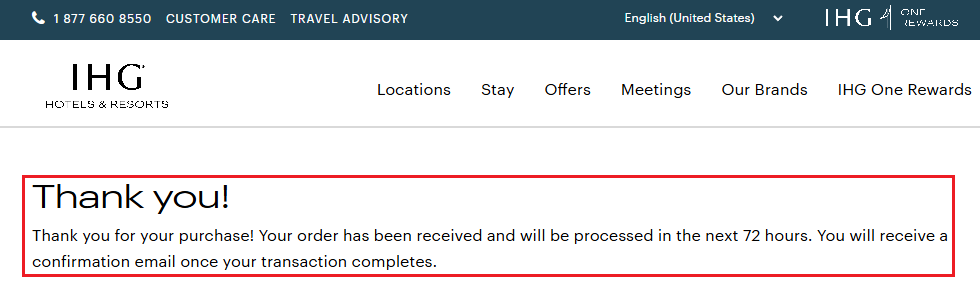

Good afternoon everyone, happy Friday! Last weekend, I needed to book a last minute IHG hotel stay that cost 47,000 IHG Points. Laura had a 40K Free Night Certificate and 3,000 IHG Points in her account. Since we are both IHG Business Rewards Members (free membership), I decided the *easiest* and *quickest* option would be to transfer 4,000 IHG Points from my account to her account. I submitted the points transfer request and planned on booking the hotel stay right away. Unfortunately, IHG had other plans. After submitting the request, the confirmation message said “Your order has been received and will be processed in the next 72 hours.” 72 hours?! I was planning on checking into the hotel tomorrow afternoon…

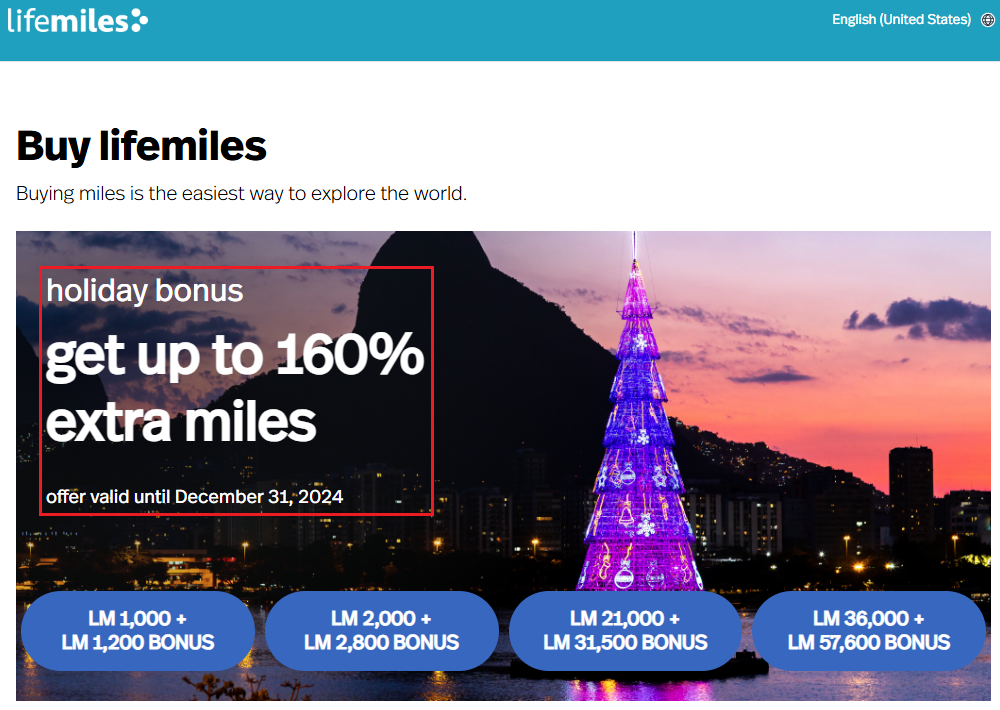

Long story short, instead of transferring valuable Chase Ultimate Rewards Points or Bilt Rewards Points to Laura’s IHG account, she bought 5,000 IHG Points since IHG was running a 100% bonus on IHG Points. In case you are wondering, the IHG Points sharing / transfer took about 2 days (~46 hours to be precise).