Good afternoon everyone, I hope your week is going well. I don’t know about you, but 2020 was the year I earned a lot more transferrable points than I spent. I am hoping that in 2021, I will be able to spend a lot more points than I did in 2020. For this post, I looked at my 3 favorite transferrable points programs (American Express Membership Rewards Points, Chase Ultimate Rewards Points, and Citi ThankYou Points). I looked at my starting balances on January 1, the number of points I earned in 2020, miscellaneous point transfers in/out, the number of points I redeemed in 2020, and the ending balance on December 31 (I don’t have any plans on redeeming any points in the next few days). For a quick calculation, I earned 350K points across the 3 programs and spent a total of 211K points (most were with Chase’s Pay Yourself Back feature).

American Express Membership Rewards Points

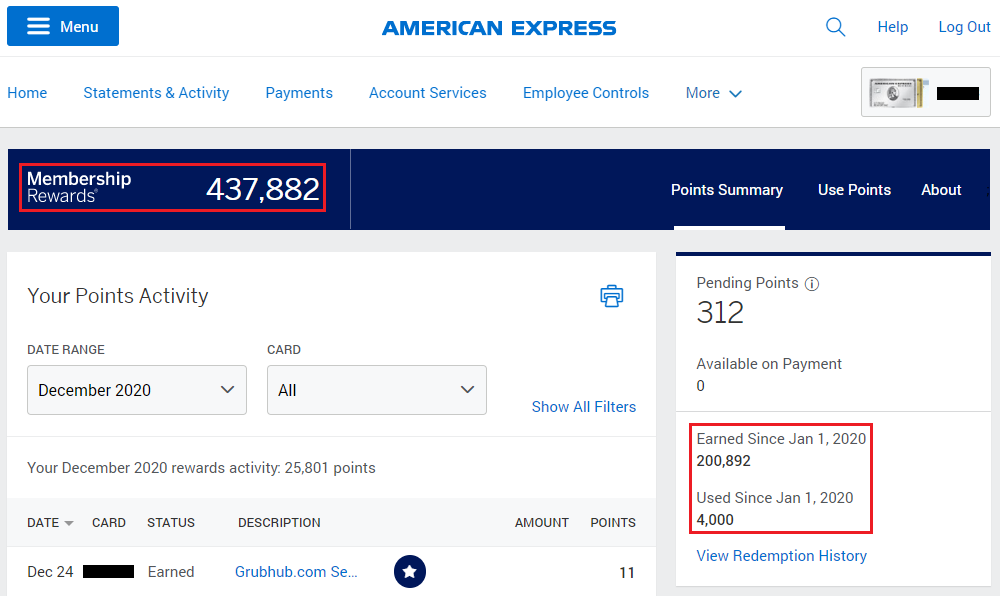

- Starting Balance on Jan 1: 240K

- Points Earned in 2020: 201K

- Points Redeemed in 2020: 4K

- Ending Balance on Dec 31: 438K

With American Express, I earned 201K AMEX MRs with 3 cards (American Express Business Platinum Card, American Express Gold Card, and American Express Blue Business Plus Credit Card). The Biz Plat had many pandemic bonus categories like wireless phones, shipping charges, and Dell purchases. The Gold Card had bonus categories for restaurants and grocery stores, along with high referral bonuses. And the Blue Biz Plus offered 2x everywhere and was my go to card when I wasn’t working on meeting minimum spending requirements on new CCs. Across all 3 CCs, I received a total of 65K AMEX MRs from referral bonuses. To view your points summary, click here. To view your redemption history, click the View Redemption History link.