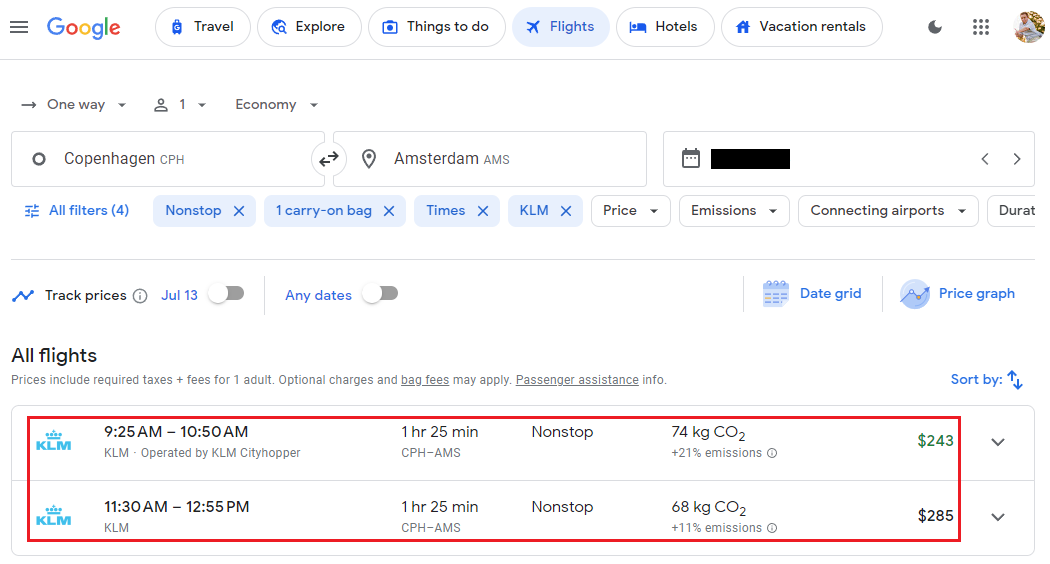

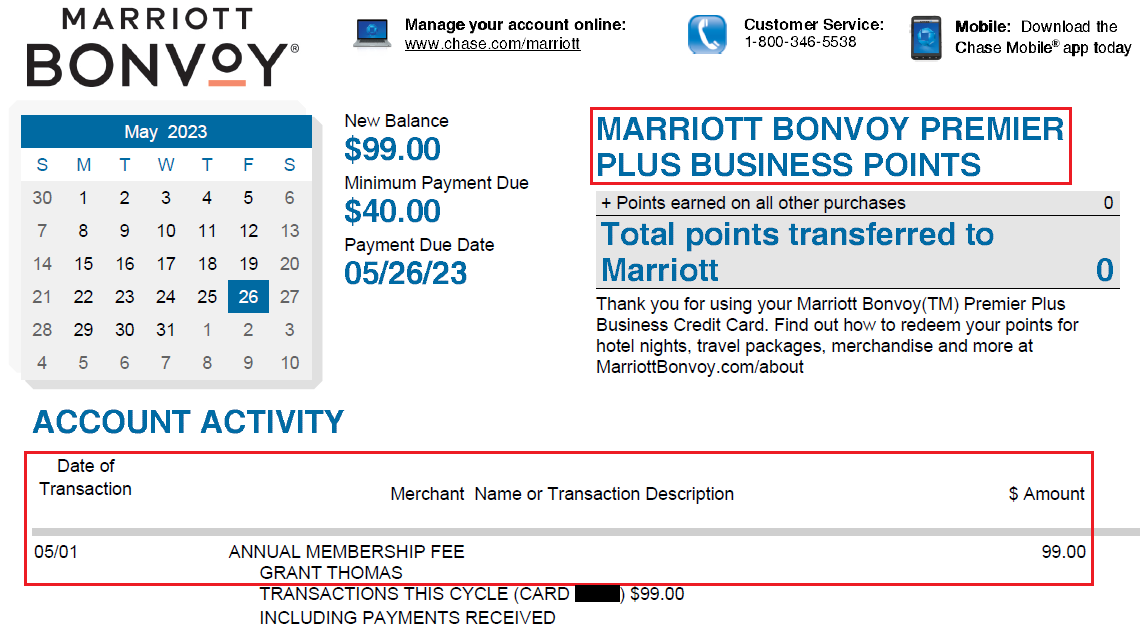

Good afternoon everyone, I hope you had a great Father’s Day Weekend. 3 weeks ago, my wife and I decided to book a last minute trip to Europe this summer with stops in Prague (PRG), Copenhagen (CPH), and Amsterdam (AMS). I am also a big fan of Viator, so I was researching some activities and food walking tours for our trip. I then remembered that I saw a few Viator Citi Merchant Offers recently, so I enrolled my eligible Citi credit cards in the offers and made my Viator purchases. In this post, I will show you how to enroll / activate your Viator offers and show how quickly the statement credit posts.

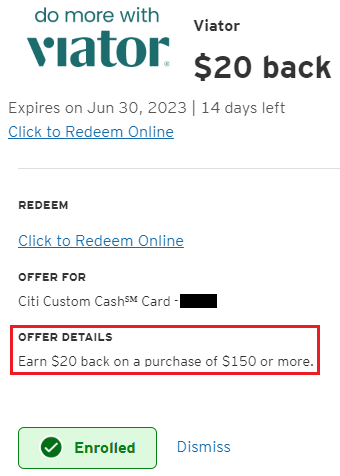

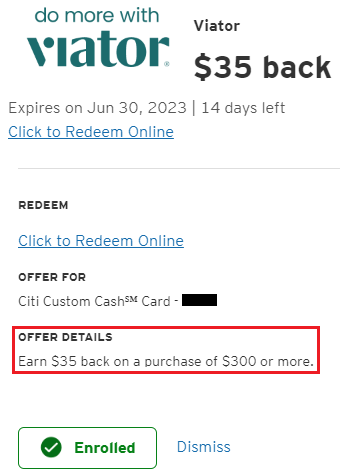

I checked all 6 of my Citi credit cards and found 2 different versions of the Viator Citi Merchant Offers: $20 Off $150 and $35 Off $300. These offers do not appear on the same credit cards and you must make a single purchase to trigger the offers.