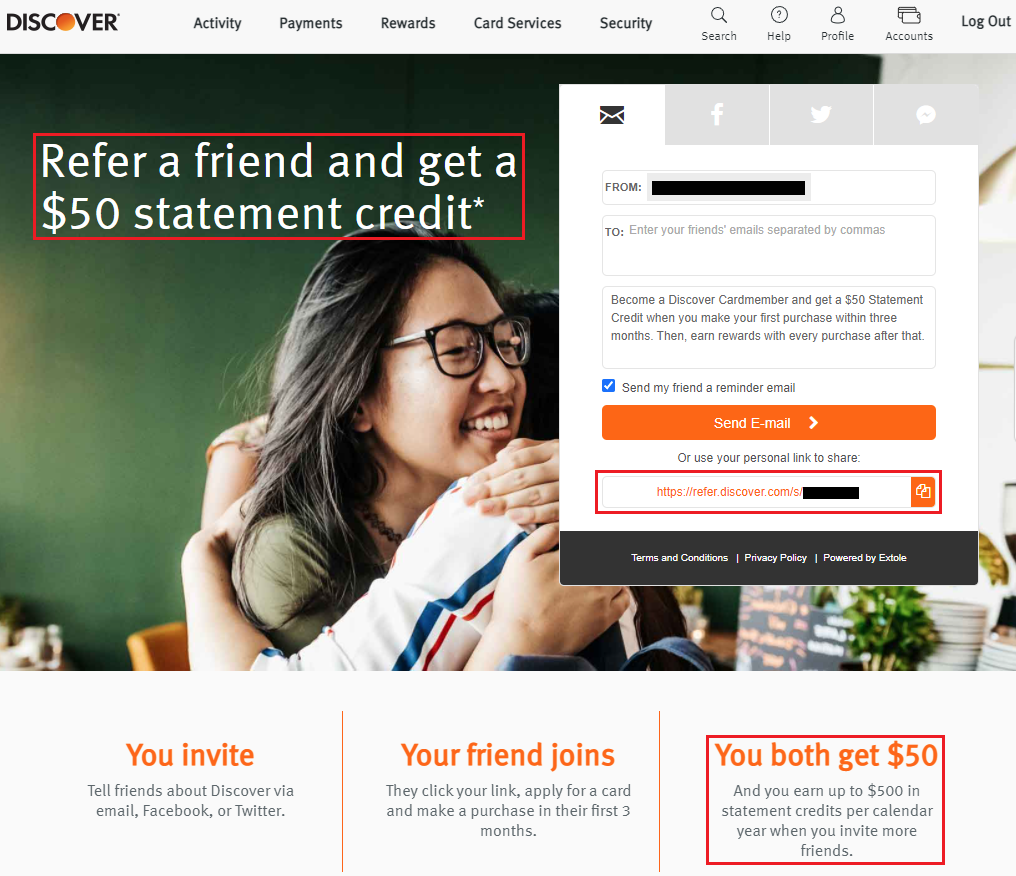

If you are not eligible for the increased referral offer, you will see the standard $50 refer a friend offer. I have 2 Discover It Credit Cards and one has the $50 offer and the other has the $100 offer. The links are unique.

If you are interested in this credit card, here is my referral link that has the $100 sign up bonus after first purchase. I think I can refer more than 5 people, but I will only earn the $100 referral bonus on the first 5 approvals (due to the $500 referral maximum). If you have any questions, please leave a comment below. If you are targeted for this offer, please feel free to post your referral link in the comments section too. Have a great day everyone!