Good afternoon everyone. A few months ago, I upgraded my Chase Marriott Bonvoy Boundless Visa Signature to JPMorgan Chase Ritz Carlton Visa Infinite. Fast forward to March 1 and the $450 annual fee posted to my Ritz Carlton credit card. Over the last few weeks, I was trying to decide if I should keep this credit card and pay the $450 annual fee or downgrade to the Marriott Bonvoy Boundless credit card which only has a $95 annual fee (but comes with a 35K Marriott Bonvoy free night certificate).

The biggest reason for me to downgrade this credit card was the loss of the Visa Infinite Discount Air Benefit which allowed me to save $100 on roundtrip domestic flights for 2 or more passengers. I used that benefit a few times last year and was looking forward to using it a few times this year to offset the $450 annual fee. Unfortunately, that benefit abruptly disappeared in early January 2020.

With that benefit gone, the remaining 2 benefits worthwhile to me were the $300 annual travel credit and the 50K Marriott Bonvoy free night certificate. As of today, I already redeemed the free night certificate for a hotel in New York City in June and used ~$85 of the $300 annual travel credit.

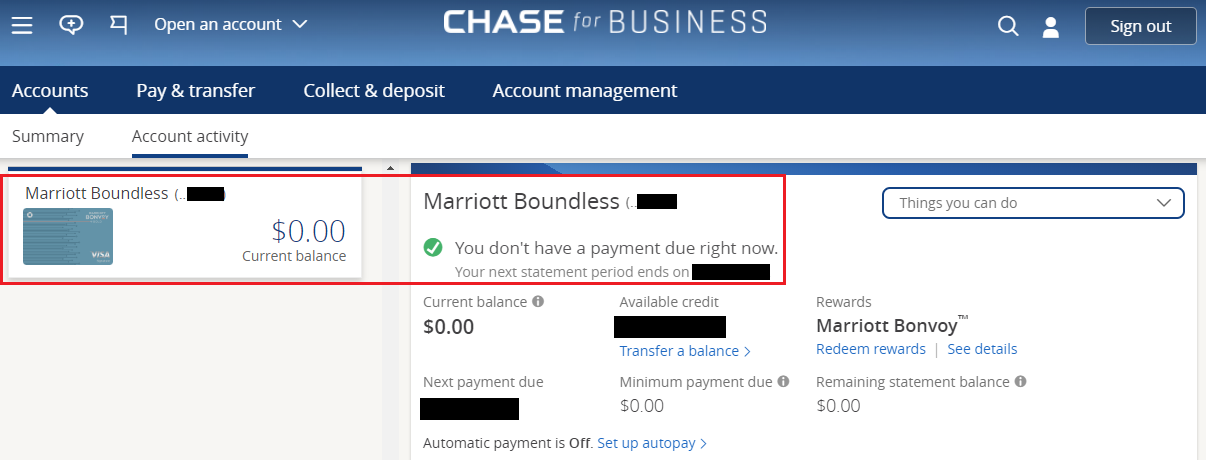

I called the JPMorgan Chase customer service number to see if they could waive the annual fee, but that was not possible, so I suggested downgrading to the Marriott Bonvoy Boundless credit card. After a few minutes, the downgrade process was completed. I will receive the new credit cards in the next week and the $450 annual fee would be refunded back to my account in the next few days ($450 annual fee was refunded the following day). Here is what my Marriott Bonvoy Boundless card looks like in my Chase online account.

Continue reading →