Good afternoon everyone, I hope you had a great weekend. I called about retention offers on a few different credit cards today and wanted to share my results. Please make sure to scroll to the bottom of this post and read my tips on making retention calls. I took a page out of Frequent Miler’s playbook (My $575 phone call (complete in 20 minutes)) and called about these 4 credit cards:

- Chase Hyatt Credit Card ($75 annual fee posted December 1)

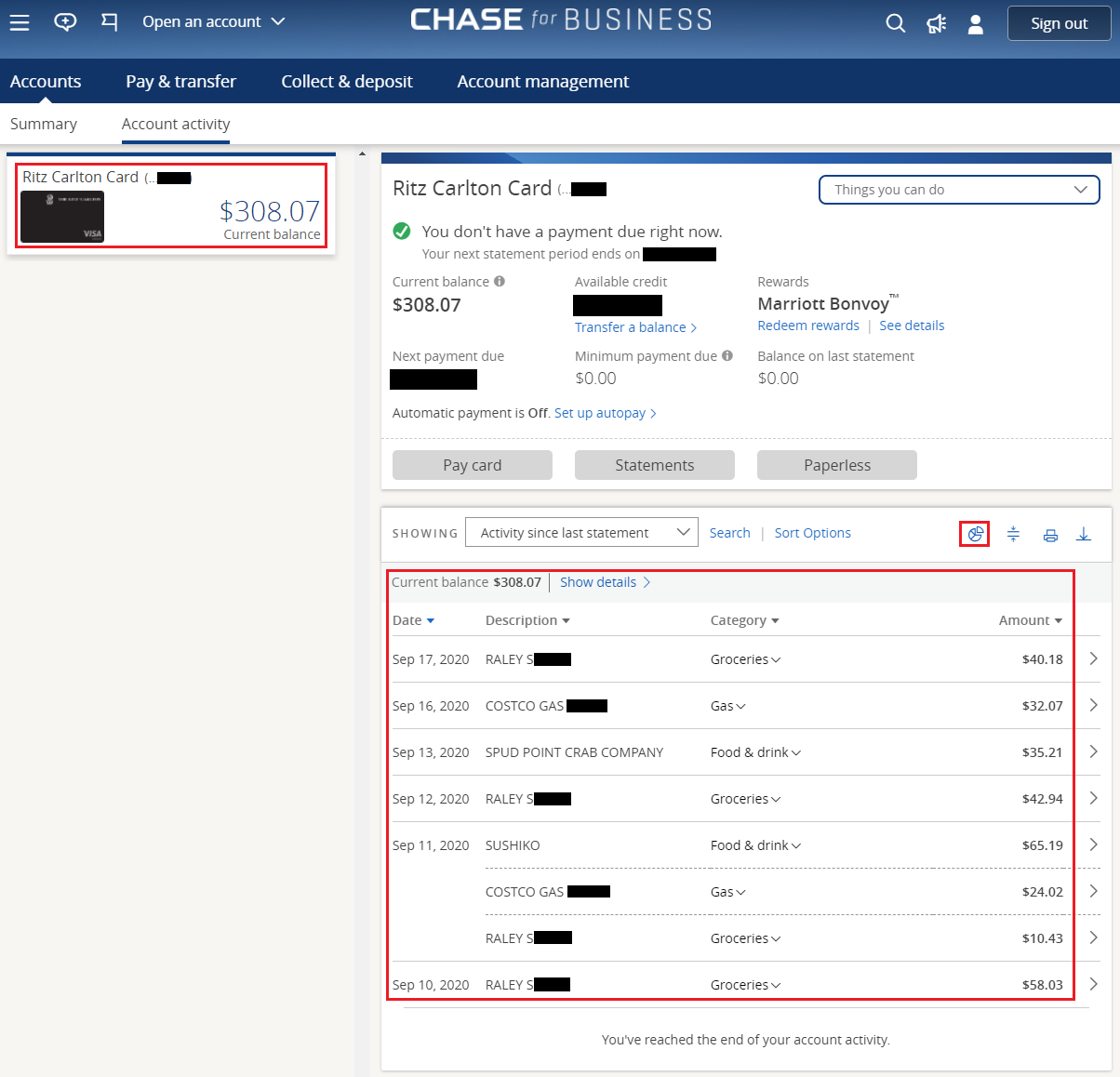

- JPMorgan Chase Ritz Carlton Visa Infinite Credit Card ($450 annual fee posted July 1)

- Chase Marriott Bonvoy Premier Plus Business Credit Card ($99 annual fee posted May 1)

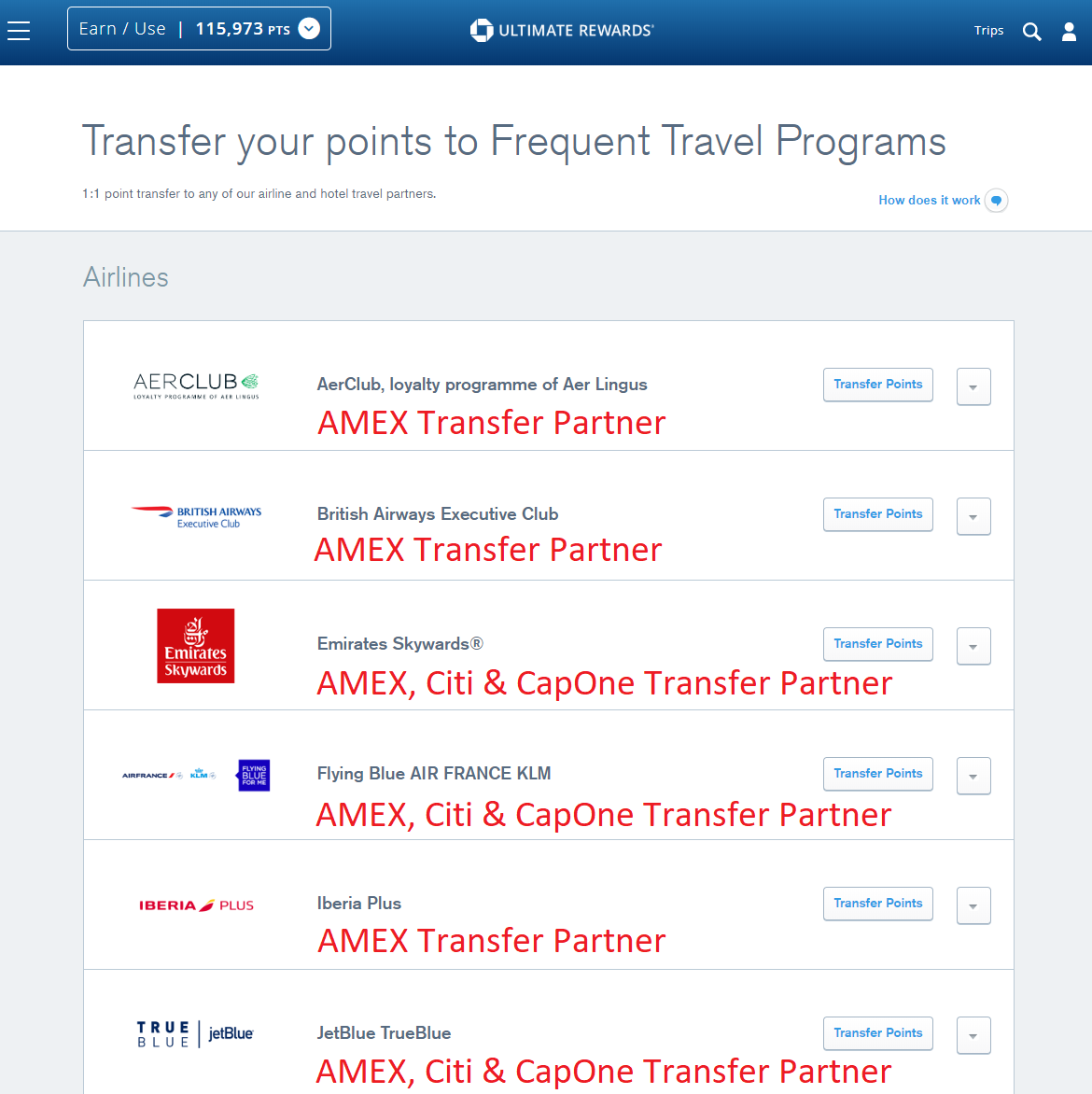

- American Express Business Platinum Charge Card ($595 annual fee posted December 2)

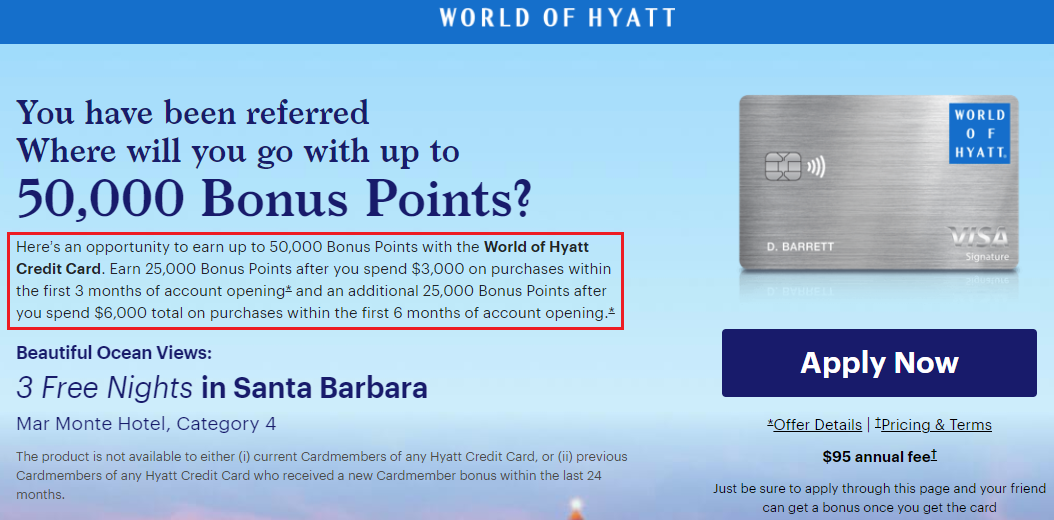

Since the old Chase Hyatt Credit Card is product changing to the new Chase World of Hyatt Credit Card on January 11, 2021, I decided to call Chase and ask about a retention offer. This is a huge ask that I knew was never going to fly, but I tried anyways. I told the Chase rep that I was planning on closing my old Hyatt credit card and was going to apply for the new World of Hyatt credit card in a few weeks since I could earn up to 50,000 World of Hyatt Points with the new sign up bonus. Instead of going through the process of closing one card and applying for the other card, I asked if Chase could provide some bonus World of Hyatt Points to forgo the sign up bonus. Nope, that was not possible. At that point, I asked the rep to close that credit card and transfer the credit limit over to another Chase personal call. I am 0 for 1 at this point, onto the next call.