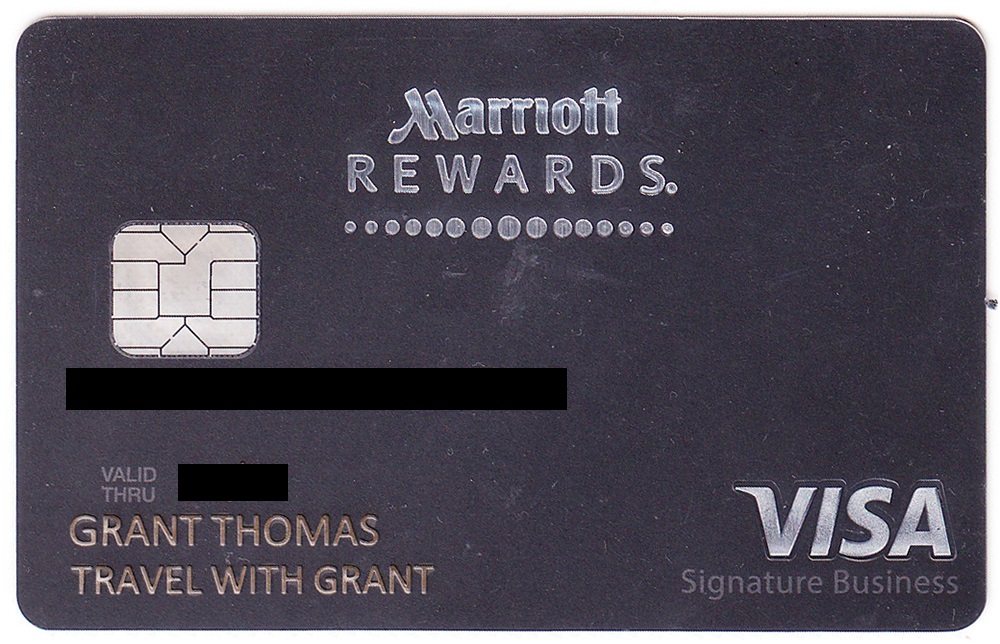

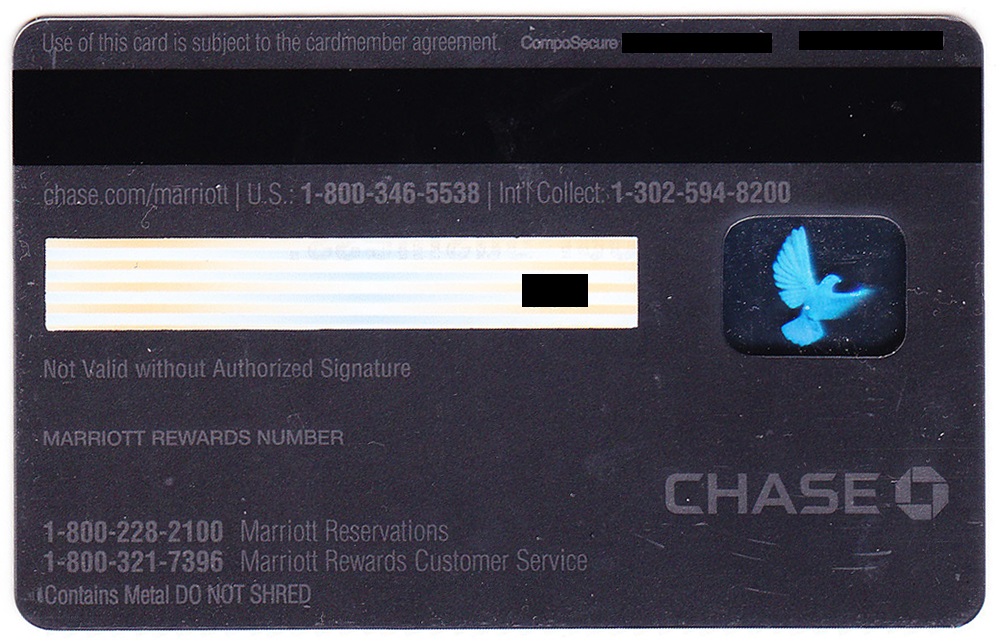

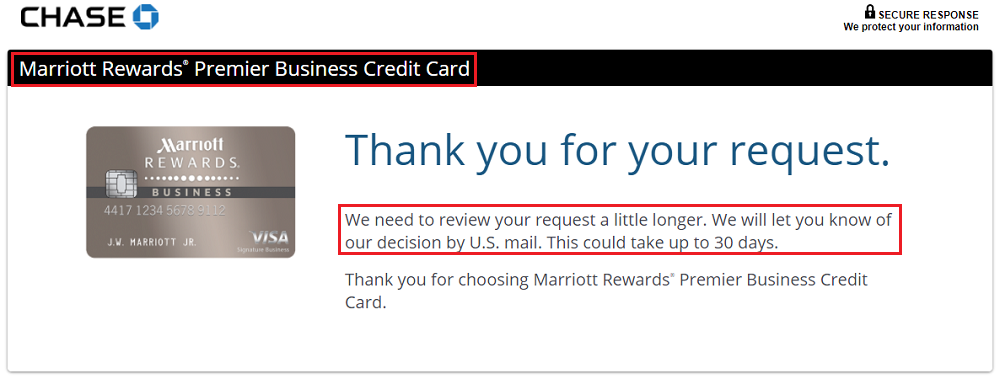

Good afternoon everyone. A few days ago, I wrote about how I knew I was approved for a new Chase credit card before getting an email or letter in the mail. Fast forward to now, my new Chase Marriott Rewards Business Credit Card arrived in the mail. The credit card design doesn’t look like the card that I approved for, so I will share my theory below. I also got the welcome letter that I will share below. The front and back of the new credit card is metal, and looks very similar to the personal Chase Marriott Rewards Credit Card, but is not quite as thick as the JPMorgan Chase Ritz Carlton Credit Card.