Good afternoon everyone, I hope your week is going well. A few days ago, I was reviewing our recent credit card statements and saw that the $325 annual fee posted to Laura’s American Express Gold Card. We discussed the card benefits and decided it wasn’t worth prepaying $325 in order to jump through all of these hoops to earn back the $325 annual fee. As a reminder, here are the coupons statement credits on this card:

- $10 Uber / Uber Eats credit each month ($120 total)

- $10 Grubhub credit each month ($120 total)

- $7 Dunkin credit each month ($84 total)

- $50 Resy credit every 6 months (launched in July 2024, so only $50 total in 2024)

Even though we did receive all of these credits in 2024, I would not value them close to $374. In order to receive all of those credits, we had to jump through 37 hoops throughout the year. We are still sitting on $28 of Dunkin credit (the nearest Dunkin in about 40 miles away) and we have a $50 restaurant gift card for a nearby Resy restaurant that we bought at the end of December.

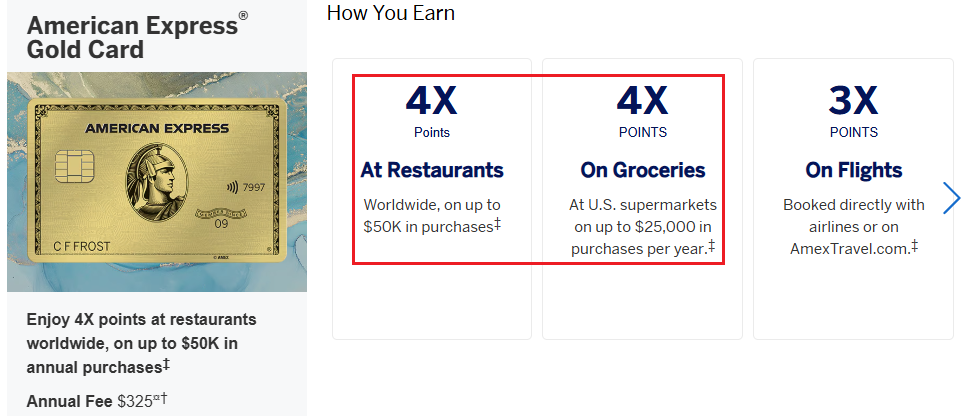

Also, we were not using the card for 4x at restaurants and 4x on groceries. I have plenty of AMEX MR Points, so we were using 2 Citi Custom Cash Credit Cards for 5x at restaurants and 5x on groceries. Then in 2025, we switched to using the Chase Freedom Flex Credit Card for 5x on groceries ($1,500 quarterly max) and the Discover It Credit Card for 5x at restaurants ($1,500 quarterly max).

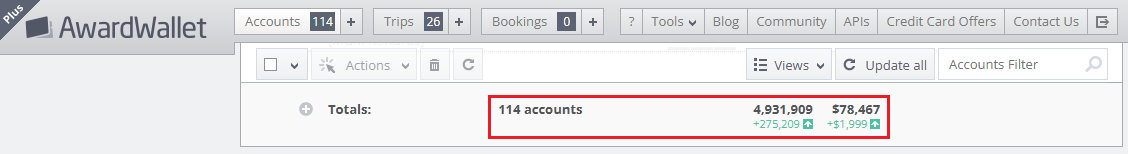

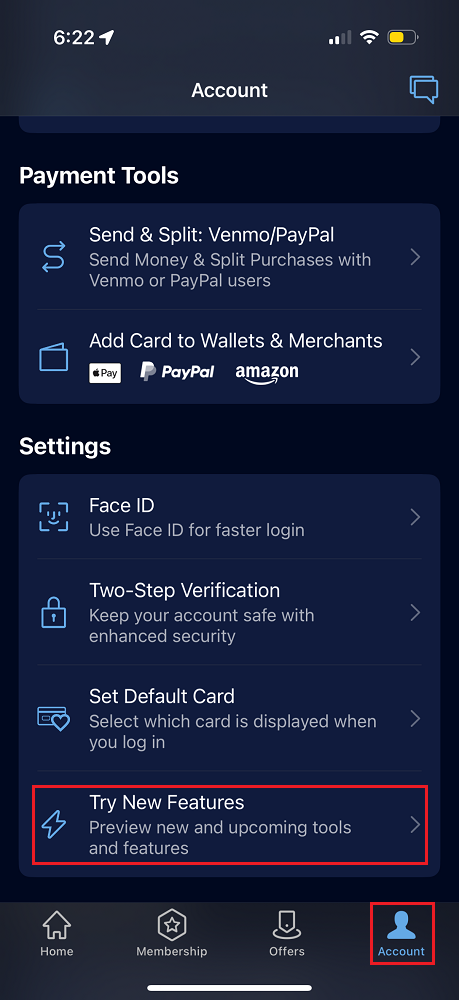

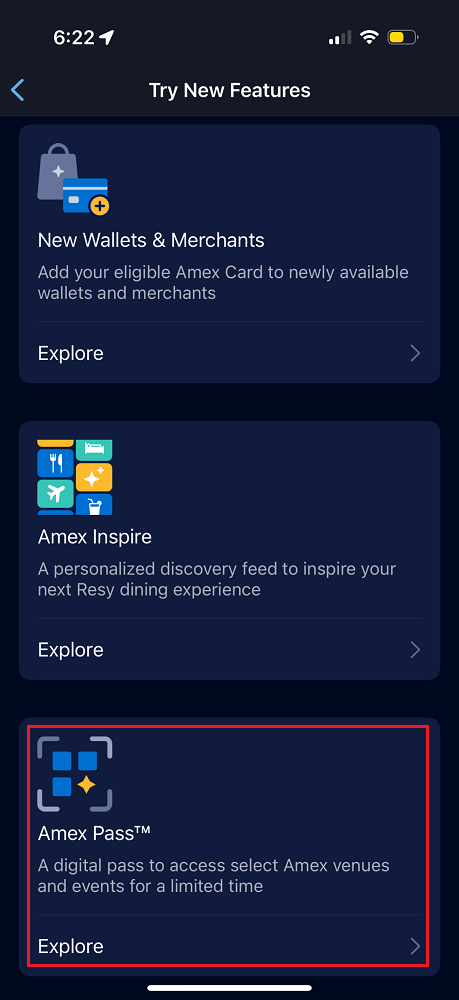

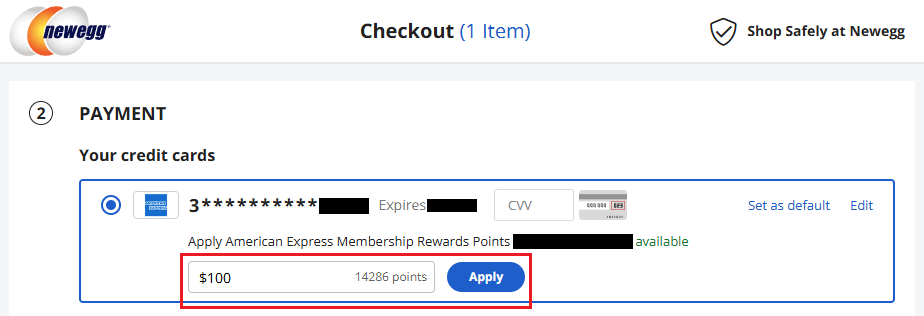

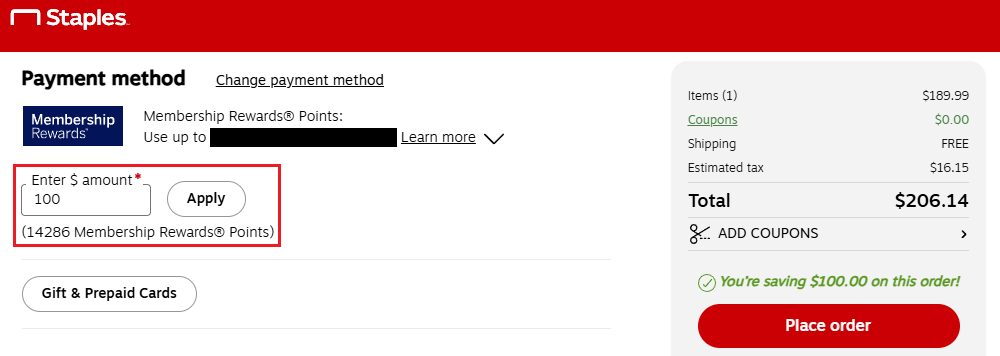

In addition, we decided to transfer all 150,000 of Laura’s AMEX MR Points to her Hawaiian Airlines account, then she transferred them to my Hawaiian Airlines account and then I moved them to my Alaska Airlines account (read more about that process here). The next step was to contact AMEX via Online Chat to close the card…