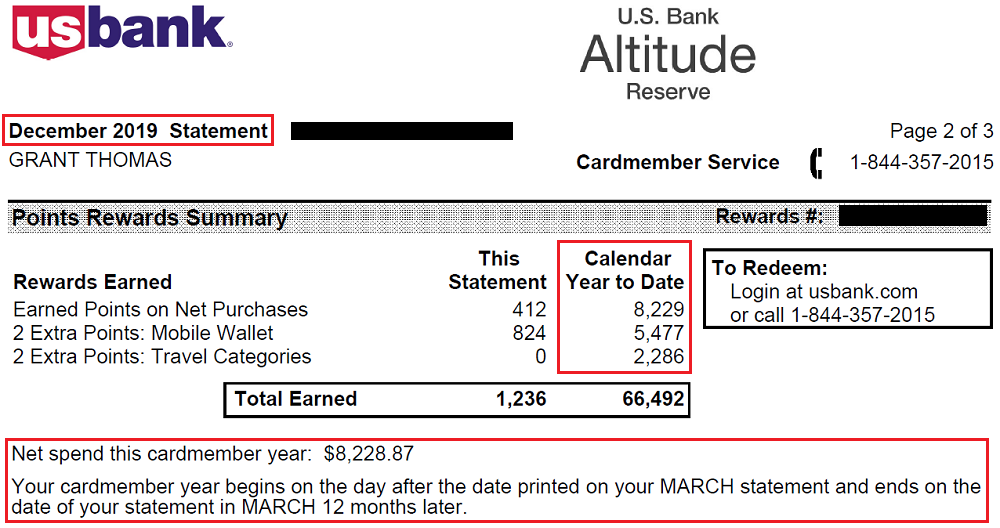

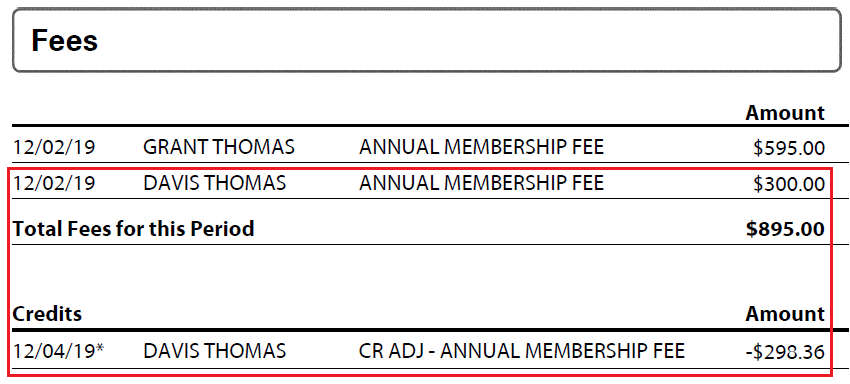

Good afternoon everyone, I hope your weekend is going well. A few weeks ago, I wrote these 2 posts:

- I Paid $4,588 in Credit Card Annual Fees in 2019 & Was it Worth it?

- Why Do We Keep 16 No Annual Fee Credit Cards?

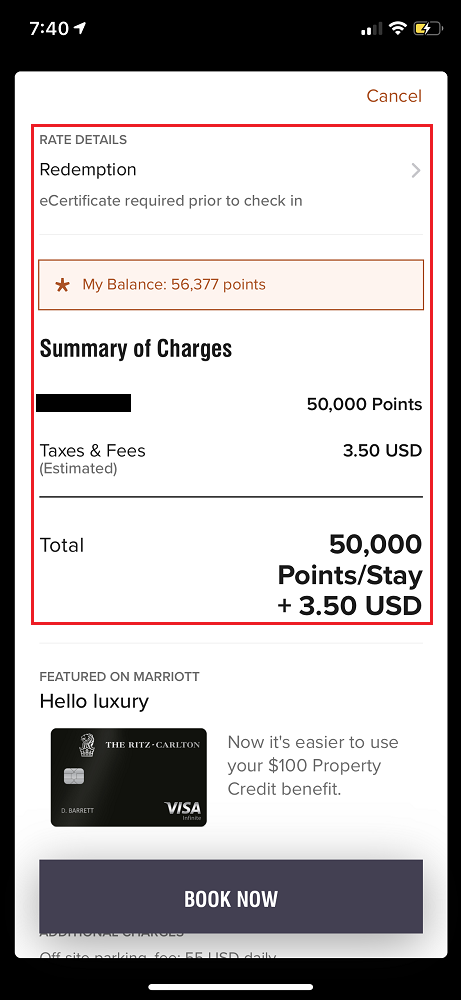

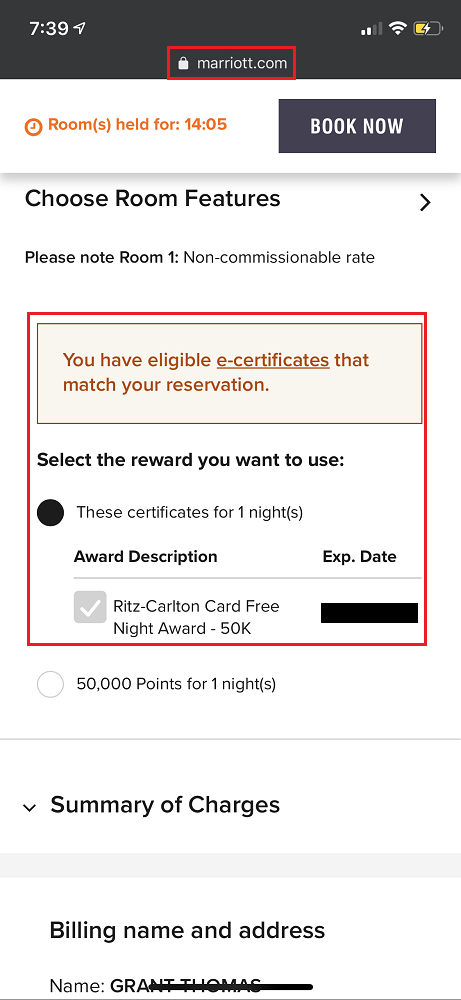

In those posts, I listed all the credit cards that Laura and I have. I also justified why I paid $4,588 in credit card annual fees in 2019. Since that post, there have been a few credit card changes (JPMorgan Chase Ritz Carlton Credit Card lost the Visa Infinite Discount Air Benefit and the Chase Sapphire Reserve Credit Card added Lyft and DoorDash benefits). A few readers commented and other bloggers linked to the top post and shared which credit cards they keep every year. As part of my 2020 travel resolutions, I said I wanted to reduce the amount I paid in credit card annual fees. In this theoretical post, here are the 5 credit cards with annual fees that I would keep…