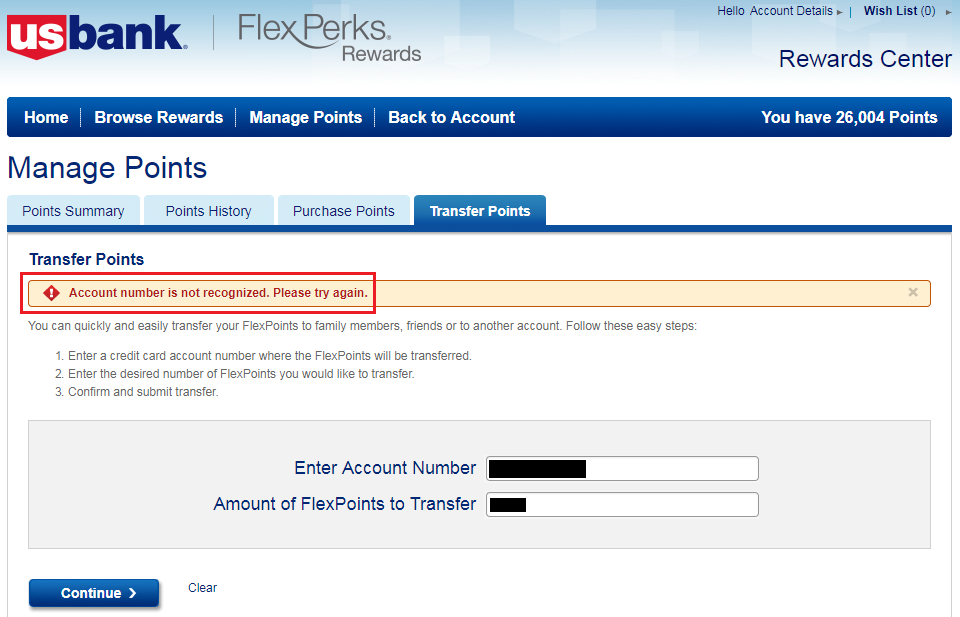

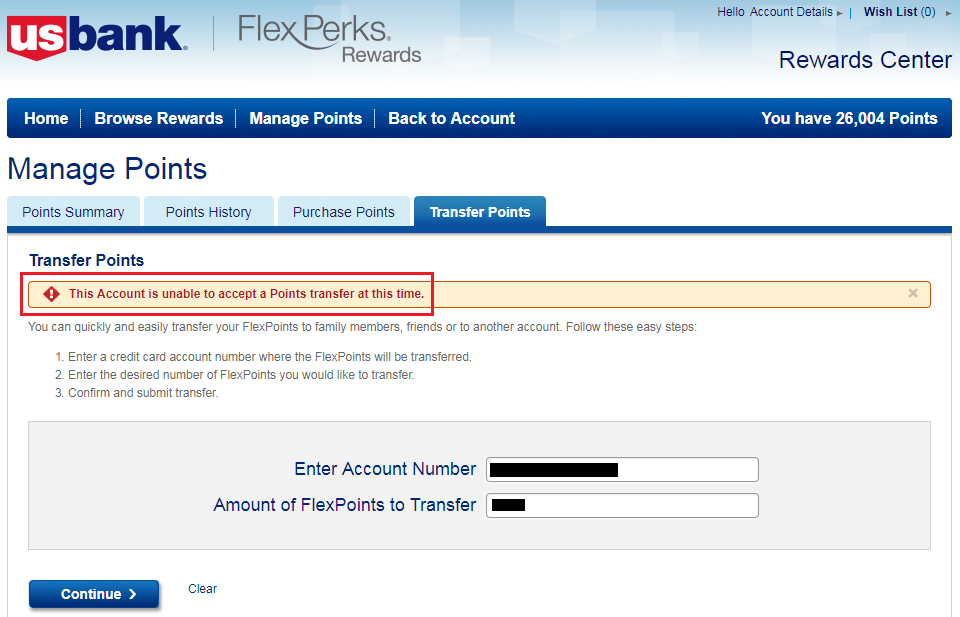

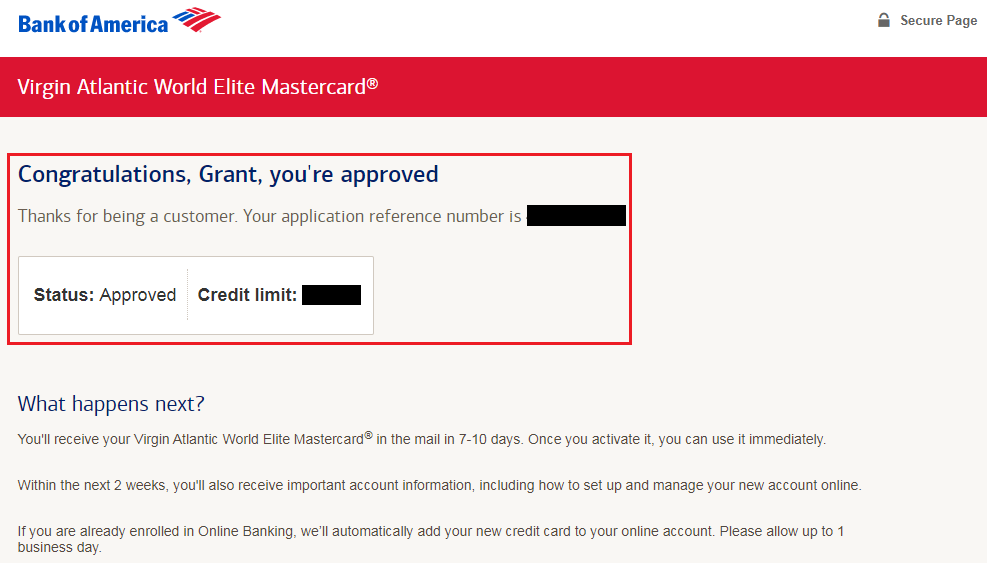

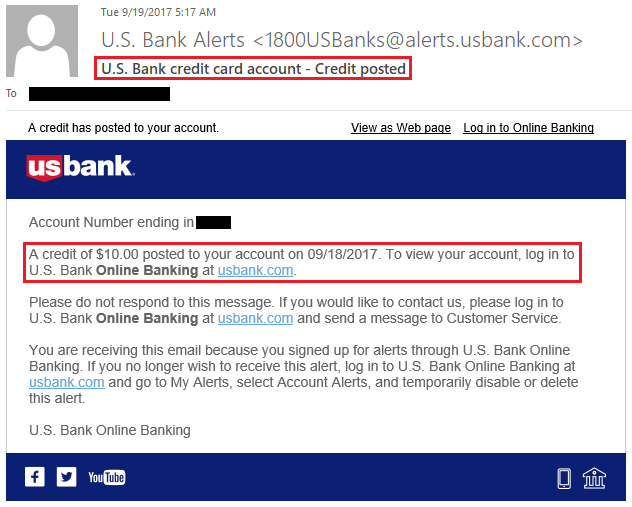

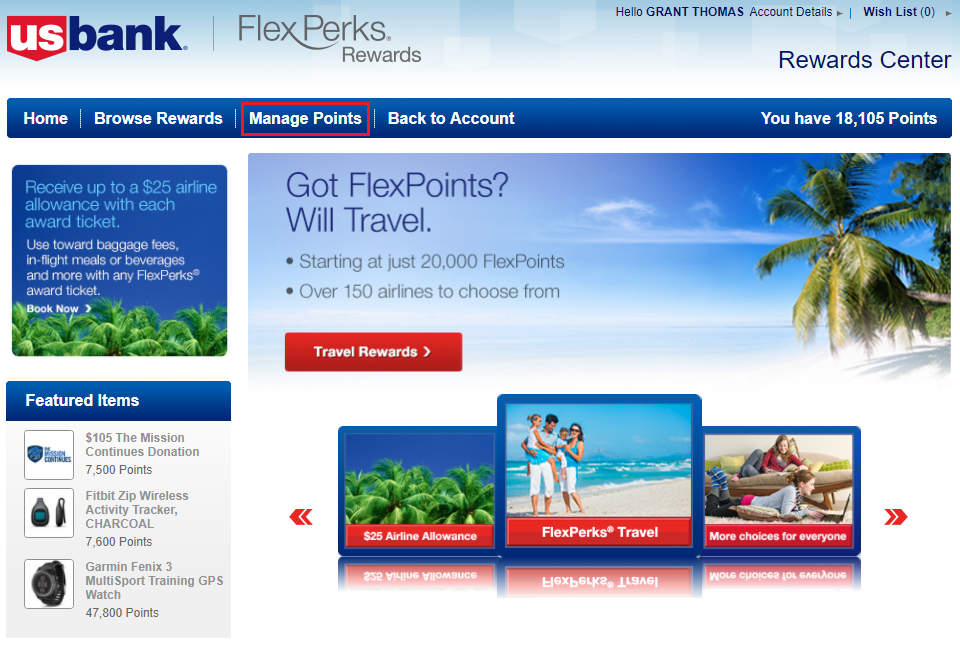

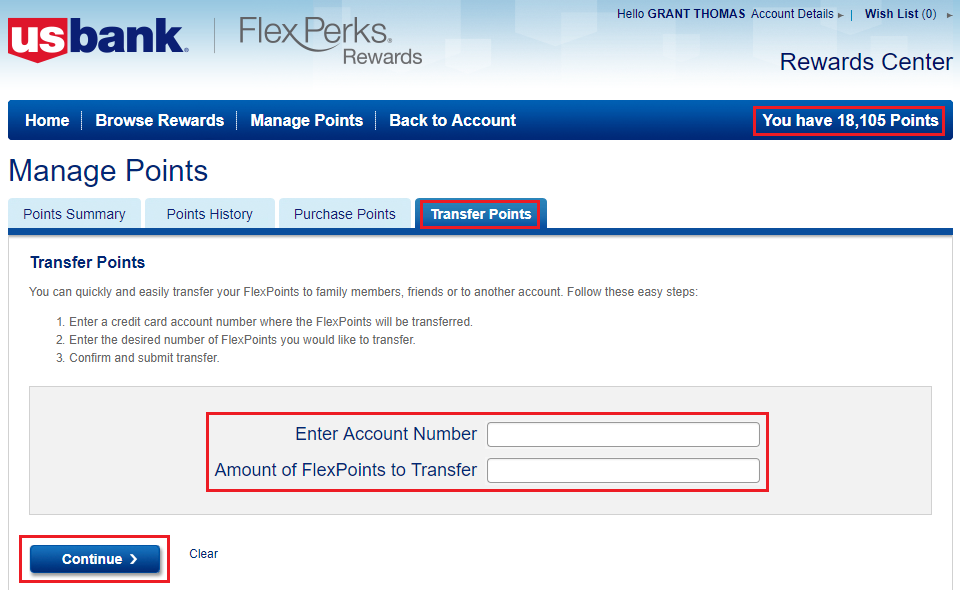

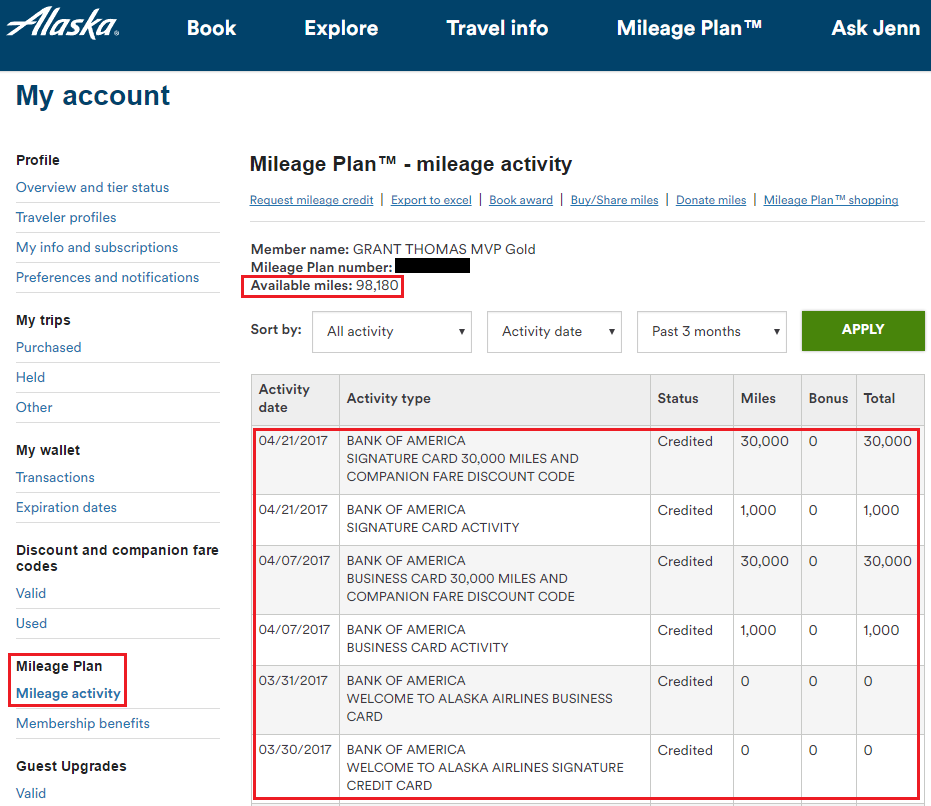

Good afternoon everyone, I have a quick tip to share regarding transferring US Bank FlexPoints from a FlexPerks Rewards account to an Altitude Reserve account. My friend was trying to book a flight with his FlexPoints from his US Bank Altitude Reserve Credit Card, but he was short a few FlexPoints. I had a few extra FlexPoints in my account, so I told him I would transfer the FlexPoints to his account. I recently wrote about the New US Bank FlexPerks Transfer Process (Share & Combine US Bank FlexPoints), so I thought the process would be simple. He sent me his Altitude Reserve account number and Altitude Reserve credit card number and I tried to make the transfer online, but I kept getting an error message. He also has a traditional FlexPerks Rewards credit card, so I tried to send him FlexPoints to his FlexPerks Rewards account, but I kept getting an error message there too.