Good morning everyone. We all know the classic Capital One line, “What’s in your wallet?” (spoiler alert: no Capital One Credit Cards are currently in my real wallet), but I thought it would be fun to do this type of post monthly or every other month, depending on which credit cards I am currently using. At last count, I currently have 40+ personal and business credit cards, but I don’t carry or use every credit card every month. I treat my credit cards like tools in a tool box, each credit card has a specific use and no credit card is perfect for every situation. I also have 3 “wallets” for my credit cards: the physical cards that I carry with me in my iPhone case, the credit and debit cards in my ApplePay Wallet, and the credit cards in my travel wallet (aka backpack) that I use when I travel. I will go through my 3 “wallets”, but the cards in my ApplePay Wallet and travel wallet (aka backpack) don’t change very often.

Credit Cards in my iPhone Case / Wallet

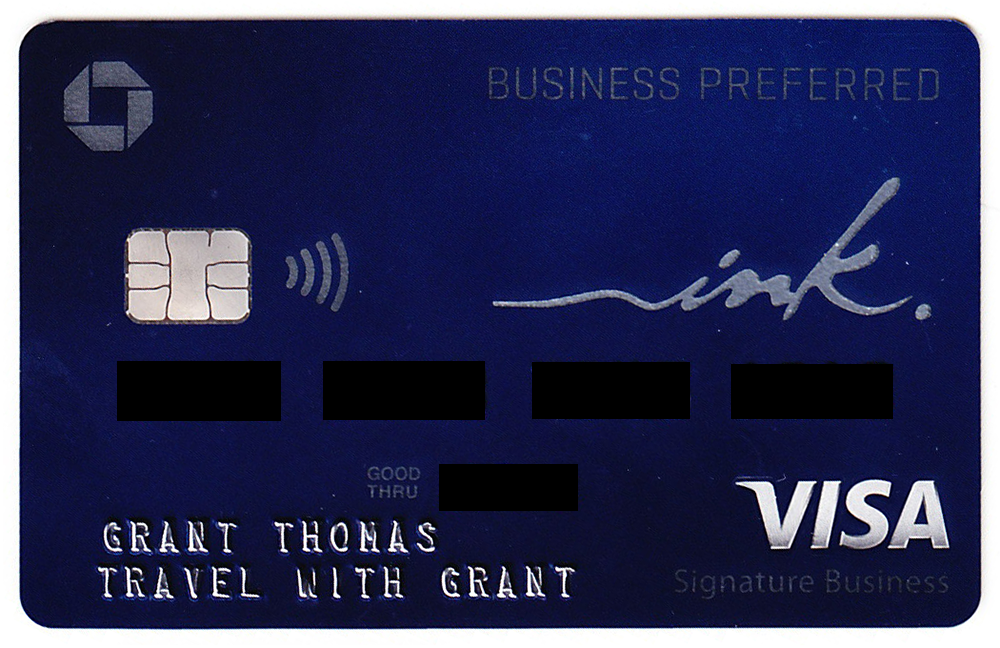

Last week, I was approved for the Chase Ink Business Preferred Credit Card that currently offers a sign up bonus of 100,000 Chase Ultimate Rewards Points after spending $8,000 in 3 months. I am meeting the minimum spend on this credit card by paying for a few home improvement projections, car insurance, and any other large purchase that will get me closer to my $8,000 minimum spending requirement. I don’t have immediate plans for these 100K Chase Ultimate Rewards Points, but I can always use more Chase Ultimate Rewards Points.

Continue reading →