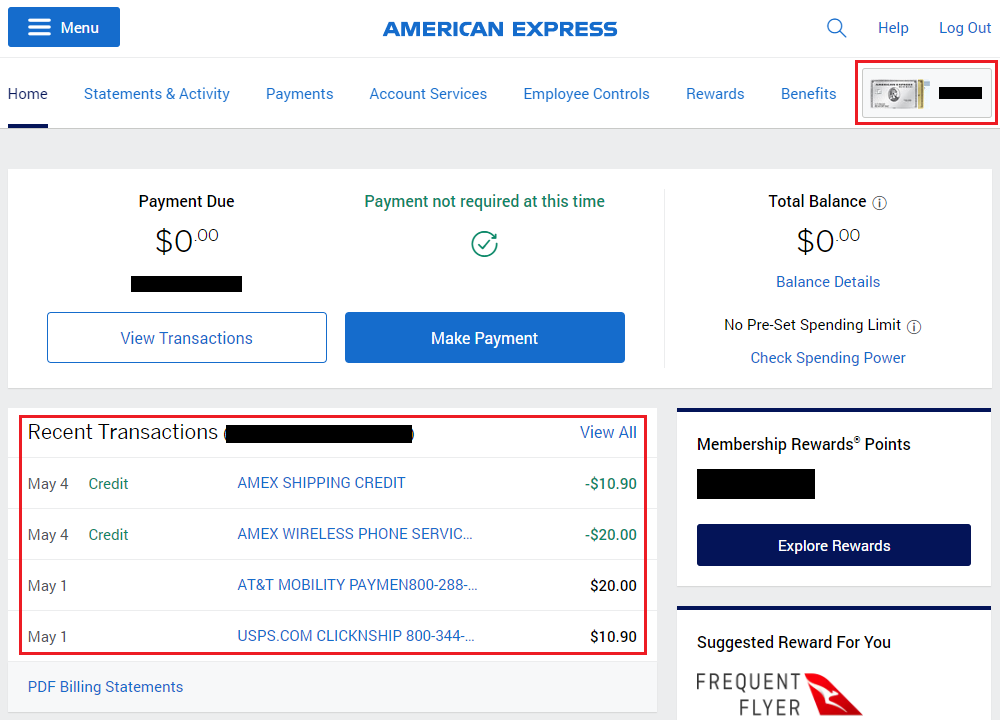

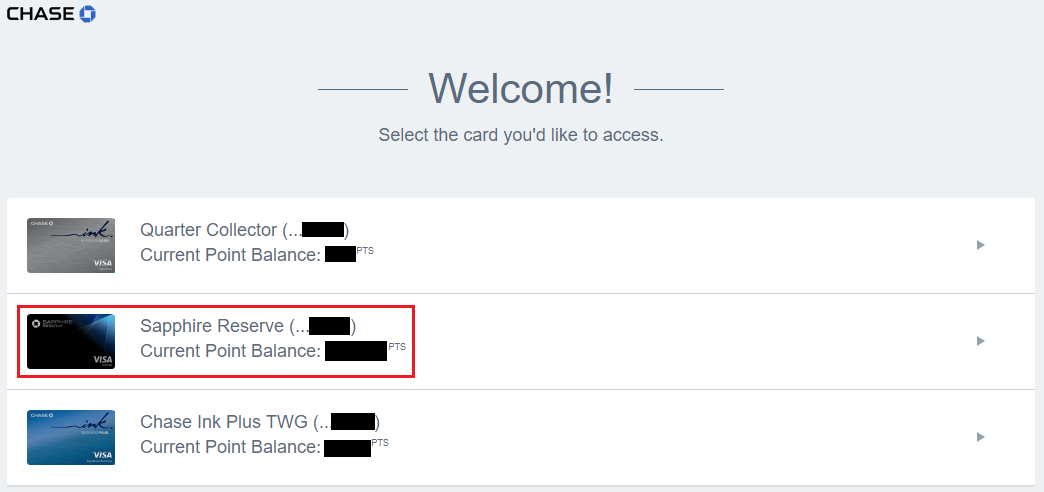

Good morning everyone. A long time ago (February 2020), I purchased 2 American Airlines award tickets to fly from LaGuardia, New York (LGA) to Dallas, Texas (DFW) to Orange County, California (SNA). Laura and I were going to be in NYC in early July and then fly to Orange County for Fourth of July weekend. I picked this route because I wanted to check out the American Express Centurion Lounges at LGA and DFW. I used 20,000 American Airlines miles per ticket (40k total), paid the taxes with my Chase Sapphire Reserve Credit Card, and paid for upgraded seat assignments with my American Express Gold Card and JPMorgan Chase Ritz Carlton Visa Infinite. Then the Coronavirus Pandemic hit and we cancelled our entire NYC trip.

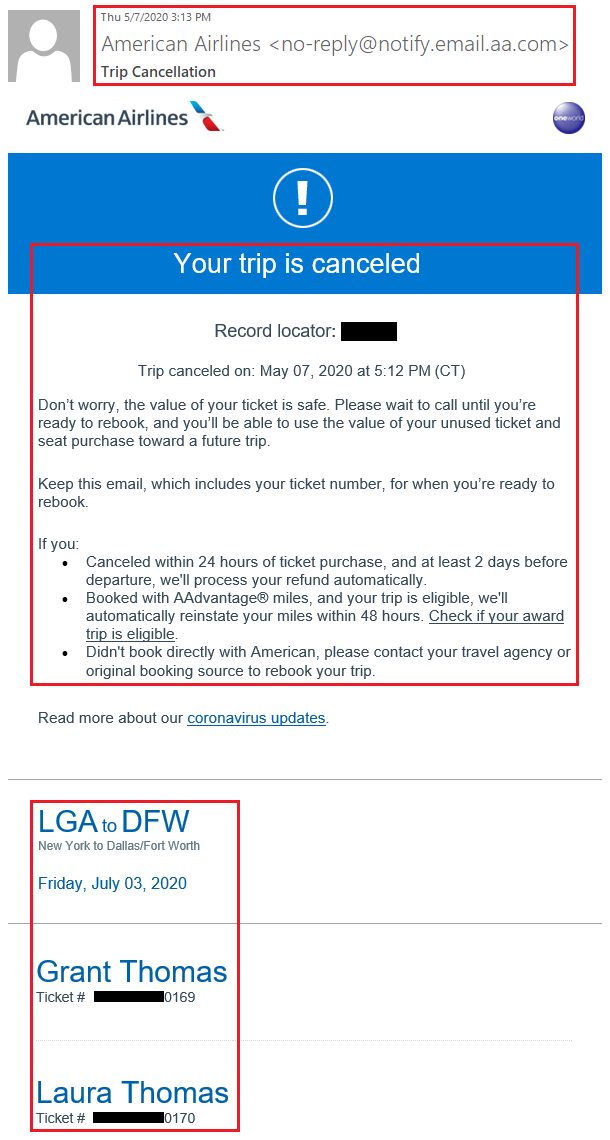

This was my first time cancelling an American Airlines award ticket, so I didn’t know what to expect in terms of refunds and redeposited miles. In this post, I will walk you through the timeline of events. I cancelled our American Airlines award tickets on May 7 and received the following Trip Cancellation email immediately. In the email, it said, “If you booked with AAdvantage miles, and your trip is eligible, we’ll automatically reinstate your miles within 48 hours.” Unfortunately, 48 hours came and went, but nothing happened…