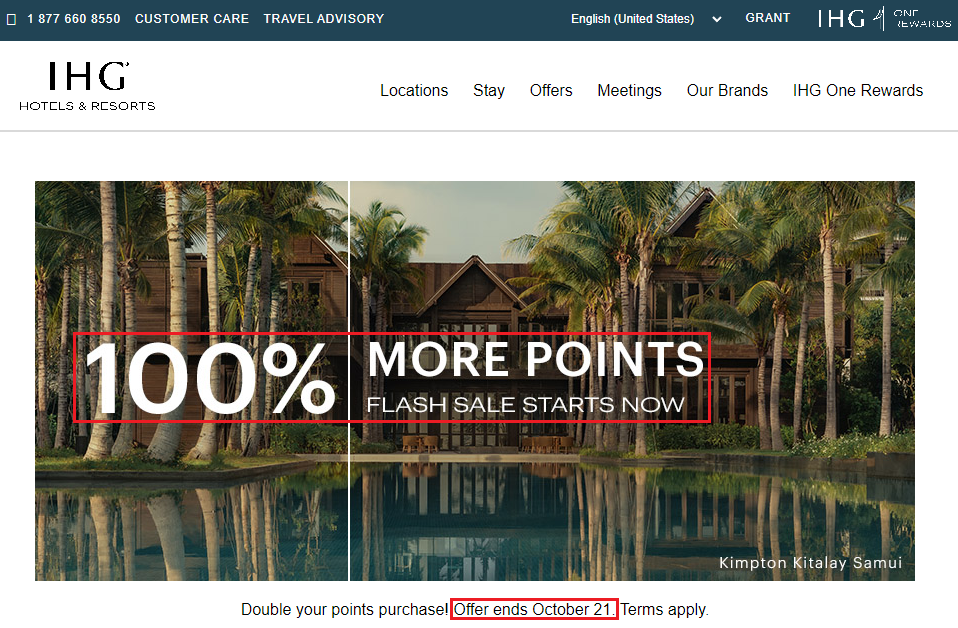

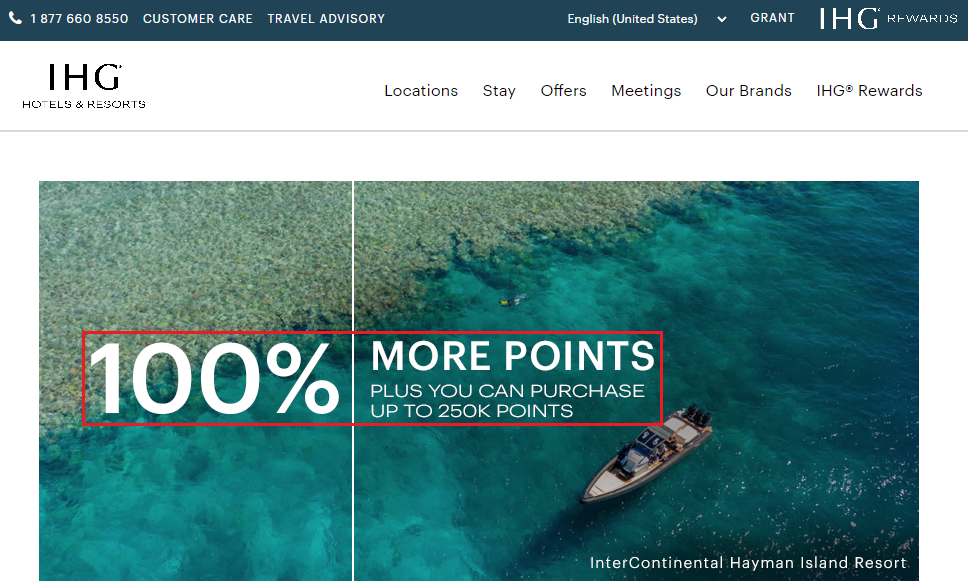

Good afternoon everyone, I hope you had a great weekend and your Cyber Monday is going well too. Since everything seems to be on sale today (including travel), I checked all my existing airline and hotel reservations and found a few price drops with Southwest Airlines, IHG Hotels, and Marriott Hotels. I’m sure other travel providers have discounts too, so check your existing travel reservations. First up, a Southwest Airlines flight dropped 5,173 points per passenger for my wife and I to travel after Christmas.