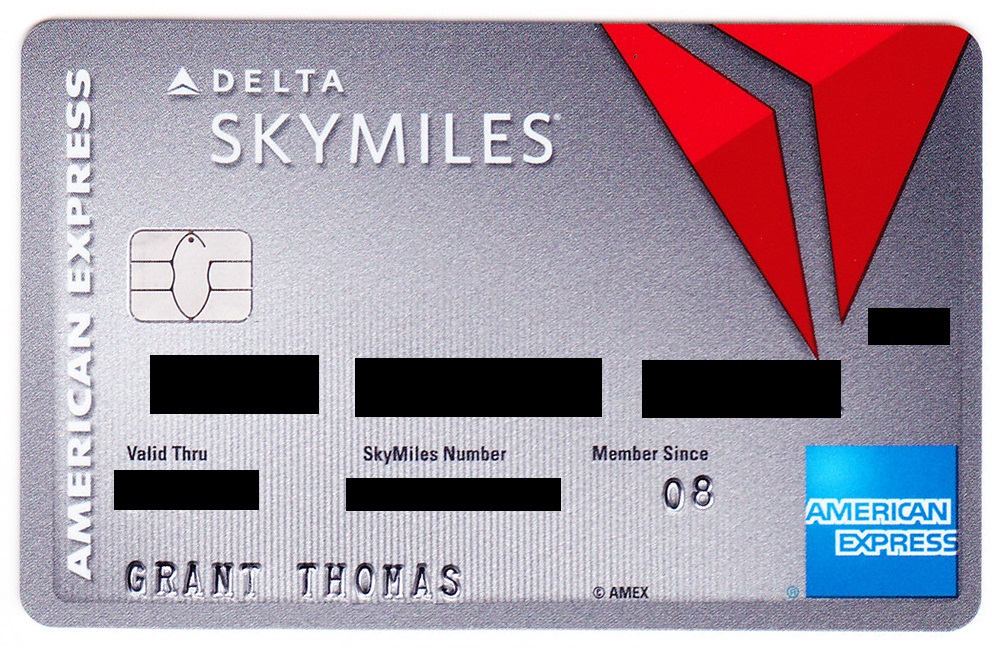

Good morning everyone, I hope your weekend is off to a great start. A few days ago, I wrote about my July App-O-Rama and my approval process for the American Express Delta Platinum SkyMiles Credit Card. Since my application was not instantly approved, I called American Express. I was told that I had too many credit cards with American Express and I needed to close an existing American Express credit card to open up a credit card slot. I closed my American Express Hilton Honors Business Credit Card and transferred the credit limit over to my new American Express Delta Platinum SkyMiles Credit Card. The American Express rep also offered to expedite the delivery of my new credit card. Yes please! My new credit card arrived via UPS Next Day Air and here is the unboxing post that shows the card art, welcome documents, and the card benefits. Here is the front and back of the American Express Delta Platinum SkyMiles Credit Card: