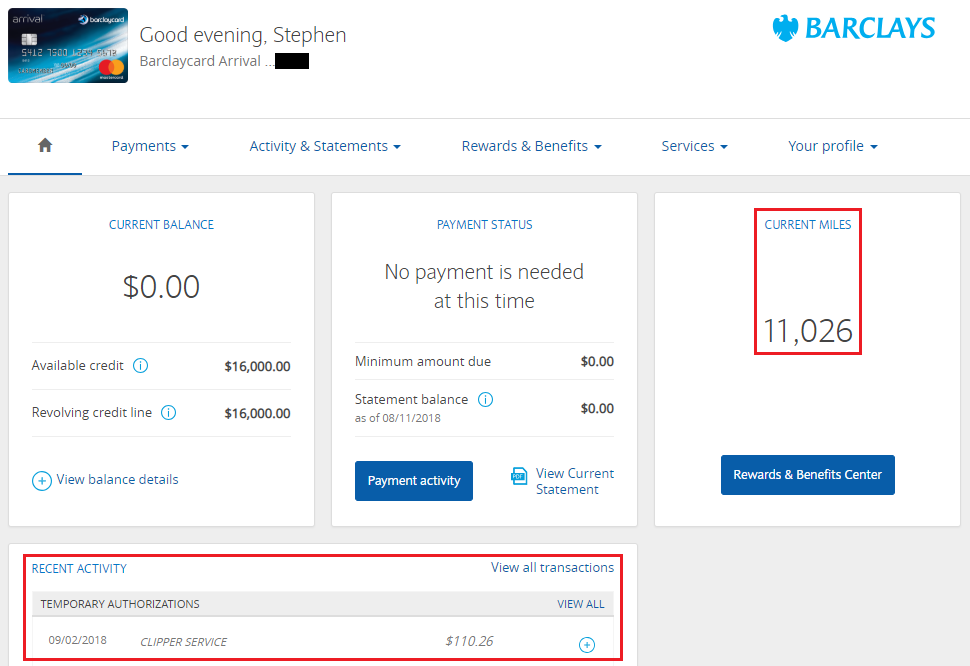

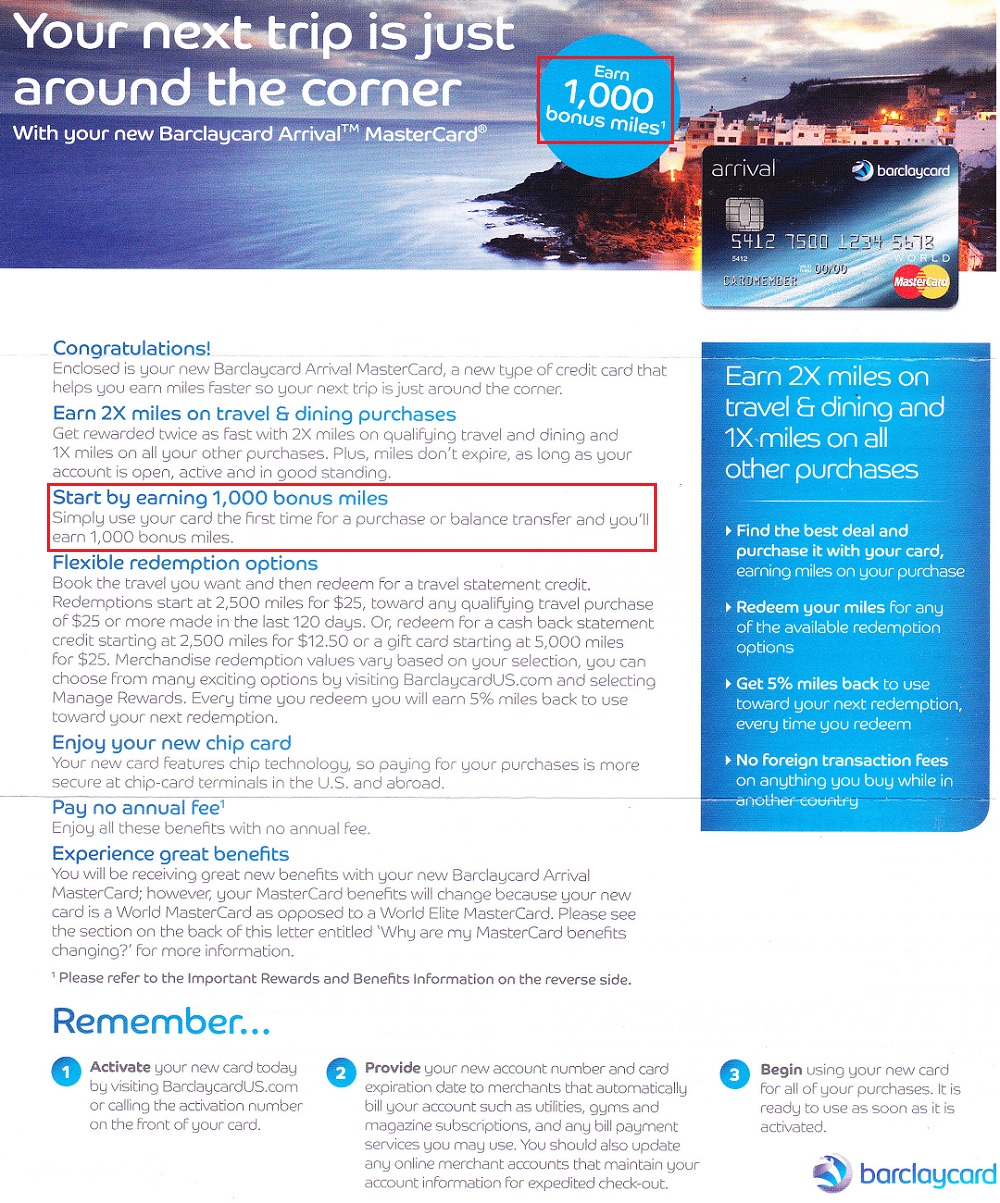

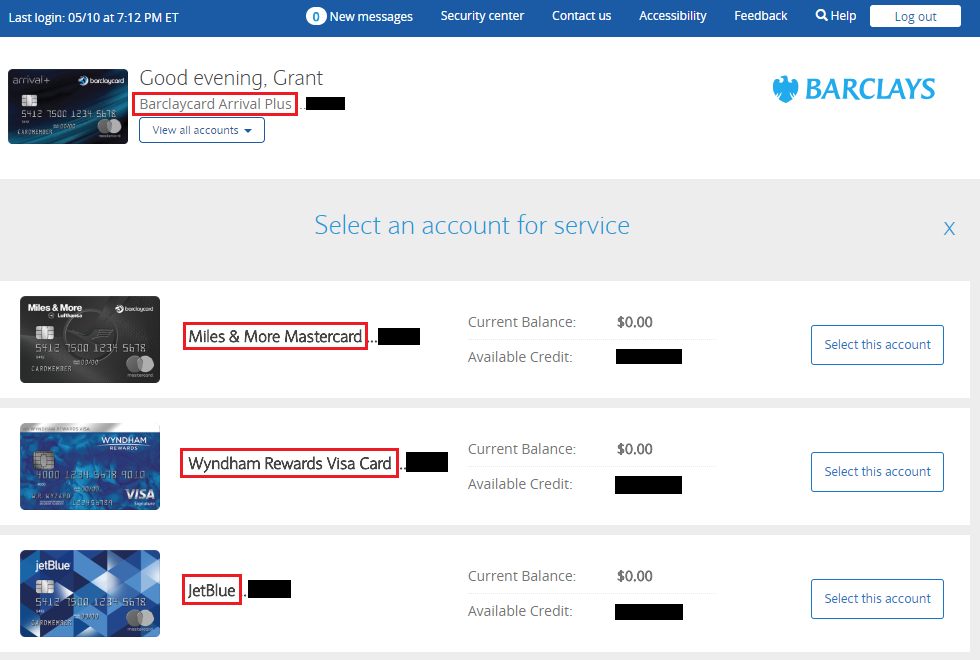

Good morning everyone, I hope you had a great weekend. Last week, I helped my brother keep his American Airlines miles from expiring. In today’s episode of managing my family’s miles & points, my dad told me he had 11,026 Barclays Arrival Miles in his account and wanted to close his Barclays Arrival Plus Credit Card. I told him that he should redeem his Barclays Arrival Miles before he closes his credit card. I told him to buy an airline eGC and then redeem Barclays Arrival Miles for that travel purchase.

He didn’t have any upcoming travel plans, so I told him I would help him out. I would make a purchase on his Barclays Arrival Plus Credit Card, redeem the Barclays Arrival Miles for the purchase, and then pay him back for the purchase. Since I live and work in the San Francisco Bay Area, I use my Clipper Card to take public transportation (BART, SMART, Ferry, CalTrain, etc.) around the Bay and to SFO and OAK. I go through $200-$300 a month in Clipper Card charges, so I knew I could use up $110.26 pretty quickly, so I loaded $110.26 to my Clipper Card with my dad’s Barclays Arrival Plus Credit Card. I normally use my Chase Sapphire Reserve Credit Card for the 3x travel rewards for Clipper Card charges, but I wouldn’t lose sleep over the missing points.