Good morning everyone. A few weeks ago, I did a mini app-o-rama and applied for 3 credit cards: Capital One Venture X Credit Card (read post), Chase IHG Rewards Premier Business Credit Card, and Bank of America Alaska Airlines Credit Card (read post).

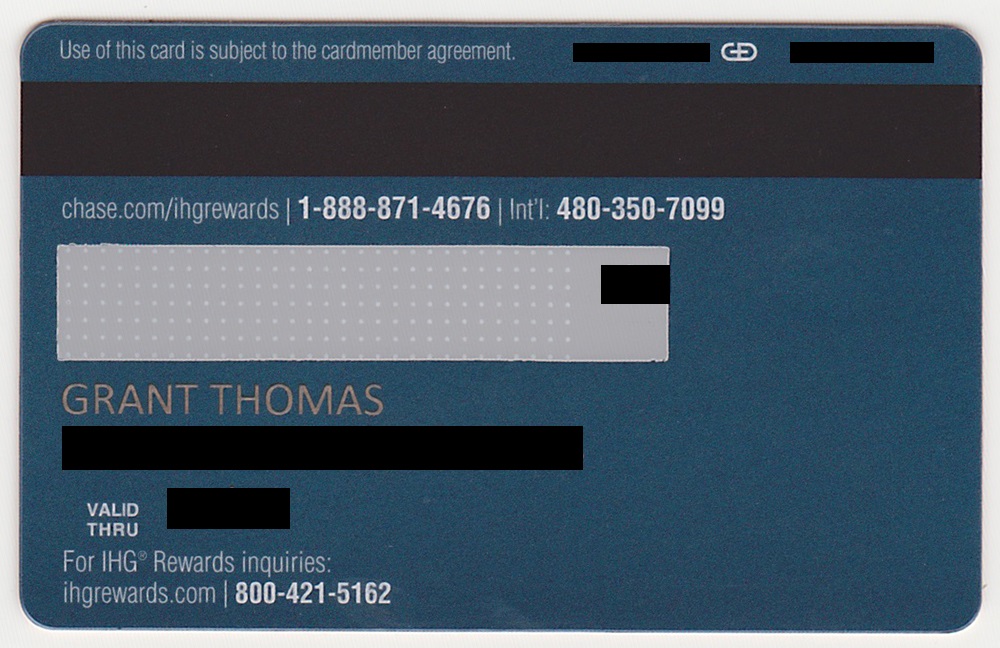

In this post, I will show you the Chase IHG Rewards Premier Business card art, welcome letter, brochure, and the online activation process. First things first, here is the front and back of the card. It is clean and nicely designed. It has a very similar style as the Chase IHG Rewards Premier Credit Card.