Warning: if you are just starting out with rewards-earning credit cards, please do not apply for several credit cards at the same time. You are responsible for your credit history and credit scores. You have been warned…

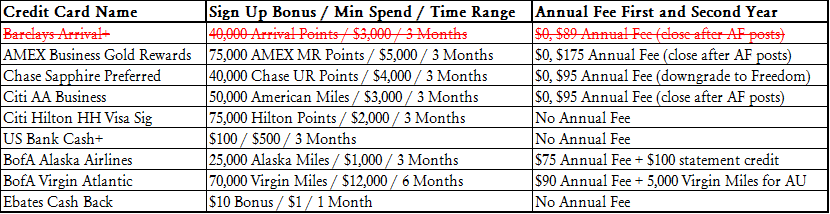

Good evening everyone. Last month, I wrote July 2015: My 8 Credit Card App-O-Rama Game Plan and I shared my plans/reasoning for applying for the below 8 credit cards.

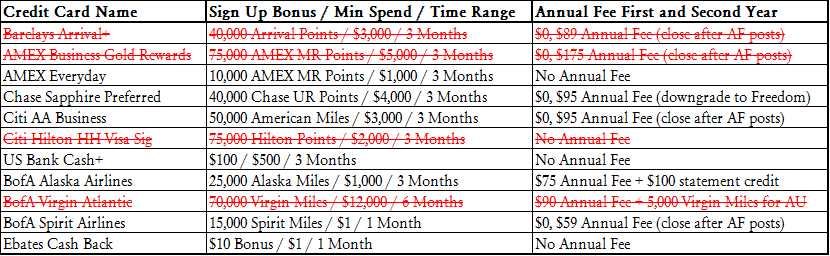

After listening to your feedback and suggestions, I decided to make some changes to my App-O-Rama plan. The table below shows the 7 credits that I ended up applying for. Here are my reasons for not applying for a few of the credit cards:

- The Barclays Arrival Plus Credit Card was not available for new applications on my App-O-Rama date.

- I couldn’t get the targeted 75,000 offer on the AMEX Business Gold Rewards Charge Card, so I decided to wait for a better public offer.

- I forgot that Citi’s “8 Day Rule” applies to personal and business credit cards, so I decided to apply for the Citi American Airlines Business Credit Card instead of the Citi Hilton HHonors Visa Signature Credit Card.

- I decided to go for the Bank of America Spirit Airlines Credit Card instead of another Bank of America Virgin Atlantic Credit Card.