Good morning everyone, happy Friday! I know it is a few days before the end of the year, so technically, all of these predictions could come true, but I am going to call it now. At the beginning of the year, I wrote My Overly Ambitious 2024 Airline, Hotel & Credit Card Predictions. The original predictions are in black, correct predictions are in green, and incorrect predictions are in red. Without further ado, here are the results of my predictions for 2024:

My 2024 Airline Predictions

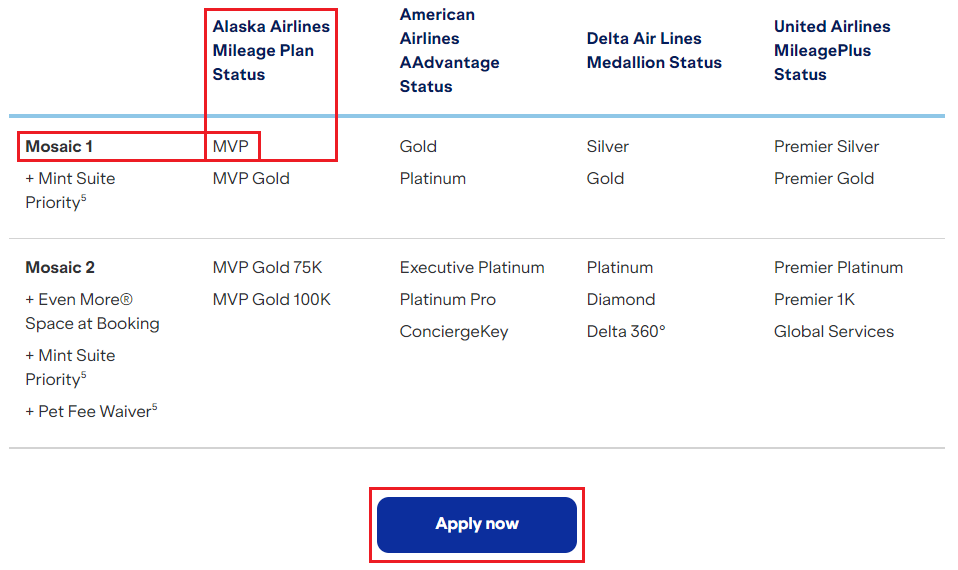

- Alaska Airlines or Southwest Airlines will introduce a “family pooling” benefit for miles or travel credit. – Technically, Alaska Airlines doesn’t allow “family pooling”, but it is possible (right now) to move miles into a single account. If someone in your family has a Barclays Hawaiian Airlines Credit Card, you can transfer Hawaiian Airlines Miles between accounts for free and move those miles to and from your Alaska Airlines account for free. Read this post for step by step instructions.

- American Airlines will allow Web Special awards to be changed online (currently, they can only be cancelled). – Nope, you cannot make changes to American Airlines Web Special awards.

- British Airways will add another airline (besides Finnair) to the Avios family. – Nope, Qatar and Finnair were the most recent additions to the Avios family.

- Delta will change their 15% SkyMiles discount for Delta credit cards holders. – Nope, the 15% discount for credit card holders hasn’t changed.

- United will allow you to combine multiple travel bank funds and future flight credits for the same reservation. – Nope, it is not possible to combine travel bank funds and future flight credits for a single United Airlines reservation.