Good morning everyone, I hope you all has a great weekend. A few weeks ago, I applied for 8 new credit cards during my App-O-Rama. Here are the 8 credit cards and sign up bonuses that I applied for (not in this particular order). Unfortunately, my App-O-Rama skills are not as good as they used to be and I was (ultimately) declined for most of these credit cards.

- Bank of America Alaska Airlines Visa Signature Credit Card: 30,000 AS Miles + $100 statement credit after spending $1,000 in 3 months ($75 annual fee)

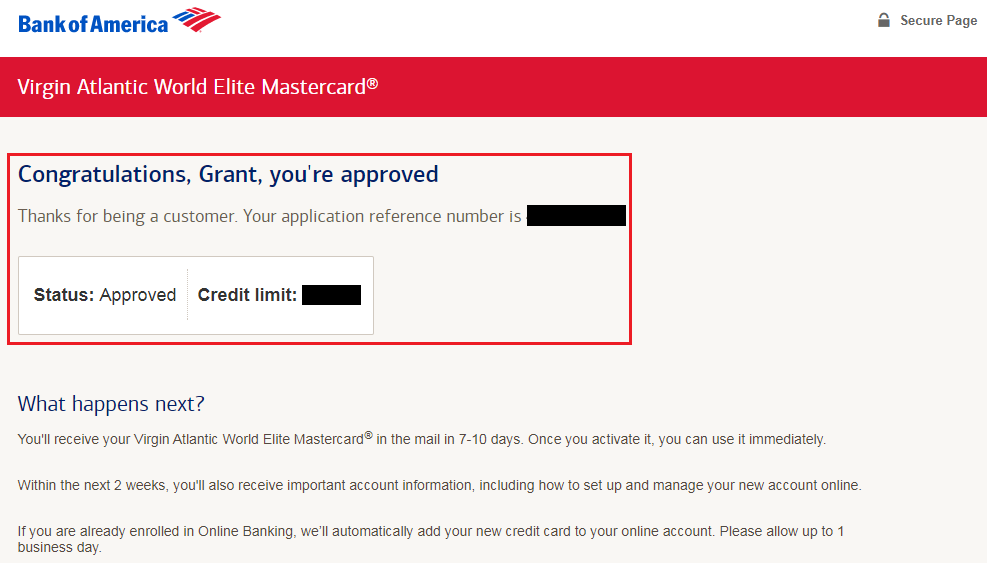

- Bank of America Virgin Atlantic Credit Card: 75,000 VA Miles after spending $12,000 in 6 months ($90 annual fee)

- Bank of America Amtrak Rewards Credit Card: 30,000 Amtrak Points after spending $1,000 in 3 months ($79 annual fee)

- US Bank Altitude Reserve Credit Card: 50,000 FlexPoints ($750 in travel credit) after spending $4,500 in 3 months ($400 annual fee)

- Wells Fargo Visa Signature Credit Card: 20,000 Go Far Reward Points after spending $1,000 in 3 months ($0 annual fee)

- First Bankcard Best Western Credit Card: 50,000 Points after spending $1,000 in 3 months ($59 annual fee, first year waived)

- Synchrony Bank Cathay Pacific Credit Card: 50,000 CX Miles after spending $2,500 in 3 months ($95 annual fee)

- Barclays Wyndham Rewards Credit Card: 45,000 Wyndham Points (3 free nights) after spending $2,000 in 3 months ($75 annual fee)

Long story short, I applied for 3 Bank of America credit cards, starting with the Bank of America Alaska Airlines Visa Signature Credit Card. I recently closed my previous Bank of America Alaska Airlines Visa Signature Credit Card a few weeks ago, so I was ready to apply again and earn more Alaska Airlines miles. Unfortunately, my application went to pending. Since I was not immediately declined, I decided to apply for a Bank of America Virgin Atlantic Credit Card. Surprisingly, I was instantly approved for that credit card with a pretty small credit limit. With that success, I decided to apply for a Bank of America Amtrak Rewards Credit Card. Unfortunately, that application went to pending as well. 1 out of 3 instant approvals was not bad. I was hopeful that the 2 pending applications could be approved with a short reconsideration call.