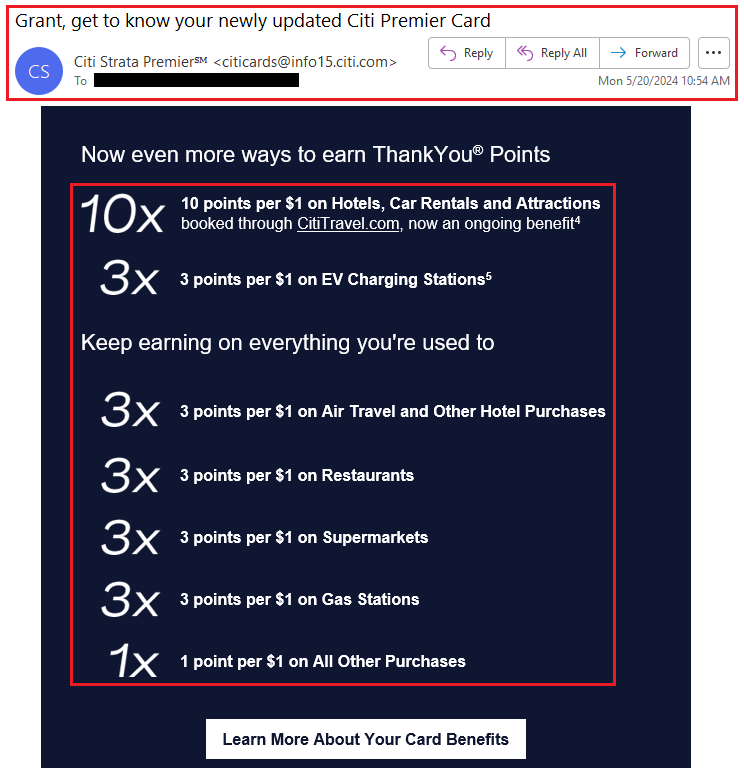

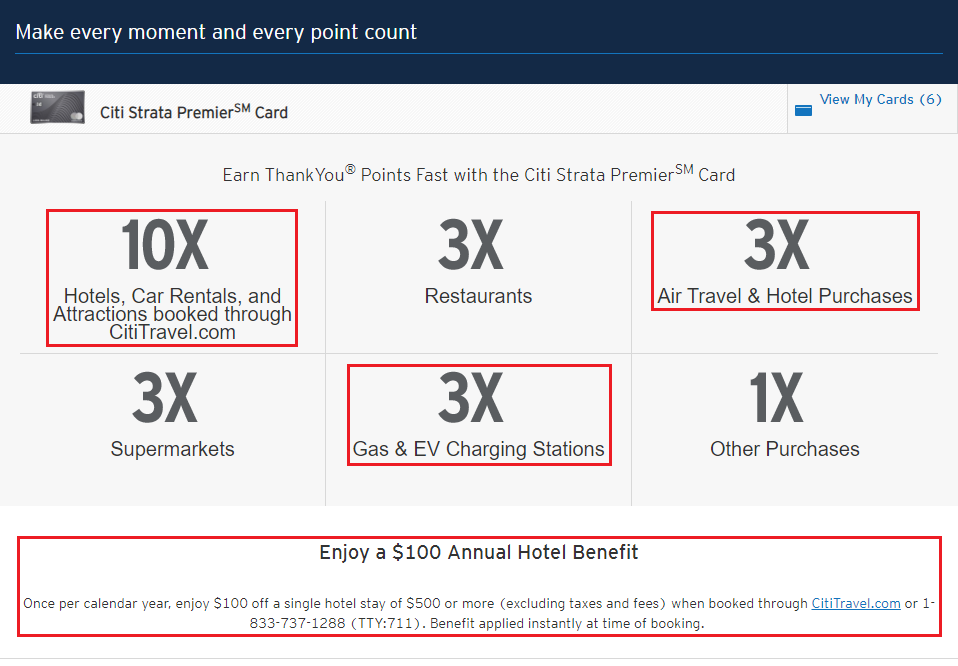

Good afternoon everyone, I hope you had a great weekend. Yesterday, I wrote my Deep Dive into Citi Strata Premier Credit Card Earning Categories & Travel Protections (Rental Car, Trip Interruptions & Lost Luggage). I wrote about the various travel-related earning categories and covered the 4 main travel protections on the new-ish Citi Strata Premier Credit Card. In this post, I will compare those earning categories and travel protections with the US Bank Altitude Reserve Credit Card. As a reminder, the Citi Strata Premier (CSP) earns 10x on hotels, car rentals, and attractions booked through the Citi Travel Portal and 3x on air travel, travel agencies, hotels, gas stations and EV charging stations.