Good afternoon everyone. Last month, I was reading an article by Nick at Frequent Miler called Almost #Bonvoyed: a cautionary tale on free night certs. In that post, Nick shared that after cancelling a Marriott stay booked with a free night certificate, the free night certificate did not automatically redeposit into his Marriott account. He had to track down the cancelled reservation and call Marriott to get the free night certificate redeposited into his Marriott account. Bonvoy! Toward the end of the article, Nick stated, “You shouldn’t need a spreadsheet to track the history of your Marriott free night certs — but the reality is that you do need to stay organized with them.”

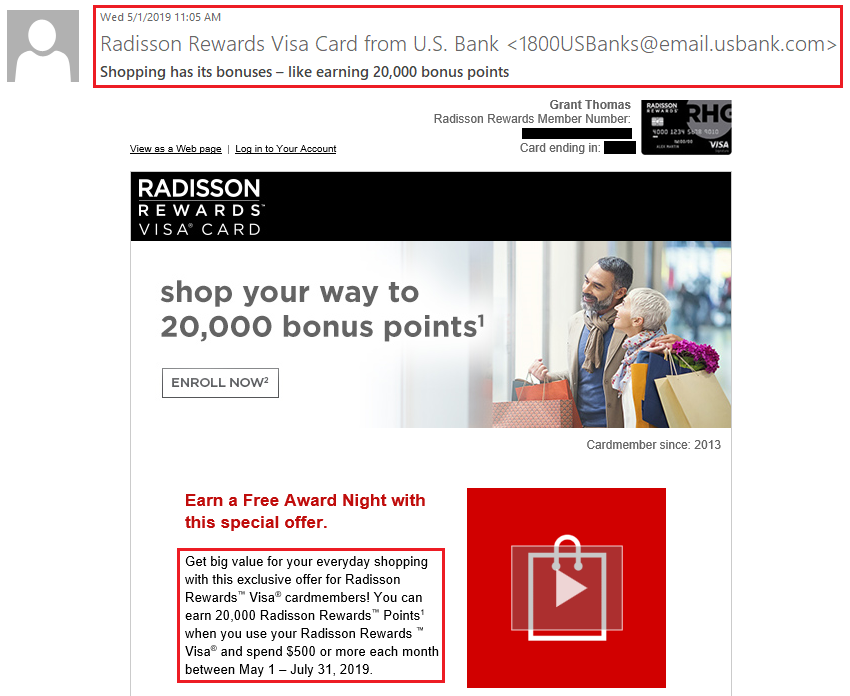

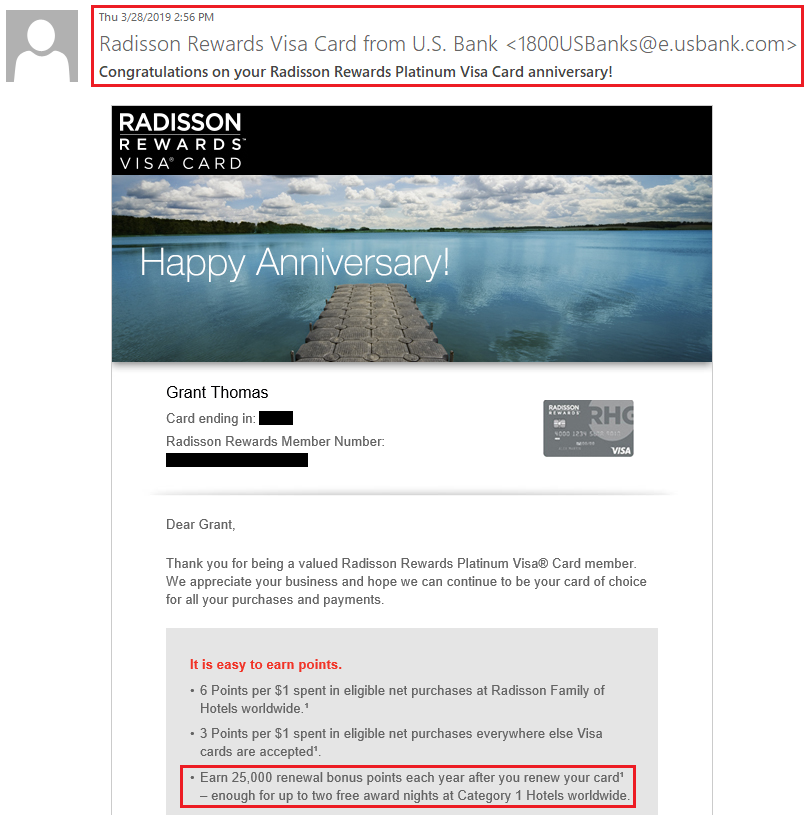

That’s when the idea hit me, I should create a spreadsheet to track my Marriott category 1-5 free night certificates… as well as my Hilton free weekend night certificates, Hyatt category 1-4 free night certificates, IHG 40k free night certificates, and Radisson Rewards anniversary points. Here is my Hotel Free Night Certificate Tracker, maybe it will help you stay organized too.