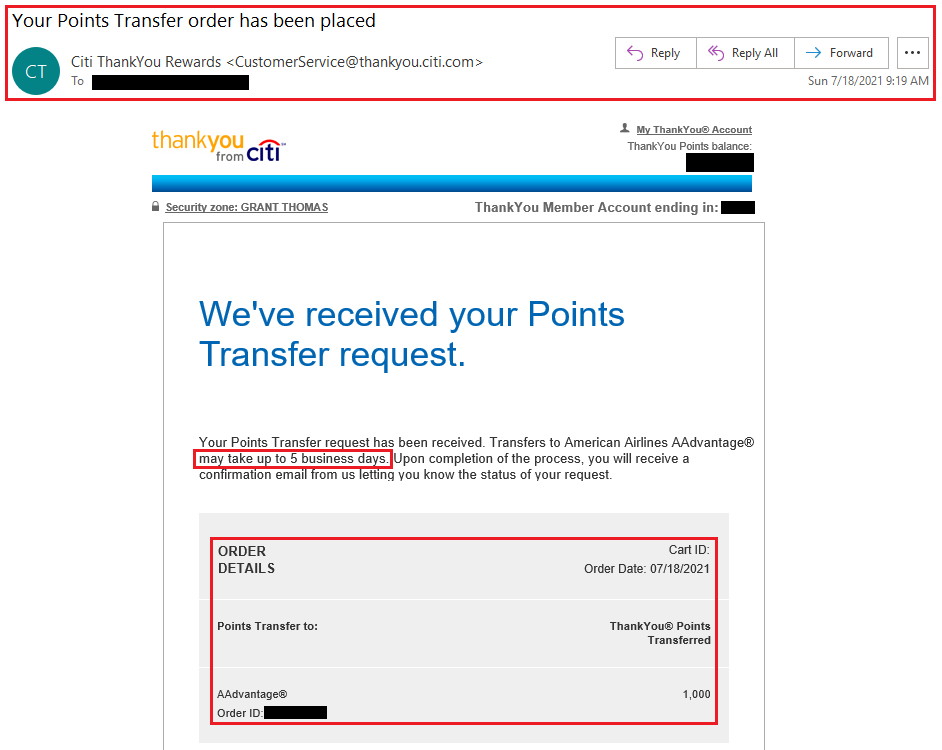

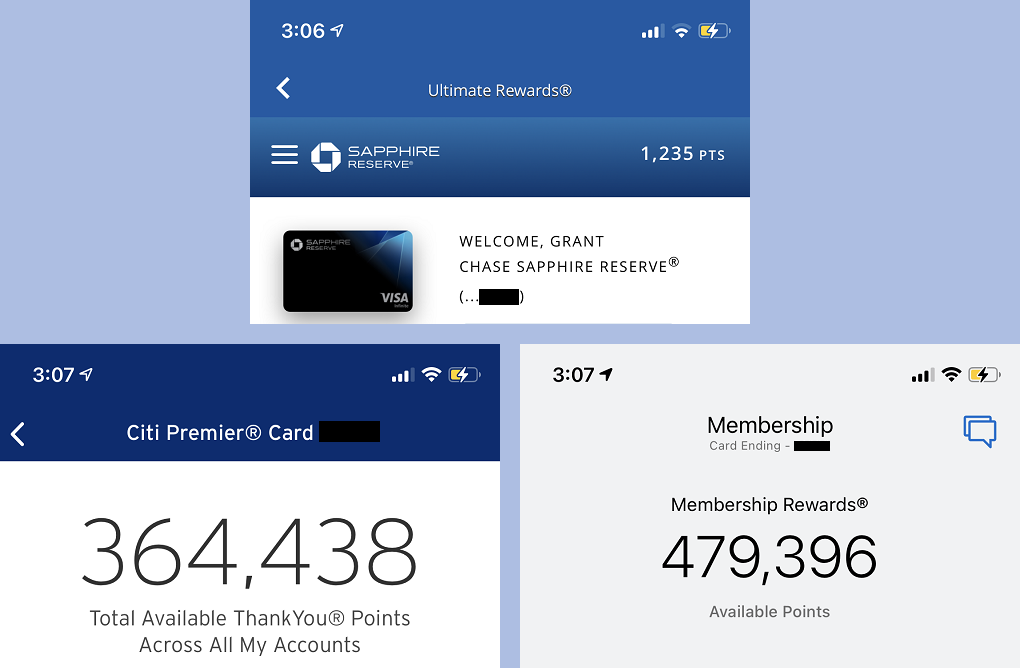

Good morning everyone, I hope you had a great weekend. Yesterday morning, Frequent Miler wrote You Can Now Transfer Citi ThankYou Points To American Airlines, But Only For A Limited Time. I decided to do a sample transfer of 1,000 Citi ThankYou Points (TYPs) to American Airlines to test the transfer times and see if the transfer was instant. I submitted the transfer request at 9:19am and checked my American Airlines account a few minutes later. Unfortunately, the transfer was not instant, so I set up an AwardWallet “Balance Watch” alert to see when the miles posted, so I could calculate the transfer time. From my experience, the transfer took 12-13 hours to post.