Updated on 7/20/2019 at 8am: I added the Barclays rejection letter to the bottom of this post.

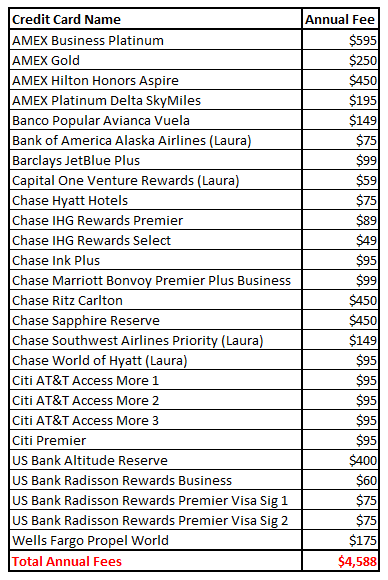

Good morning everyone, I hope your 2 day Prime Day shopping spree is going well. Even though I didn’t buy much on the first day of Prime Day, I did pick up a few new credit cards. My last App-O-Rama was in March, so I patiently waited 3+ months until my July App-O-Rama. As a reminder, I was approved for 3 out of 4 credit cards in my March App-O-Rama, including the American Express Gold Card, the US Bank Altitude Reserve Visa Signature Credit Card, and the Wells Fargo Business Platinum Credit Card. With those minimum spending requirements completed and the sign up bonuses redeemed, it was time to focus on these 5 credit cards. Here is a quick summary of my July App-O-Rama:

- Citi Premier Credit Card – instantly approved

- American Express Platinum Delta SkyMiles Credit Card – pending, then approved (I called AMEX and had to close an old card to open up a credit card slot)

- Barclay AAdvantage Aviator Business Credit Card – pending, then declined (too many recent inquiries)

- Banco Popular Avianca Vuela Credit Card – instantly approved

- Wells Fargo Propel World Credit Card – instantly approved (I called Wells Fargo to apply for this credit card over the phone)

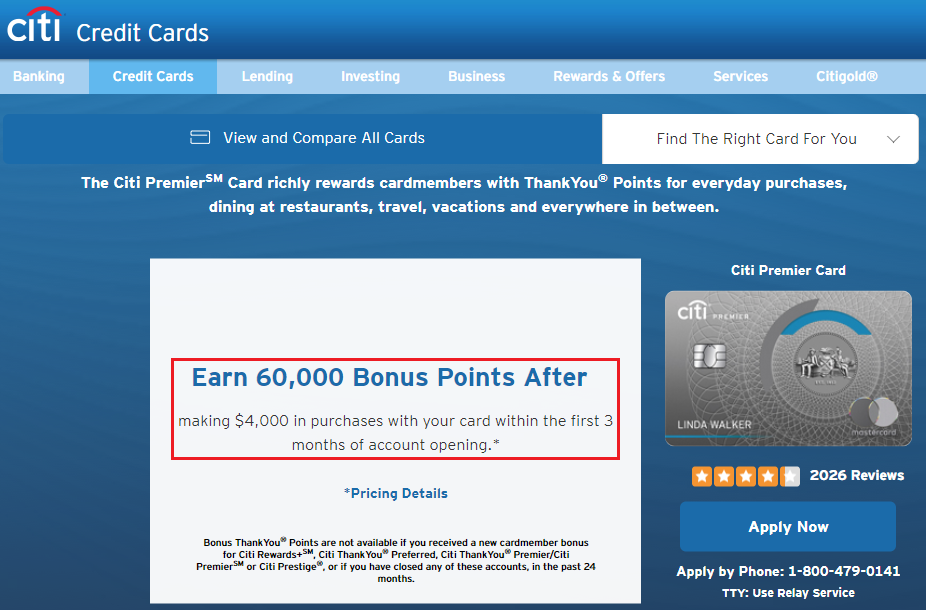

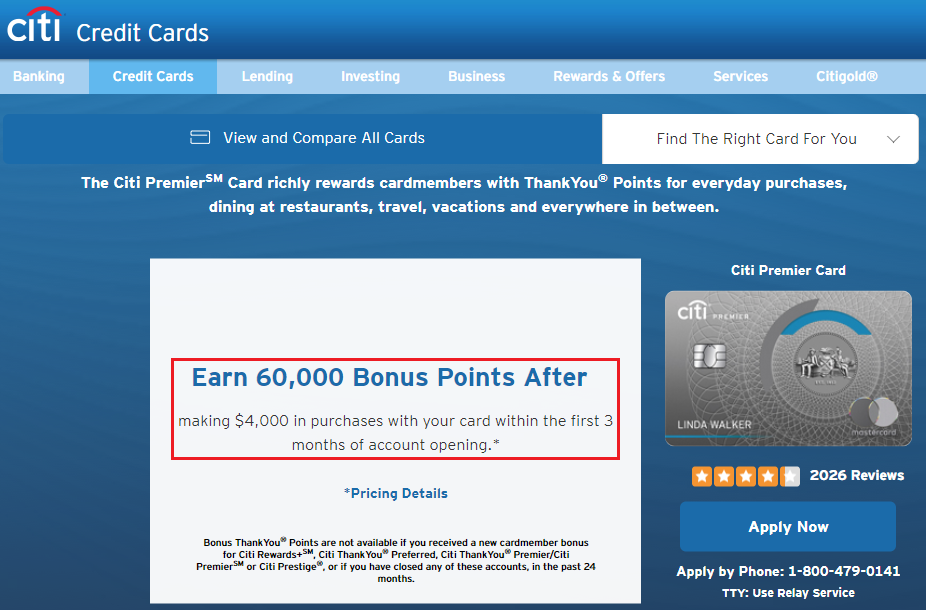

Citi Premier Credit Card

I currently have a Citi Premier Credit Card that I have had for 4+ years, but I wanted to get another one since the sign up bonus is currently 60,000 Citi Thank You Points after spending $4,000 in 3 months. If I was approved for a second Citi Premier Credit Card, my plan was to downgrade/convert my old Citi Premier Credit Card into a Citi Rewards+ Credit Card.

Continue reading →