Good morning everyone, I hope you had a festive Drinko Cinco de Mayo yesterday. A few weeks ago, I called Citi to convert my Citi Prestige Credit Card into a Citi Dividend Credit Card. During that call, I asked the rep if it were possible to convert my Citi Forward Credit Card to another Citi Dividend Credit Card. She checked the card’s offers and told me that no product change / conversion offers were available. Undeterred, I asked if she saw any other offers on the credit card and she read off a few retention / targeted spending offers. After going through all available offers, I accepted an offer for 3,000 bonus Citi Thank You Points after spending $300 in the next 30-90 days (I don’t remember the exact number of days, since I was planning on completing the spending requirement the following day).

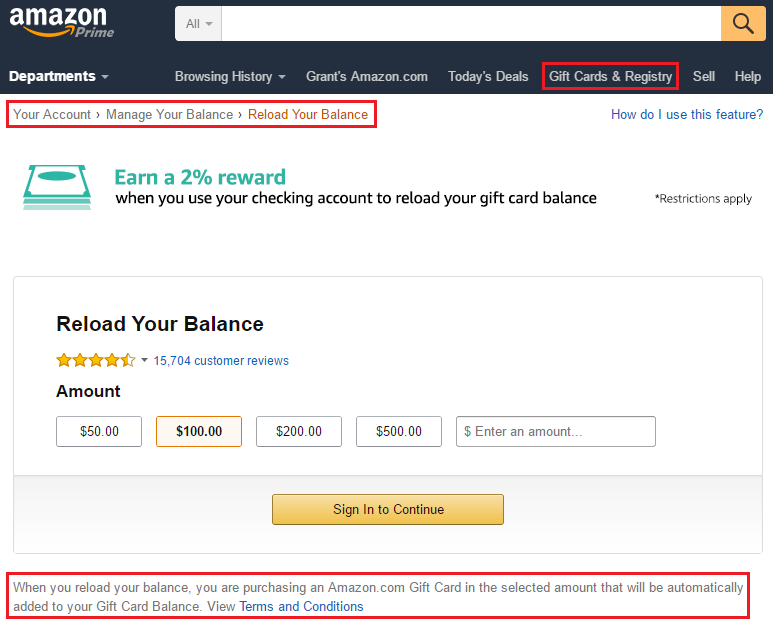

To complete the spending requirement, I loaded / reloaded my Amazon gift card balance with $301 using my Citi Forward Credit Card. A long time ago, the Citi Forward Credit Card used to offer 5x Citi Thank You Points at restaurants and bookstores (including Amazon). But unfortunately, on June 4, 2016, Citi changed the earning rate of the Citi Forward Credit Card from 5x to 2x at restaurants and bookstores, thereby reducing my spending on the card from a lot to $0.

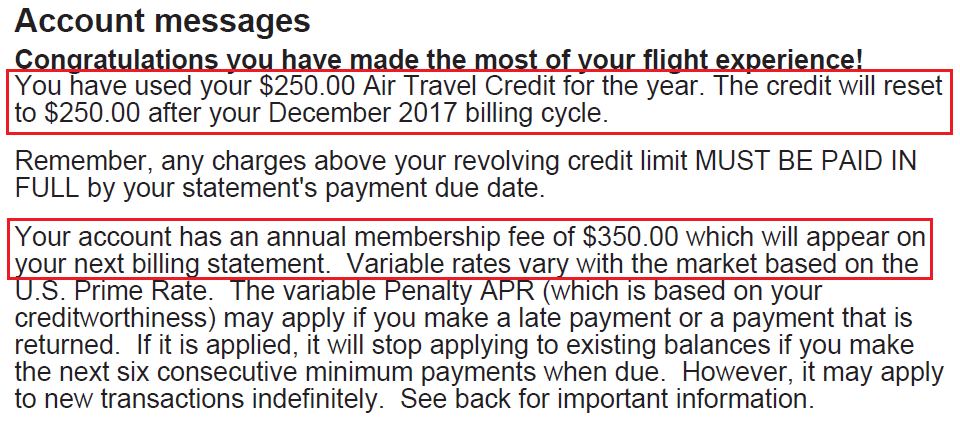

Fun fact: The rep mentioned that as long as there is a purchase once every 25 statement cycles (~2 years), Citi will not close the credit card for inactivity.