Good afternoon everyone, happy Friday! I was working on my Buy Miles & Points Page and found 4 offers that end in the next 2 weeks. Always check the math to make sure that buying miles & points makes sense for you. Do not buy miles & points speculatively unless you have a use in mind. With that said, here are 4 offers that end soon.

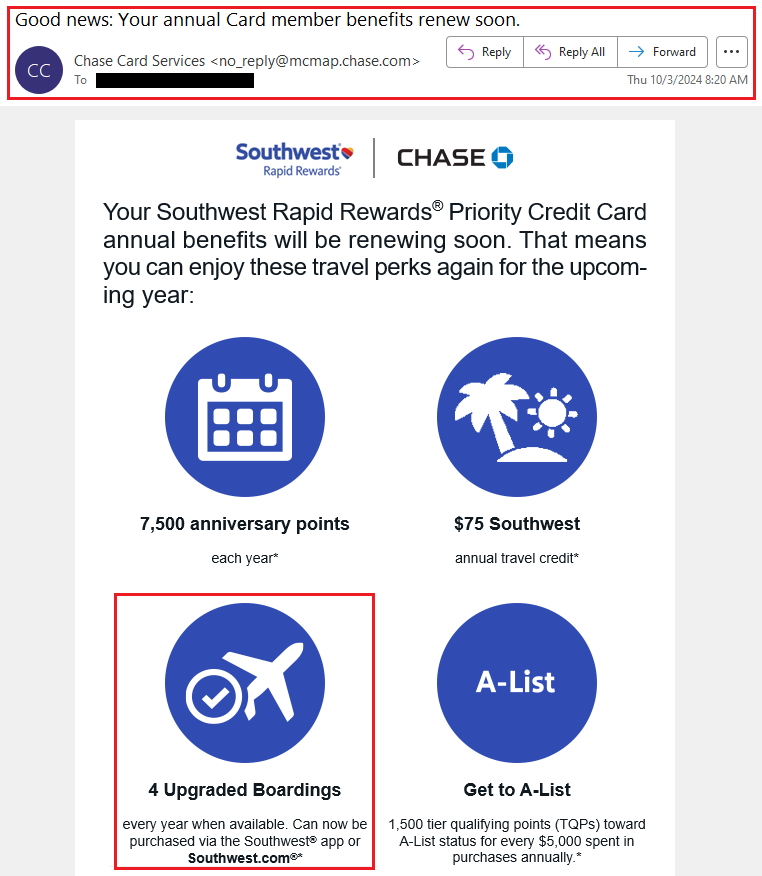

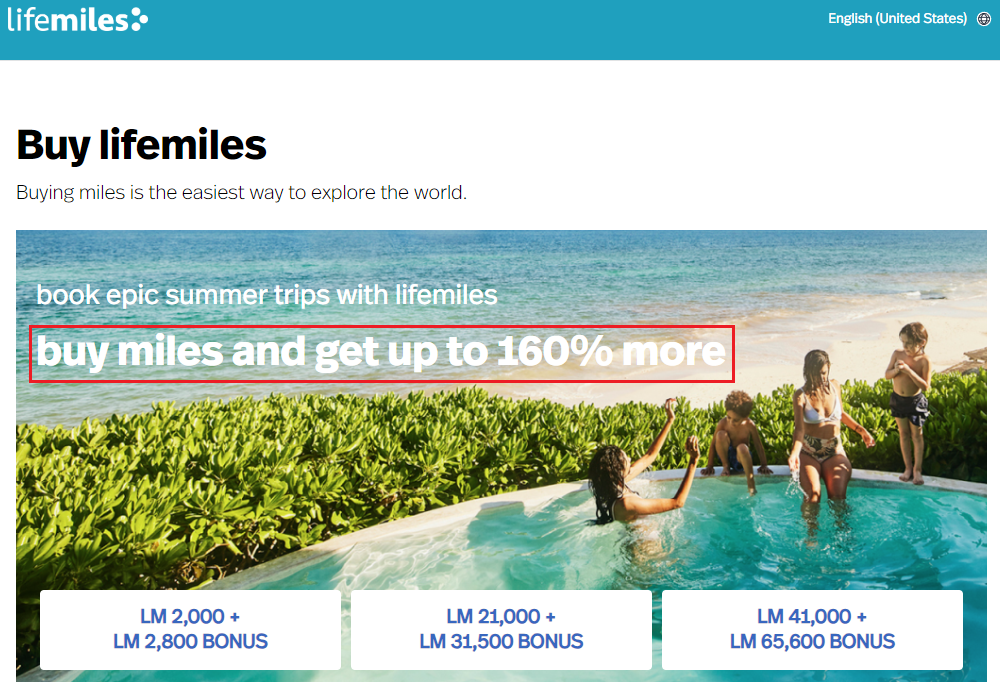

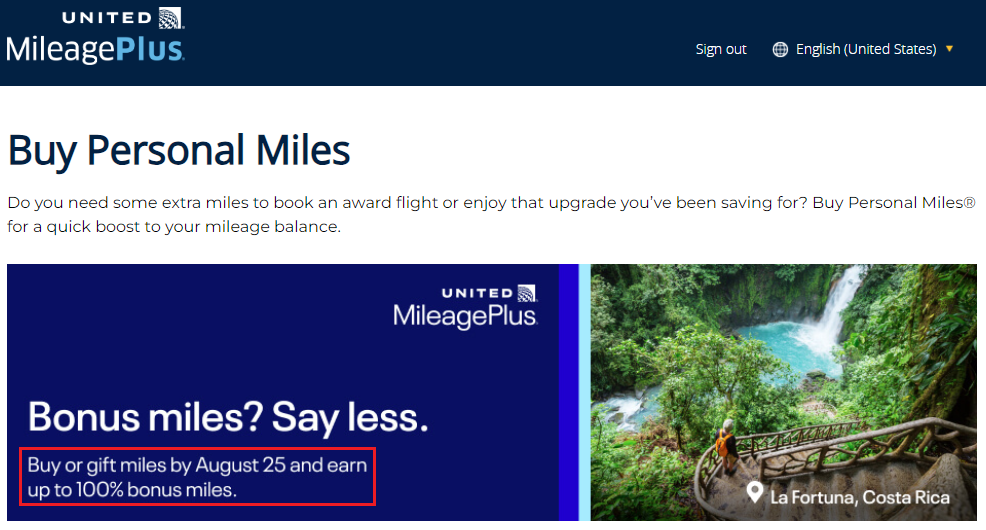

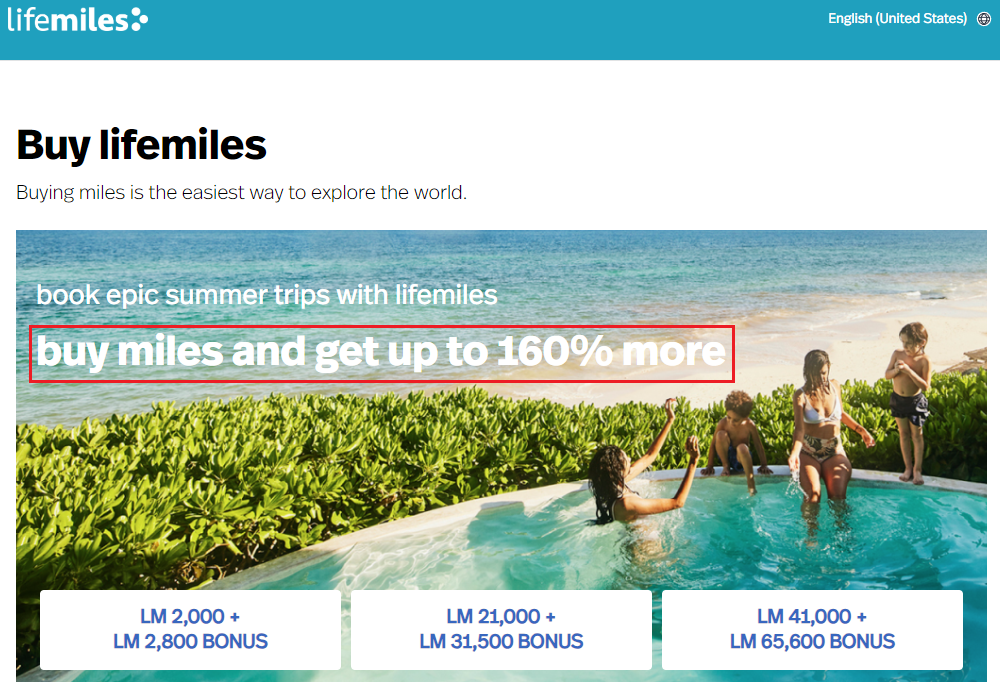

Up first, Avianca Airlines is offering up to a 160% bonus, depending on the number of Avianca Airlines LifeMiles you purchase. This offer expires today – August 16.

Here are the complete terms & conditions of the Avianca Airlines promo:

Original promotion term between July 19, 2024 and August 15, 2024 (09:00AM GMT-6, El Salvador). New promotion end date: August 16, 2024 (11:59PM GMT-6, El Salvador). The bonus applies as follows: for purchases of 1,000 lifemiles receive 120% additional miles, purchases between 2,000 – 20,000 lifemiles receive 140% additional miles, purchases between 21,000 – 40,000 lifemiles receive 150% additional miles and for purchases between 41,000 – 200,000 lifemiles receive 160% additional miles. The miles must be purchased in multiples of 1,000. The minimum miles to purchase per transaction is 1,000 lifemiles. The maximum miles to purchase per transaction during this promotion is 200,000 lifemiles. Additionally, the maximum miles that a member can receive during the promotion is 500,000 miles, minus the miles that the member has previously purchased in 2024, excluding bonus miles. The purchase transaction cannot be made if the number of miles to purchase, including all miles purchased in 2024 and excluding bonus miles, exceed the 500,000 miles limit. The maximum number of miles to receive by a member through the purchase of miles per calendar year outside of this promotion is 500,000 lifemiles excluding any bonus miles received. If the member surpasses the limit, through purchases made during this promotion and other purchases in 2024, considering the bonuses received for those purchases, he or she will not be able to purchase any more miles outside of promotional periods until the next calendar year. Each package of 1,000 lifemiles is US$33.00 without applicable taxes and US$40.26* including applicable taxes according to country of the mailing address registered in the lifemiles database. GST/HST will be charged to Canadian residents. QST Will be charged to Quebec residents. All accrued miles count towards Elite progress, except for miles accrued in Iberia, GOL, and certain miles compensations/bonuses. You will earn qualifying miles according to the rates established for each product or service. Check your Elite progress and other conditions at lifemiles.com. The purchase of miles is not reversible or refundable, except in countries where this right is granted by applicable law, such as the right to retraction in Colombia, in the cases where it applies. The purchase of miles is an immediate execution contract. Once the payment is made, the miles will be accrued in up to 72 hours on the member’s account. As of that moment, the miles can be used according to the terms and conditions of the lifemiles Program. Miles are not endorsable. Miles purchase is available through lifemiles.com. The receipt of the transaction will reflect the total number of miles accrued to the member´s account, including the bonus miles and the total charge for the transaction. Does not apply to the Flexible Redemption (LifeMiles + Money) during the payment process of air ticket redemption. Miles purchased, once accrued, can be redeemed in accordance with the conditions specified in the lifemiles Program Terms and Conditions and the portfolio of products and services available for redemption. Lifemiles Terms and Conditions apply. Available at lifemiles.com. LifeMiles is a trademark of LifeMiles LTD. Any currency exchange rate, foreign transaction fee and additional fees are determined solely by the issuer of your payment instrument and not by Points or LifeMiles LTD. If you have any questions about these fees or the exchange rate applied to your transaction, please contact your bank. Powered by Points to purchase lifemiles. Transaction will appear as ‘Lifemiles by Points‘ on your monthly credit card statement.

*The values are settled based on the exchange rate of the date of the transaction. The price can be lower depending on the correspondence country entered on the Member’s profile in their lifemiles account.

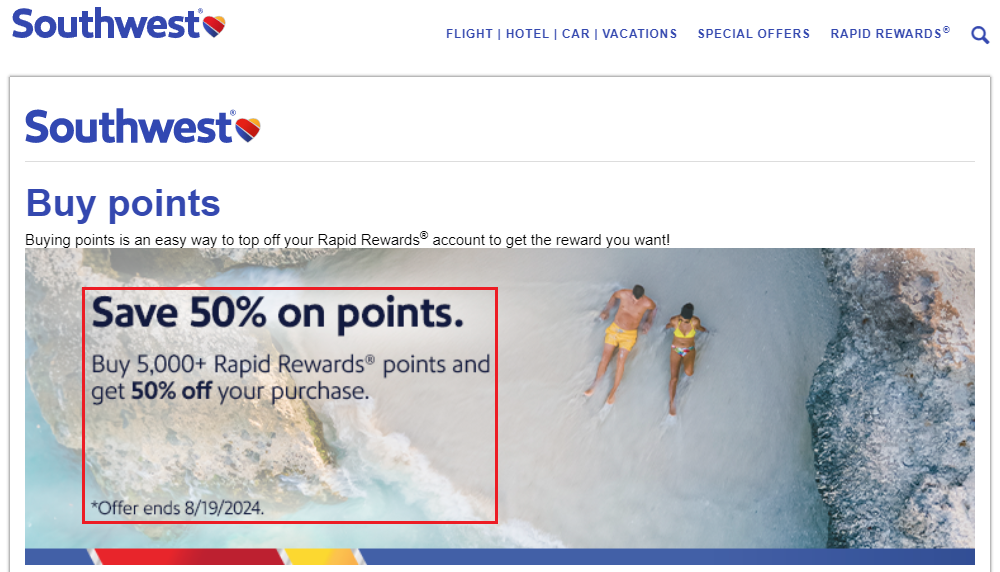

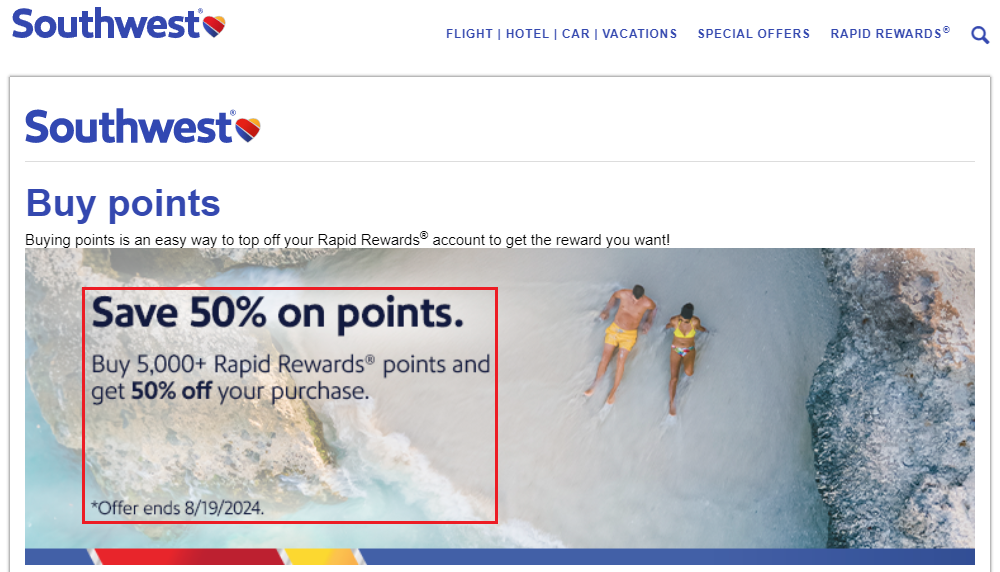

Up next, Southwest Airlines is offering up to a 50% discount, depending on the number of Southwest Airlines Rapid Rewards Points you purchase. This offer expires on August 19.

Here are the complete terms & conditions of the Southwest Airlines promo:

Offer is valid between July 30, 2024 12:00:01 a.m. CT and August 19, 2024 11:59:59 p.m. CT. Rapid Rewards® Member will save 50% when the Member purchases 5,000 or more Rapid Rewards points within a single purchase. Gifted and transferred point transactions are not included in this offer. A valid credit card is required to purchase points. A minimum 5,000 points purchase threshold must be met on a per transaction basis in order to qualify for the discount. Points can be purchased in blocks of 1,000 and a daily maximum of 60,000 points can be purchased by a Member with no annual maximum. Transactions are nonrefundable and nonreversible. Purchased points do not count towards A-List, A-List Preferred, or Companion Pass® qualification. Prices are in U.S. dollars and include all applicable taxes. Prices for the purchase of points are only valid while a Member is currently logged in to Southwest.com® or when points are purchased by phone, in the process of booking a flight, and such prices are subject to change Please allow up to 72 hours for points to post to the applicable Rapid Rewards account. All Rapid Rewards rules and regulations apply and can be found at Southwest.com/rrterms. Southwest® reserves the right to amend, suspend, or change the Rapid Rewards program and/or Rapid Rewards program rules at any time without notice. Rapid Rewards Members do not acquire property rights in accrued points. The number of Rapid Rewards points needed for a particular Southwest flight is set by Southwest and will vary depending on destination, time, day of travel, demand, fare type, point redemption rate, and other factors, and is subject to change at any time until the booking is confirmed.

The email address provided here is used for confirmation of your purchase of Rapid Rewards Points and if you’ve opted into receiving emails from Points.com Inc. related to Southwest Rapid RewardsTM. This will not alter the email address currently stored in your Rapid Rewards profile.

Prices are in U.S. dollars and includes excise taxes. Prices for the purchase or gifting of Rapid Rewards points are only valid while a Member is currently logged into Southwest.com® and such prices are subject to change. Purchased Rapid Rewards points are nonrefundable and nonreversible. All Southwest Rapid RewardsTM Rules and Regulations apply in accordance with the Privacy Policy.

Up next, United Airlines is offering up to a 100% bonus, depending on the number of United Airlines MileagePlus Miles you purchase. This offer expires on August 25.

Here are the complete terms & conditions of the United Airlines promo:

-

- Promotional offer valid between 8:00 a.m. CT on August 7, 2024, and 11:59 p.m. CT on August 25, 2024.

- Promotional offer not applicable to past transactions.

- Bonus miles count toward the 200,000-mile annual limit per account.

- You may purchase up to 200,000 miles per account per calendar year.

- Miles will generally be credited to the recipient’s MileagePlus account when the transaction is complete; provided that certain transactions may take up to 72 hours.

- Bonuses will be calculated on a per transaction basis only.

- The bonus amount applicable to a transaction is shown in the chart.

- Transactions may not be aggregated to calculate the bonus.

- The credit card used in the transaction will be billed immediately upon purchase.

- Mileage rates and other fees and offer terms are subject to change.

- Miles purchased are nonrefundable.

- Purchased miles do not count toward MileagePlus Premier® status.

- See here for all Terms and Conditions applicable to this transaction, which include United’s Privacy Policy and the MileagePlus Program Rules.

- GST/HST is charged to Canadian residents. QST is charged to Quebec residents.

- If you use Powered by Points to purchase United MileagePlus miles, the transaction will appear as “Points United Miles”.

- Buying miles counts as a United® purchase when made with your United MileagePlus card. You’ll get the miles you buy, plus miles for every $1 spent.

- Pricing is only available for purchases made through buymiles.mileageplus.com.

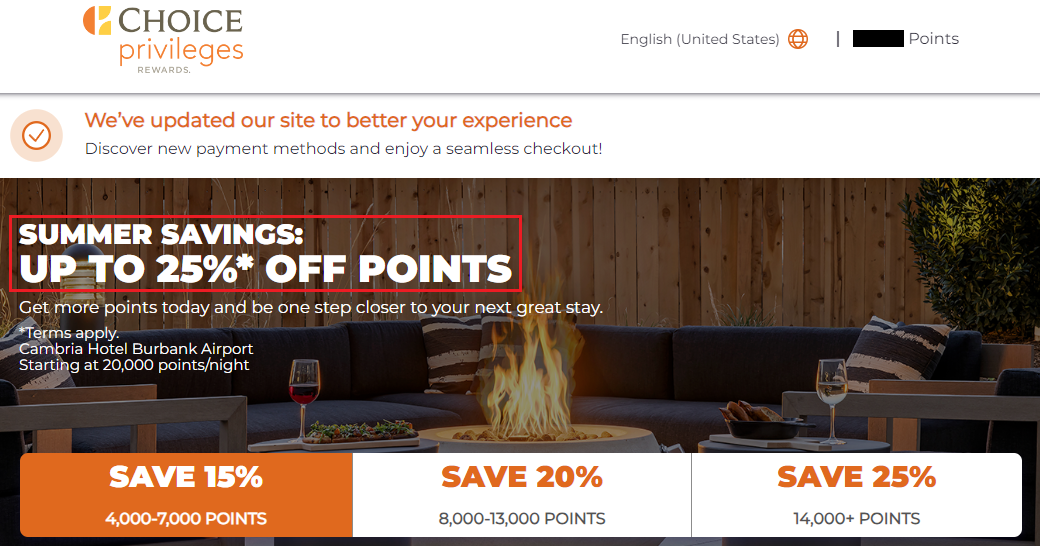

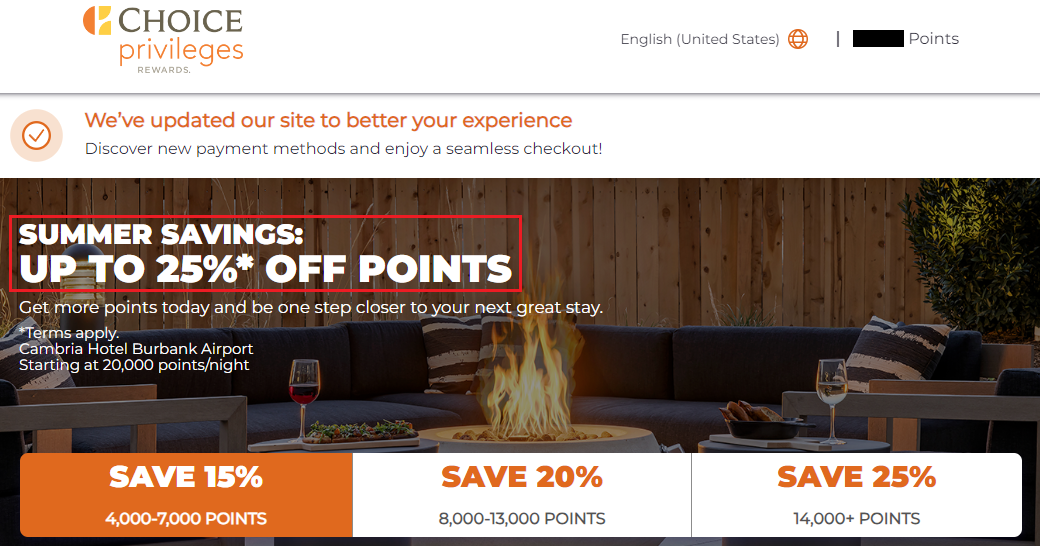

Lastly, Choice Hotels is offering up to a 25% discount, depending on the number of Choice Hotels Privileges Points you purchase. This offer expires on August 27.

Here are the complete terms & conditions of the Choice Hotels promo:

Transactions must be completed between 12 AM EST July 19, 2024 and 11:59 PM EST August 27, 2024 to be eligible for this Discount offer. There is a 4,000 point purchase minimum that applies. Must be a Choice Privileges® Rewards Program member; Points will be posted to your Choice Privileges account within 24 hours after your transaction is complete. Purchased points do not count toward Elite Status or Lifetime Elite Gold Status. Transactions are final and non-refundable. Offer may not be valid for all members. All other terms and conditions of the Choice Privileges Rewards Program apply. Choice Hotels reserves the right to amend these terms or terminate this promotion at any time. Price includes all applicable fees. A GST/HST charge applies to purchases by Canadian residents. An additional QST charge applies to purchases by Quebec residents. Purchased points are not refundable and are applicable towards all Choice Privileges rewards.

Reward nights are only available at participating hotels and may not be available at Ascend Hotel Collection casino locations. You may not reserve reward night stays through a travel agent, and free night stays are not commissionable to travel agents. Your free room night does not include incidental charges and/or resort fees. Members may cancel their reservations through the Program Line or through their online account and by the date and time specified by the reservation sales representative or online for a refund. If you are unable to use your room and fail to cancel your reservation by that time, however, or if you do not claim the room by the specified time, Choice will not credit your account with the points that you redeemed for that room.

You do not earn Choice Privileges points or airline miles for reward night stays. Choice Hotels reserves the right to change or discontinue this offer at any time. Hotels are independently owned and operated.

As of August 16, here are all the other current buy miles & points offers:

| Air Canada |

Buy Air Canada Aeroplan Miles today with up to a 30% discount. Offer expires September 3, 2024. |

| IHG Hotels |

Buy IHG One Rewards Points today with up to a 100% bonus. Offer expires September 7, 2024. |

| JetBlue |

Buy JetBlue TrueBlue Points today with up to a 100% bonus. Offer expires September 13, 2024. |

| Spirit Airlines |

Buy Spirit Airlines Free Spirit Miles today with up to a 60% bonus. Offer expires September 13, 2024. |

| Hawaiian Airlines |

Buy Hawaiian Airlines Miles today with up to a 50% bonus. Offer expires September 13, 2024. |

| Marriott Hotels |

Buy Marriott Bonvoy Points today with up to a 40% bonus. Offer expires September 23, 2024. |

| Hilton Hotels |

Buy Hilton Honors Points today with up to a 100% bonus. Offer expires September 24, 2024. |

| Hyatt Hotels |

Buy World of Hyatt Points today with up to a 20% discount. Offer expires October 8, 2024. |

| American Airlines |

Buy American Airlines AAdvantage Miles today with up to a 35% discount. No expiration date listed. |

If you have any questions about any of these promos, please leave a comment below. Have a great weekend everyone!