Good afternoon everyone. 2 weeks ago, American Express rolled out a bunch of new AMEX Offers on their American Express Business Platinum Card. Those AMEX Offers included earning 5x Membership Rewards Points on Wireless, Shipping, Advertising, Gas and Office Supply purchases. I added / activated those AMEX Offers and was especially excited about the 5x shipping AMEX Offer since I sell stuff on eBay and ship a few packages every month (mainly USPS and UPS). When my Chase Ink Plus Business Credit Card was offering 5x on shipping last year, I racked up a ton of Chase Ultimate Rewards Points. Since that deal ended a few months ago, I was excited to start using my AMEX Business Platinum to earn 5x Membership Rewards Points on shipping purchases.

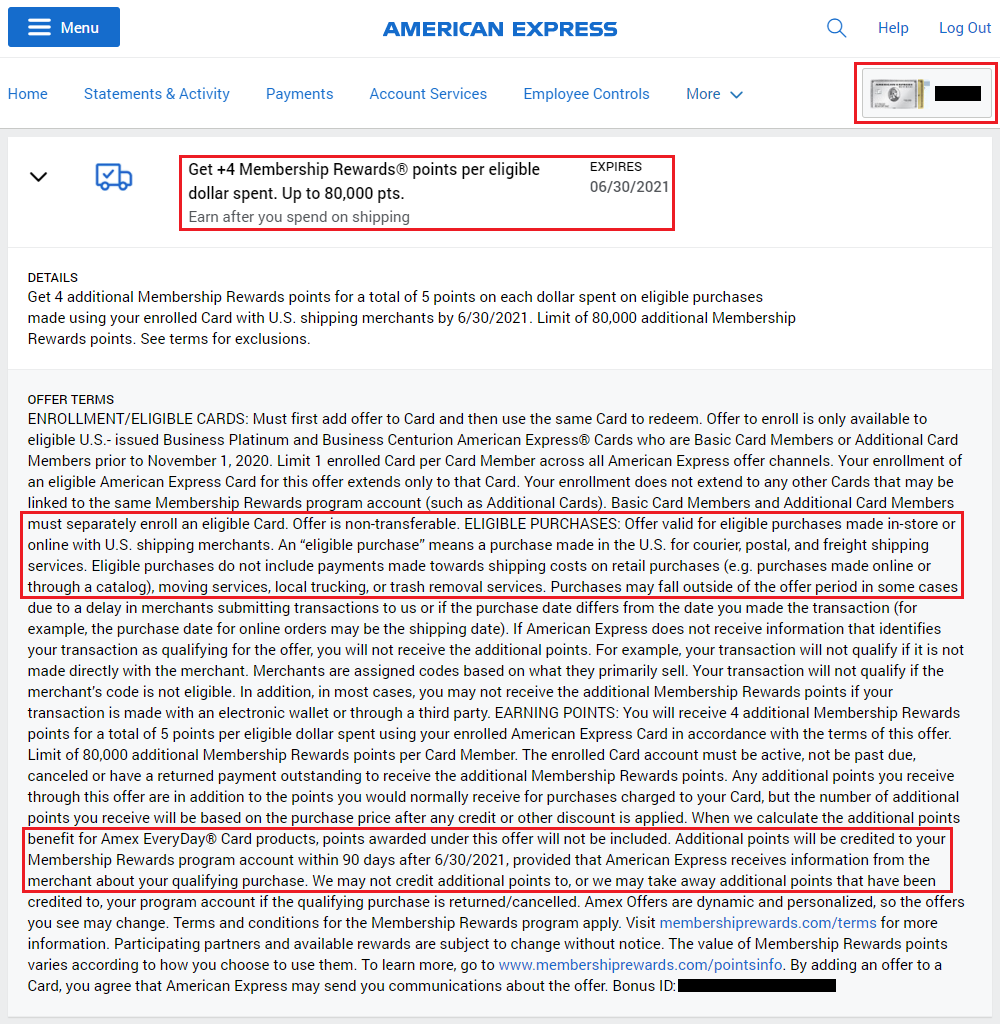

AMEX handles these AMEX Business Platinum AMEX Offers slightly differently where you earn the base rate (1x on shipping) and then earn the 4x bonus points later. According to the 5x shipping AMEX Offer terms, eligible purchases are “made in the U.S. for courier, postal, and freight shipping services” and the additional bonus points “will be credited to your Membership Rewards program account within 90 days after 6/30/2021.” With that info in mind, I wanted to share the turnaround time for the 5x shipping AMEX Offer.