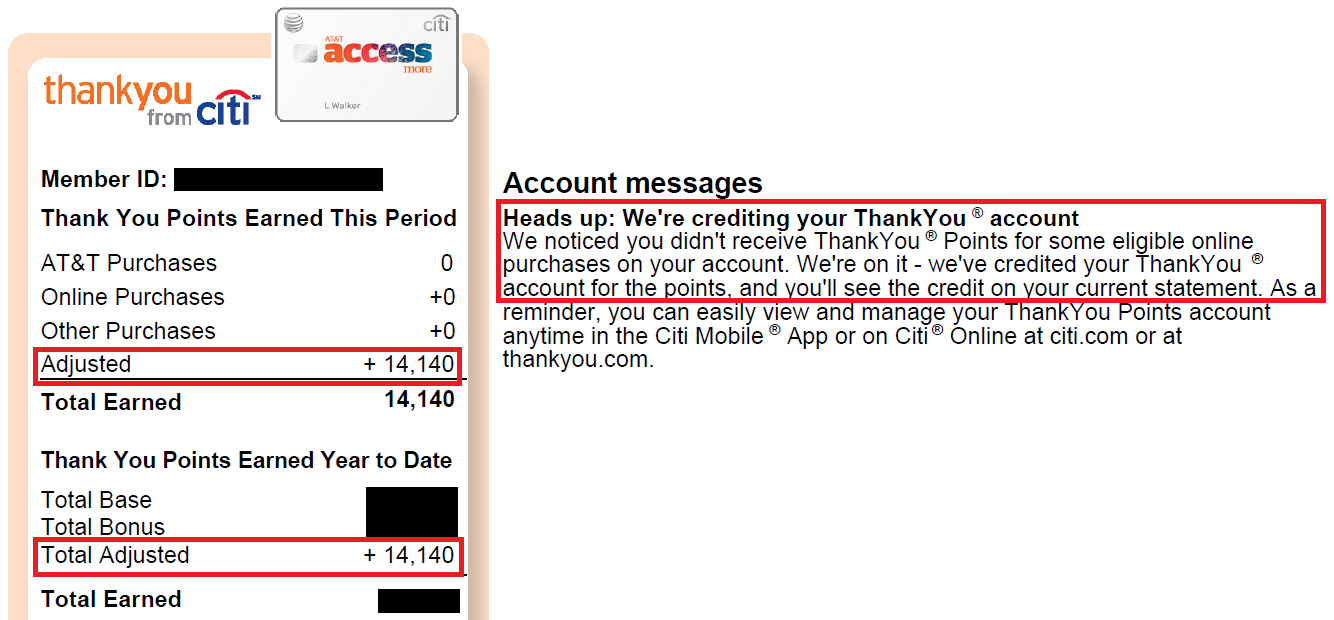

Good afternoon everyone, I hope you had a great weekend. I was reviewing my recent Citi credit card statements and saw an adjustment on my Citi AT&T Access More Credit Card (no longer available). The Account Messages section said:

Heads up: We’re crediting your ThankYou account

We noticed you didn’t receive ThankYou Points for some eligible online purchases on your account. We’re on it – we’ve credited your ThankYou account for the points, and you’ll see the credit on your current statement.

Citi identified that my credit card did not earn the correct 3x Citi ThankYou Points on all eligible purchases, so I received an adjustment of 14,140 Citi ThankYou Points, which implies that $7,070 of my purchases only earned 1x instead of the 3x rate for AT&T and online purchases. This was a nice surprise to see on my credit card statement.