Good afternoon everyone, I have one more quick post to share this weekend. My Citi Prestige Credit Card annual fee is set to post in early May and I do not anticipate keeping the credit card for another year, since there is a big devaluation to the card benefits that goes into effect on July 27. Doctor of Credit has more details, but here are the big blows to the card benefits:

- Eliminating 3 free rounds of golf.

- Eliminating American Airline redemptions at 1.6 cents per point (if you have any upcoming AA flights, read How to Book American Airlines Flights with Citi Thank You Points (1.6 Cents Per Point Value)).

- For all other flights booked with Citi Thank You Points, the redemption rate is changing from 1.33 cents per point to 1.25 cents per point.

- Fourth-night-free hotel benefit will be based on average nightly rate instead of the 4th night’s rate (and the fourth-night-free benefit will no longer include taxes).

- Eliminating Admirals Club access.

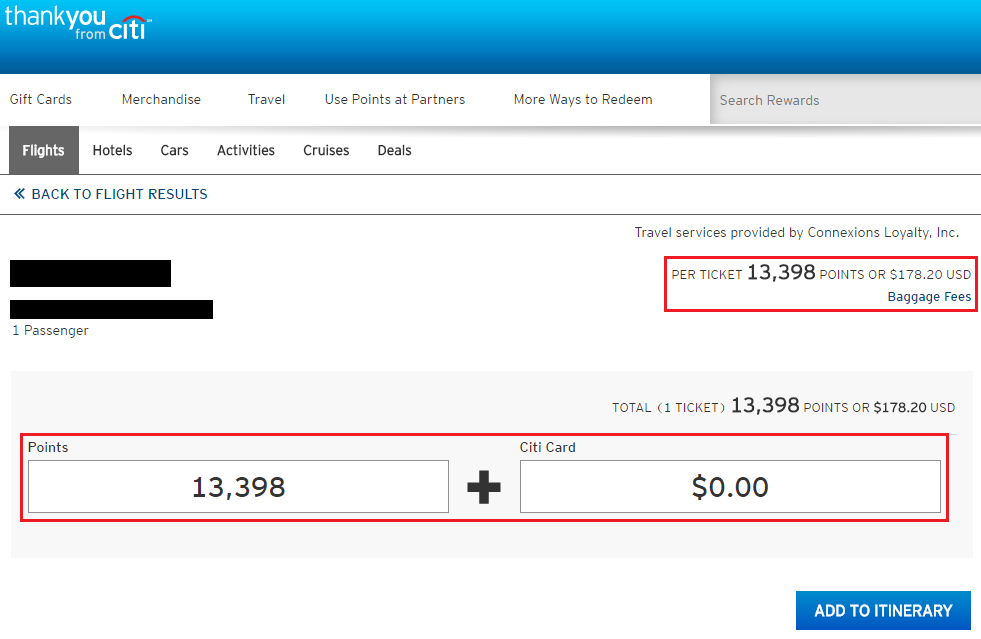

With those devaluations in mind, I wanted to redeem the full $250 airline travel credit before the annual fee posts. I wanted to experiment and see if flights booked with Citi Thank You Points and cash would trigger the $250 airline travel credit. For those unfamiliar with booking flights through the Citi Thank You portal, you have the option to pay for flights with all Citi Thank You Points, with all cash (you might as well book directly on the airline’s website) or a combination of Thank You Points and cash. In the example below, the flight costs $178.20 or 13,398 Citi Thank You Points.