Updated 12:50pm PT on 6/6: My $300 travel credit on the Chase Sapphire Reserve doesn’t reset until October. See details below.

Updated 11:00am PT on 6/5: I tested the $250 Hilton Resort Credit on a restaurant purchase and the statement credit posted in 3 days. See details below.

Updated 11:30am PT on 6/3: The $325 travel credit on the US Bank Altitude Reserve can now be used for restaurant purchases from 6/1 – 12/31. See details below.

Good morning everyone, I hope you had a good weekend. Today is June 1 and the start of a new month. As the saying goes: New Month = New Credits. I have several credit cards, but these are the 5 credit cards that have credits that I can use this month:

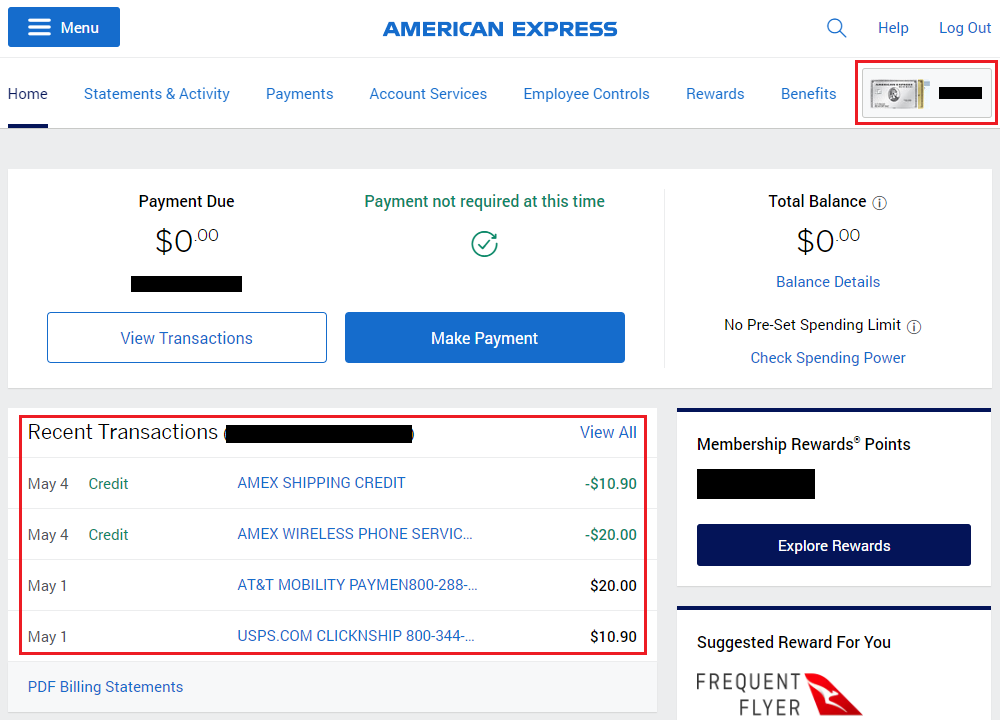

American Express Business Platinum Card

- 6/1 – 6/30: $20 shipping credit (June, July, Aug, Sep, Oct, Nov & Dec) – I used $18.70 credit last month when I Purchase & Print USPS Shipping Labels Online

- 6/1 – 6/30: $20 wireless credit (June, July, Aug, Sep, Oct, Nov & Dec) – I paid $20 to my AT&T bill last month to trigger the credit

7/1 – 12/31: $200 Dell credit(I need to wait another month before I use these credits)