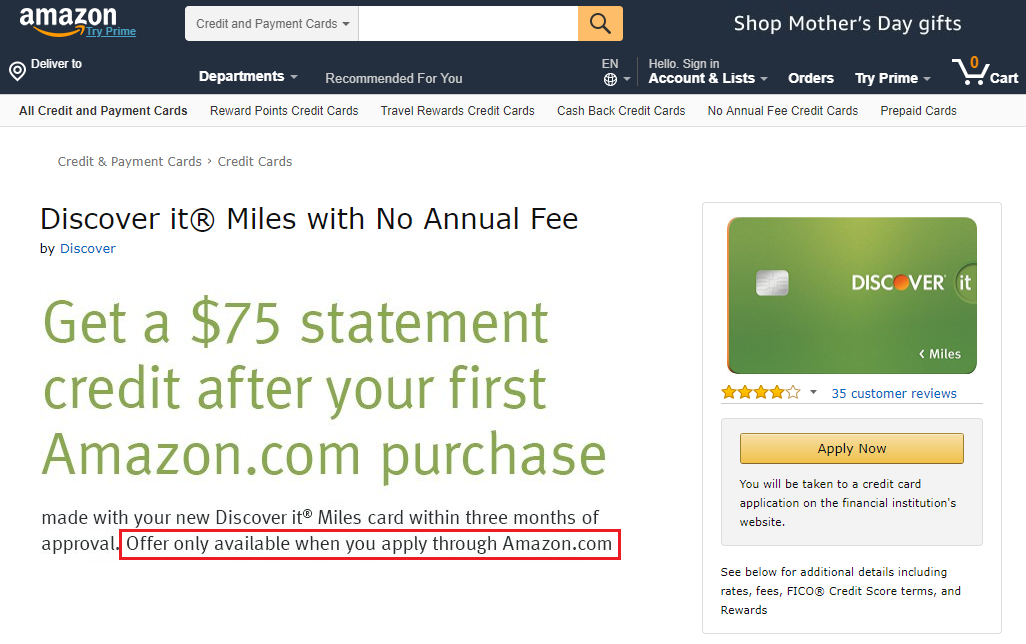

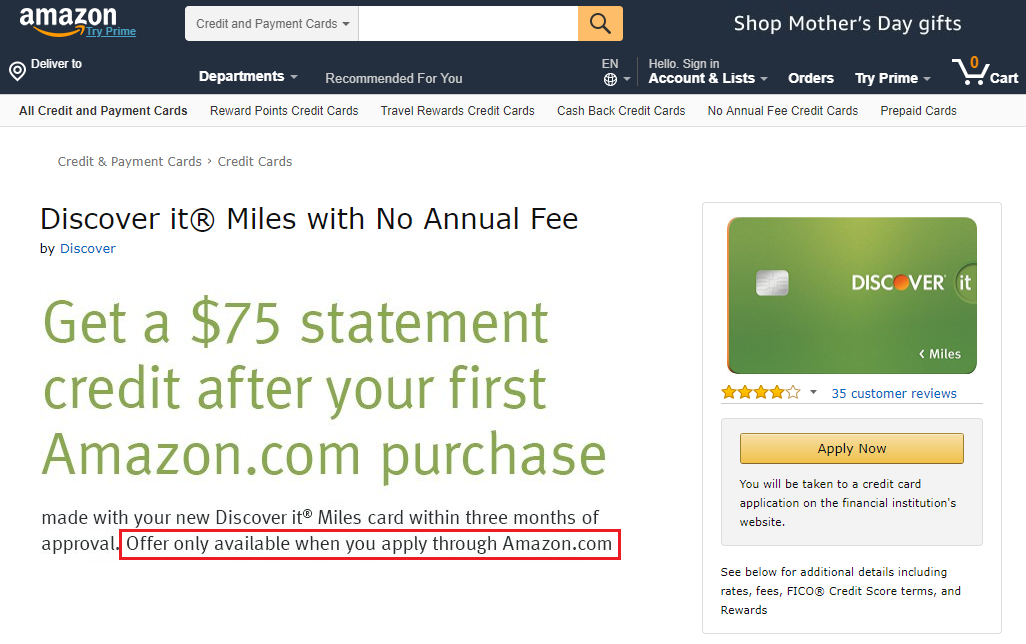

Good morning everyone. During my recent App-O-Rama, I applied for the Discover It Miles Credit Card. At the time, there was no sign up bonus, but whatever “Miles” you earned during your first year would be doubled, essentially earning 3% cash back on all purchases for the first year (then earning 1.5% cash back on all purchase after that). After a quick reconsideration call with Discover, I was approved for the Discover It Miles Credit Card on April 16. 4 days later on April 20, Doctor of Credit reported that there was a $75 sign up bonus on the Discover It Miles Credit Card. Doh!!

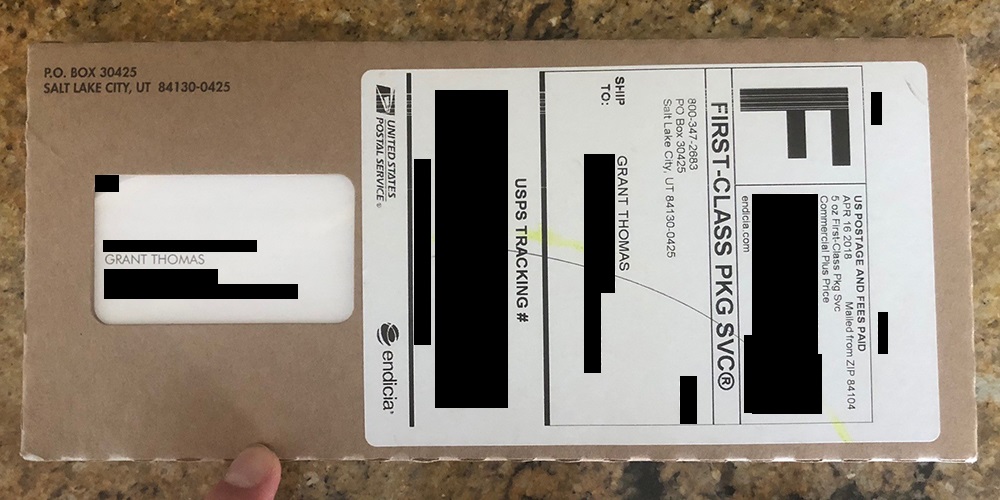

My new Discover It Miles Credit Card came a few days ago, and before activating the new credit card, I called Discover customer service to see if I could get matched to the $75 sign up bonus. I’ve seen plenty of Discover customer service friendly commercials on TV and figured it would not be a problem getting matched to the better offer. Boy, was I wrong…

Continue reading →