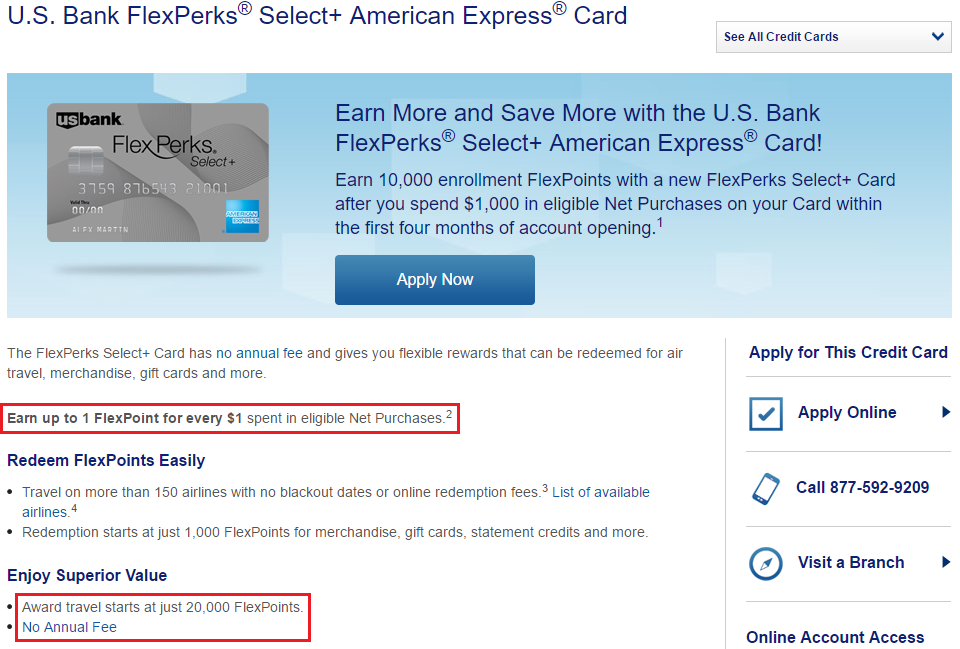

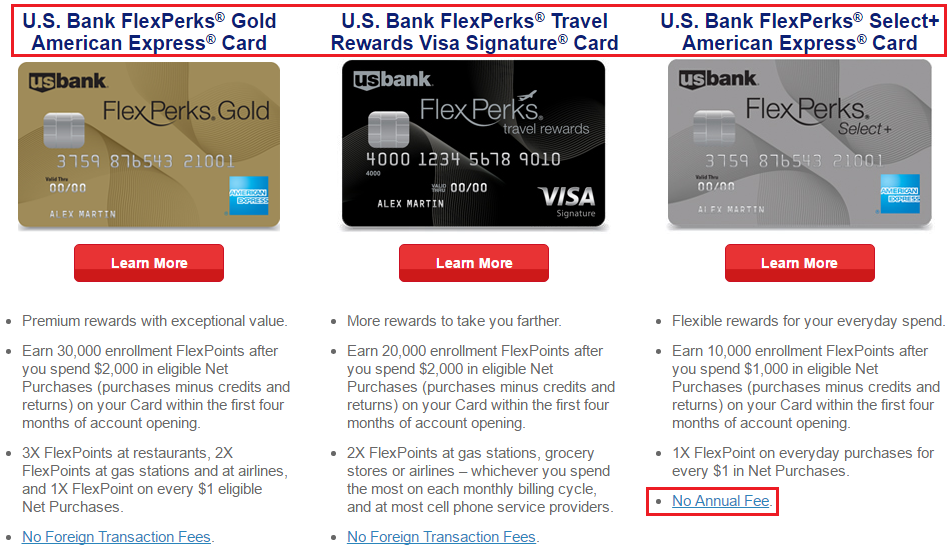

Good afternoon everyone, I hope everyone is having a great weekend so far. A few months ago, my $49 annual fee posted on my US Bank FlexPerks Travel Rewards Visa Signature Credit Card. Since I had spent down the majority of my FlexPoints, I decided to convert my US Bank FlexPerks Travel Rewards Visa Signature Credit Card into a US Bank FlexPerks Select+ American Express Credit Card. This credit card has no annual fee and earns 1 FlexPoint for every dollar spent with no bonus categories. This is by no means a good credit card, but it will keep your FlexPoints alive and you can continue to redeem 20,000 FlexPoints for an airline ticket worth up to $400.