Good morning everyone, I hope your weekend is going well. I just downloaded my recent Chase checking account statement and saw this message regarding Zelle.

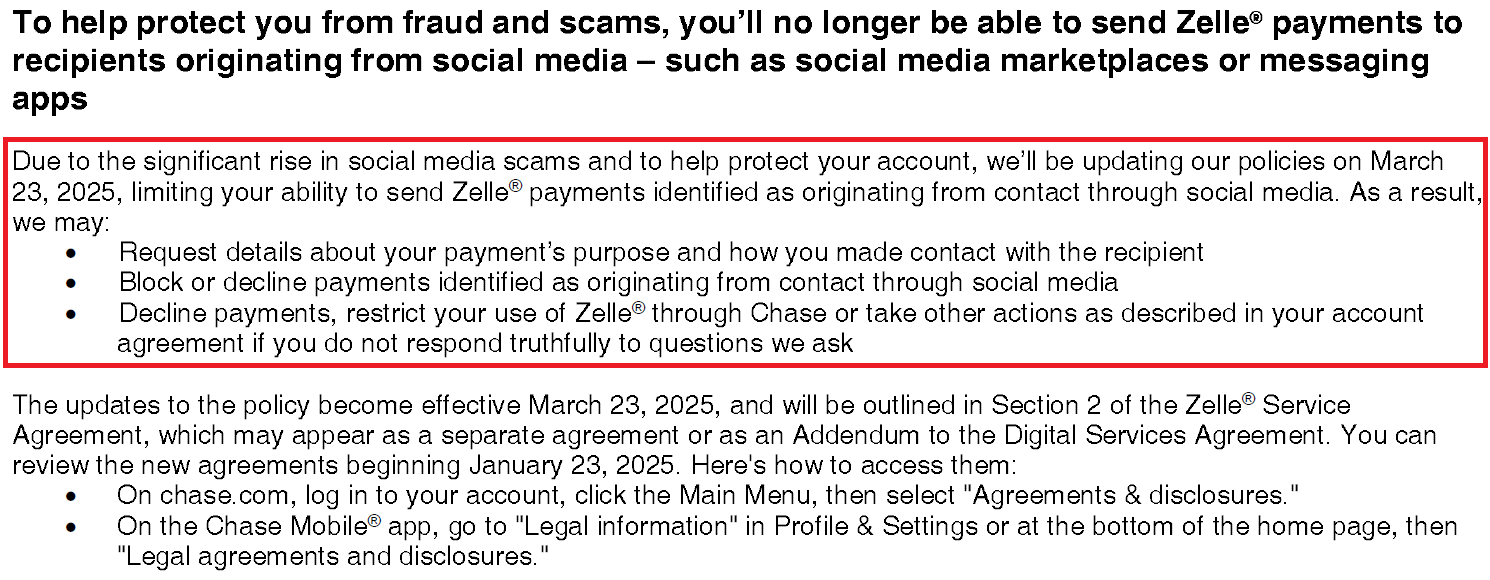

To help protect you from fraud and scams, you’ll no longer be able to send Zelle payments to recipients originating from social media such as social media marketplaces or messaging apps

Due to the significant rise in social media scams and to help protect your account, we’ll be updating our policies on March 23, 2025, limiting your ability to send Zelle payments identified as originating from contact through social media. As a result, we may:

-

-

- Request details about your payment’s purpose and how you made contact with the recipient

- Block or decline payments identified as originating from contact through social media

- Decline payments, restrict your use of Zelle through Chase or take other actions as described in your account agreement if you do not respond truthfully to questions we ask

-

Here is the full message: