Updated at 1pm PT on 12/16/21: I forgot to include the value of my Hilton Free Night Certificate from my American Express Hilton Honors Aspire Credit Card. That increased the total another $200 and the info is updated below.

Good morning everyone. If you haven’t already, please read my post from yesterday (How Much Did I Pay in Credit Card Annual Fees in 2021?). In today’s post, I will share how much value I received from each credit card in 2021. Today’s post is also a sequel to my 2020 post (I Paid $3,820 in Credit Card Annual Fees in 2020 – Was it Worth it?) and my 2019 post (I Paid $4,588 in Credit Card Annual Fees in 2019 – Was it Worth it?).

These 26 credit cards were opened before January 1, 2021, with the exception of my Chase Sapphire Preferred Credit Card which I opened in July 2021. For simplicity, I did not include the value of miles or points earned from credit card spend, since that is somewhat subjective. I counted all credits, reimbursements, retention offers, and referral bonuses at dollar face value (with airline miles and hotel points at conservative values between 0.5 CPP and 1 CPP). For hotel free night certificates, I used a standard value of $100, with the exception of the Marriott 50K Free Night Certificate which I valued at $200.

I went through all of my credit card statements and online accounts to see which Credit Card Benefits I used in 2021 and those values are summed up in the CCB $ column. If I received a retention offer, that is listed in the RO $ column. I listed the credit card annual fees in the AF $ column. Lastly, I used this formula to calculate the Profit or Loss (P / L column) for each credit card: CCB $ + RO $ – AF $ = P / L

I grouped the credit cards by issuer, sorted them by highest profit at the top, and then split them up into 3 smaller groups (LT = Laura’s card). Here are my thoughts from the first group:

- The retention offer on my American Express Business Platinum Card propelled that card to the top of the charts. It was already a money maker, but the retention offer was the icing on the cake.

- I was very diligent about using all Airline, CLEAR, Dell, Hilton Resort, Restaurant, Uber, and Wireless credits on all my AMEX cards this year.

- I can easily get more than $100 value from the Alaska Airlines Companion Fares with trips to Hawaii or New York, or expensive last minute travel.

- I’ve gotten so much value out of the Barclays Wyndham Rewards Earner Business Credit Card thanks to Vacasa vacation rentals.

- Laura loves her Capital One Venture Rewards Credit Card so much, I don’t think she could ever give it up (even though I tell her the card is not worth the $59 annual fee).

| Credit Card Name | Credit Card Benefits | CCB $ | RO $ | AF $ | P / L |

| AMEX Business Platinum | $300 Dell credit, $200 Airline Fee credit, $169 CLEAR credit, $30 Wireless credit, and $25 Staples AMEX Offer | $724 | $595 | $595 | $724 |

| AMEX Hilton Honors Aspire | $250 Hilton Resort credit, $250 Airline Fee credit, $200 Restaurant credit, and $200 value from Hilton Free Night Certificate | $900 | $0 | $450 | $450 |

| AMEX Delta Gold Business | $90 Wireless credit and I closed this credit card to avoid paying the $99 annual fee | $90 | $0 | $90 | |

| AMEX Gold | $100 Airline Fee credit, $100 Dining credit, $100 Uber credit, and $25 1-800-FLOWERS AMEX Offer | $325 | $0 | $250 | $75 |

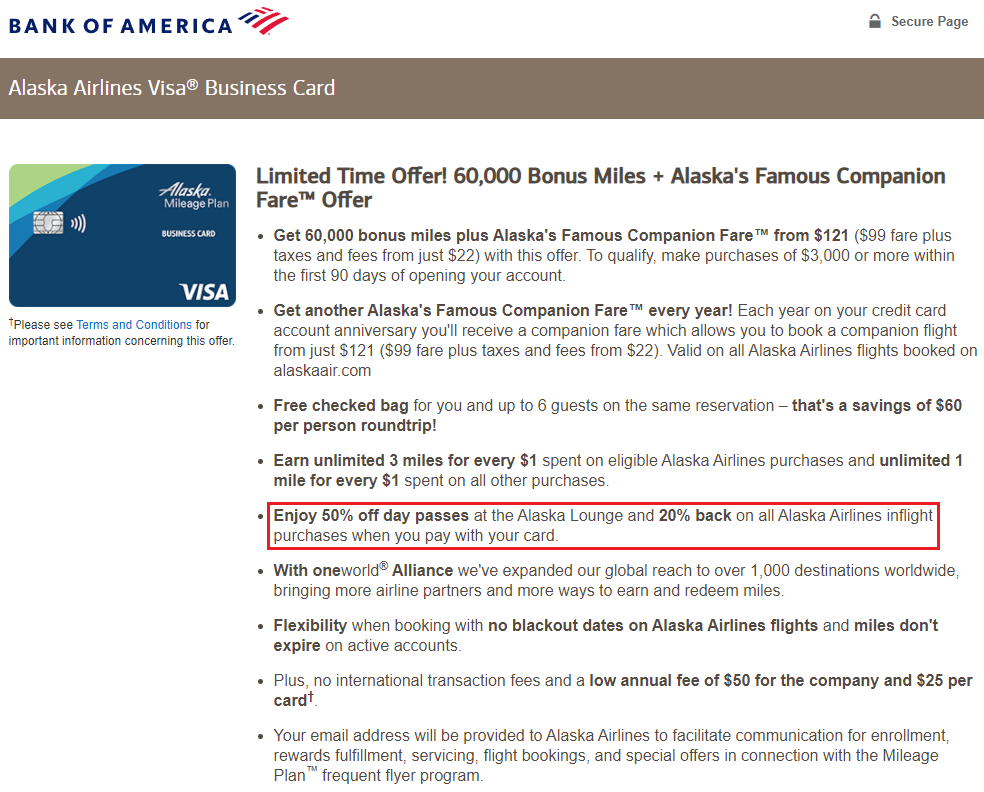

| Bank of America Alaska Airlines (LT) | $100 value from the Alaska Airlines Companion Fare | $100 | $0 | $75 | $25 |

| Bank of America Alaska Airlines Business | $100 value from the Alaska Airlines Companion Fare | $100 | $0 | $75 | $25 |

| Barclays Wyndham Rewards Earner Business | 15,000 Wyndham Rewards anniversary points ($150) and 13,500 points from the 10% cardmember discount on award stays ($135) | $285 | $0 | $95 | $190 |

| Capital One Venture Rewards (LT) | None (Laura’s go to credit card for everyday spending) | $0 | $0 | $59 | -$59 |