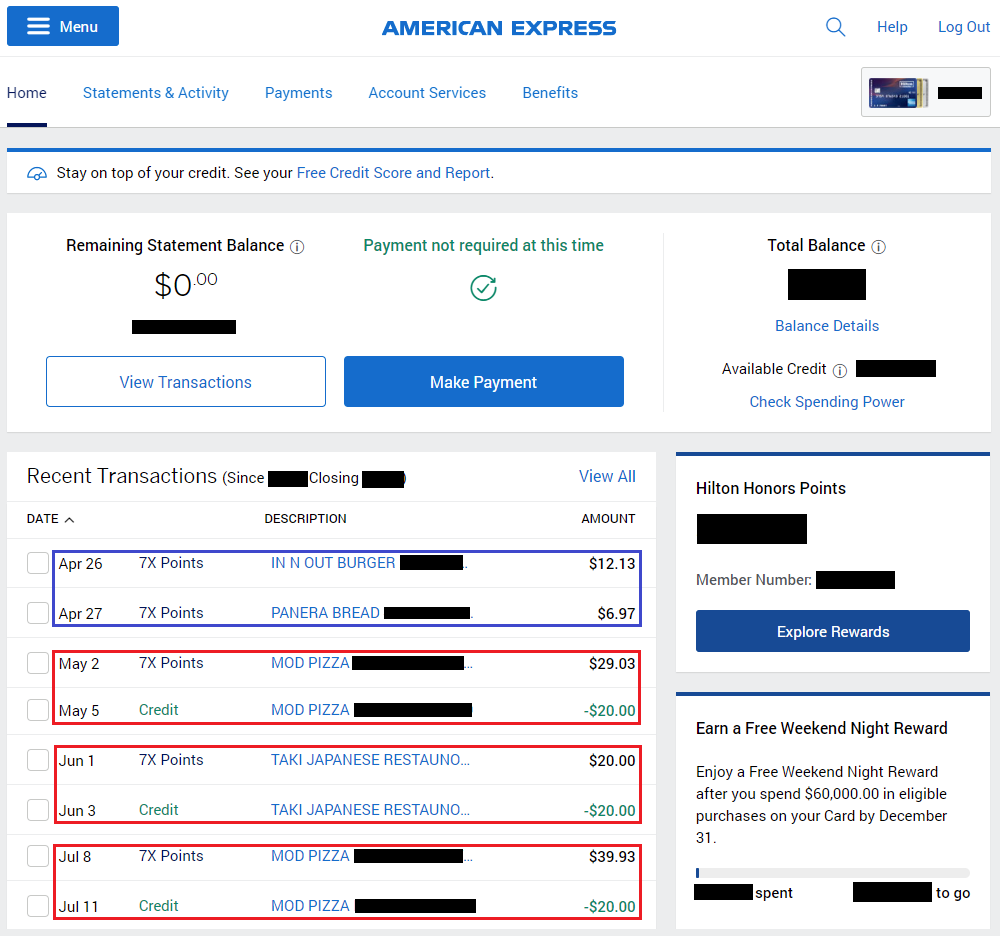

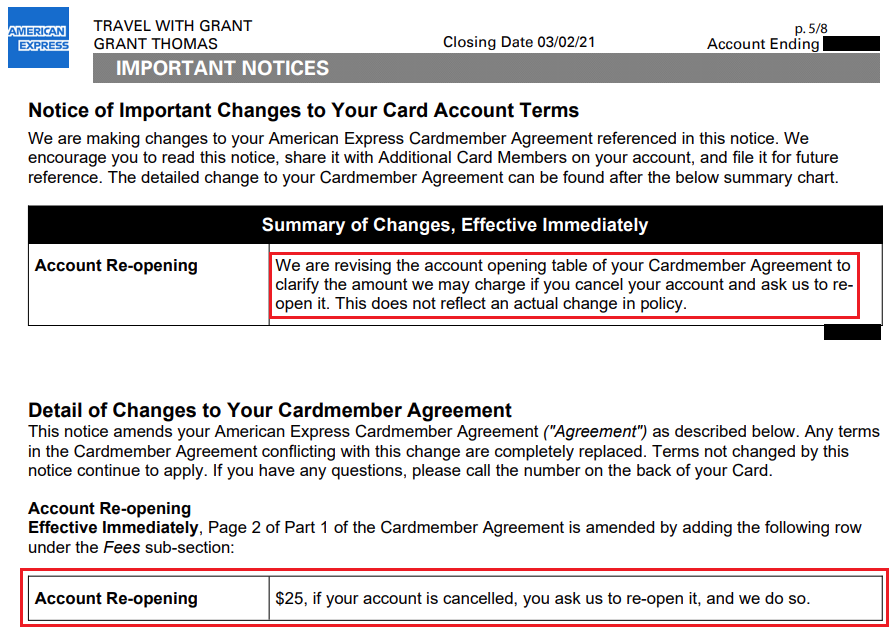

Good morning everyone, I hope your week is going well. One of the current card benefits of the American Express Hilton Honors Aspire Credit Card is the $20 monthly dining credit. Unfortunately I ran into an issue using this card benefit in April on 2 restaurant purchases (In N Out Burger and Panera Bread). As you can see, I never received the $20 dining credit for my April purchases, but I did receive the credit automatically in May, June, and July. Based on my transactions, the $20 dining credit posts ~3 days after the restaurant charge posts to your account. I contacted AMEX on May 1 and again on July 13 to check on the status of the dining credit and received conflicting answers. Here is what I was told and what I learned…