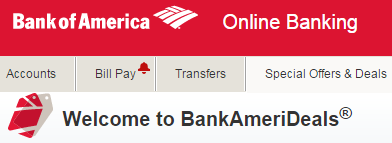

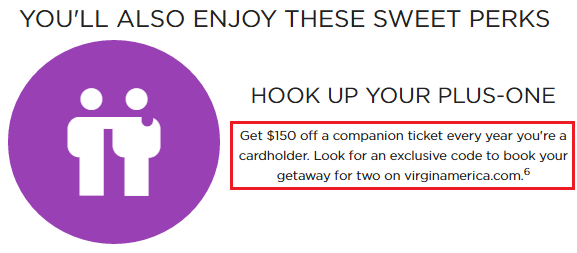

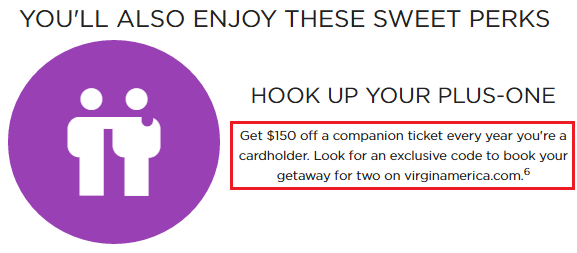

Good morning everyone, I hope you had a great weekend. I played tourist in San Francisco and rode a bright yellow GoCar around the city, down Lombard Street and up to Coit Tower, then I had a delicious dinner at Boudin’s at Fisherman’s Wharf. Anyway, I have an important post for anyone with the Comenity Virgin America Premium Visa Signature Credit Card. I was recently approved for this credit card during my June 2016 App-O-Rama. As a cardmember perk, you get a companion code discount worth up to $150 off a Virgin America flight every year you pay the $149 annual fee (Virgin America’s version of the Alaska Airlines companion pass).

The terms and conditions of the discount companion code say that the code will be emailed 6-8 weeks after you paid the annual fee. I paid the annual fee longer than that, but I did not receive the email from Virgin America (it could have been mistakenly deleted, went to spam, or just never sent – I don’t know what is more likely). In this post, I will show you how to request the missing or lost Virgin America discount companion code.

The terms and conditions of the discount companion code say that the code will be emailed 6-8 weeks after you paid the annual fee. I paid the annual fee longer than that, but I did not receive the email from Virgin America (it could have been mistakenly deleted, went to spam, or just never sent – I don’t know what is more likely). In this post, I will show you how to request the missing or lost Virgin America discount companion code.

Continue reading →