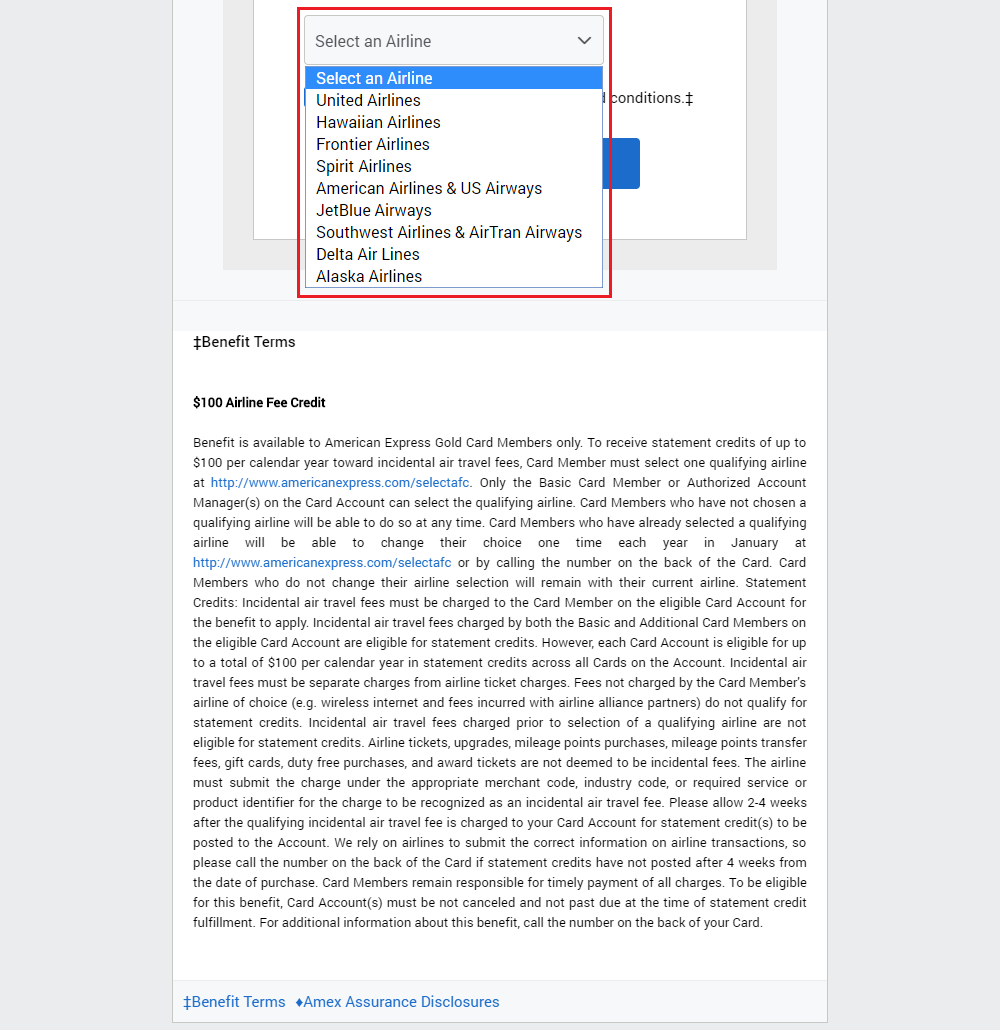

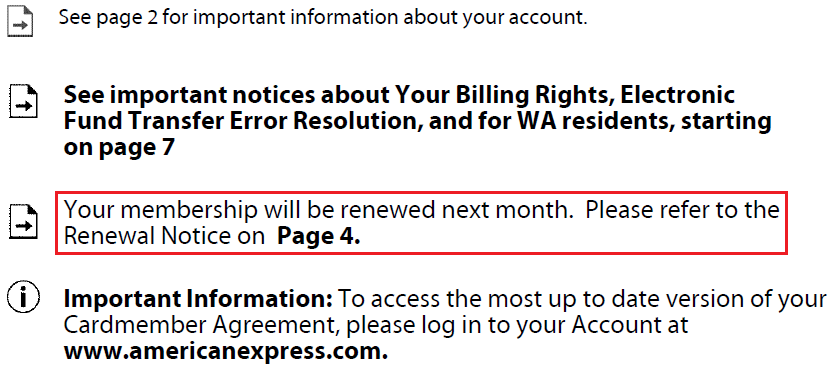

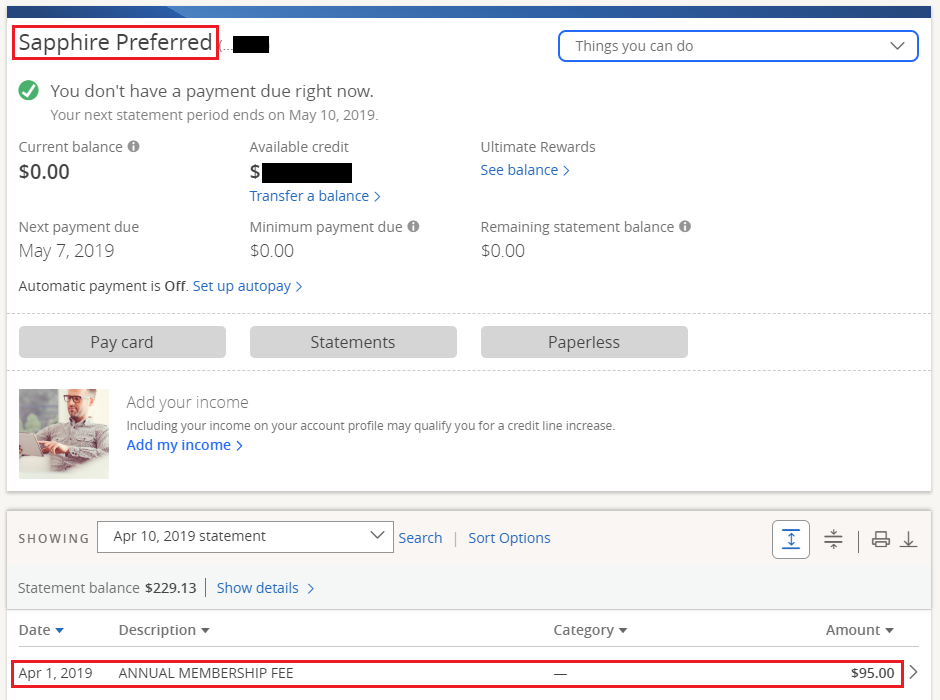

Good afternoon everyone. As part of my March App-O-Rama, I was approved for the American Express Gold Card. A few weeks ago, I wrote How to Enroll in American Express Gold Card Benefits ($120 Dining Credit & $100 Airline Fee Credit). In that post, I showed how to enroll in the $100 airline fee credit benefit. The process was very easy. I selected Southwest Airlines as my airline of choice and purchased a $100 Southwest Airlines eGC to trigger the $100 airline fee credit. Unfortunately, my $100 purchase did not trigger the benefit.