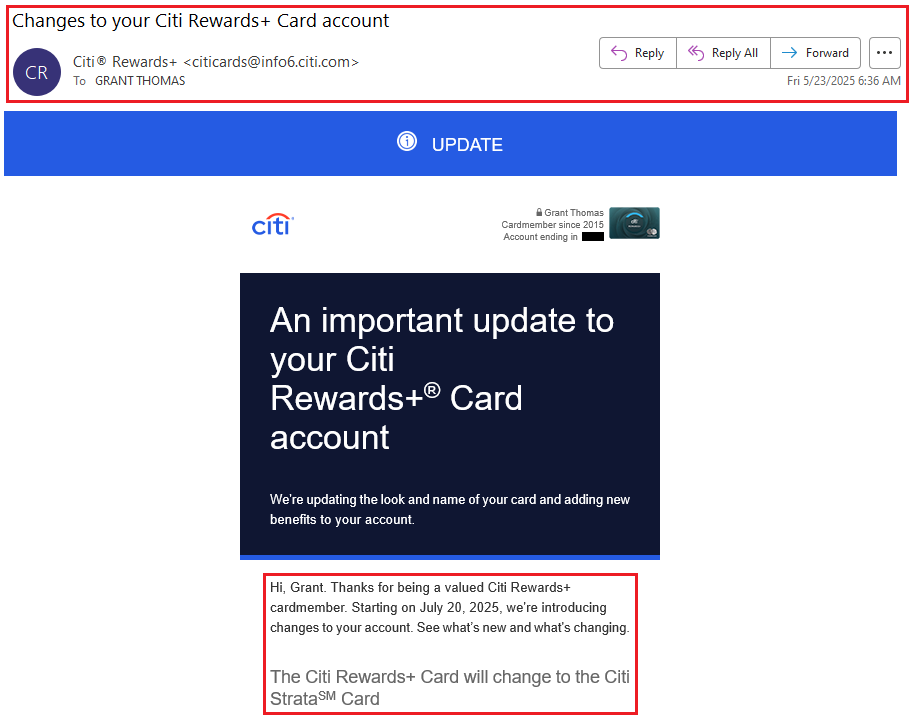

Good afternoon everyone, I hope your week is going well. Back on May 23, 2025, I received the following email from Citi regarding my Citi Rewards+ Credit Card. Affective July 20, 2025, the Citi Rewards+ Credit Card would become the new Citi Strata Credit Card. Citi made it sound like this was an upgrade, but this was definitely a downgrade for me. Here were the announced changes:

- 5X ThankYou Points for each $1 spent on hotels, car rentals, and attractions booked through Citi Travel®.

- 3X ThankYou Points for each $1 spent at Supermarkets.

- 3X ThankYou Points for each $1 spent on Select Transit and at Gas & EV Charging Stations.

- 3X ThankYou Points for each $1 spent in an eligible Self-Select Category of your choice (Fitness Clubs, Select Streaming Services, Live Entertainment, Cosmetic Stores/Barber Shops/Hair Salons or Pet Supply Stores). Please see your Citi Strata Card Terms and Conditions below for full details.

- 2X ThankYou Points for each $1 spent at Restaurants.

- 1X ThankYou Points for each $1 spent on All Other Purchases.

- Your ThankYou Points will no longer be rounded up to the nearest 10 points.

- When you redeem your ThankYou Points, you will no longer receive 10% points back for the first 100,000 ThankYou Points redeemed per calendar year.

Unfortunately, the last 2 changes were the 2 best features of the Citi Rewards+.