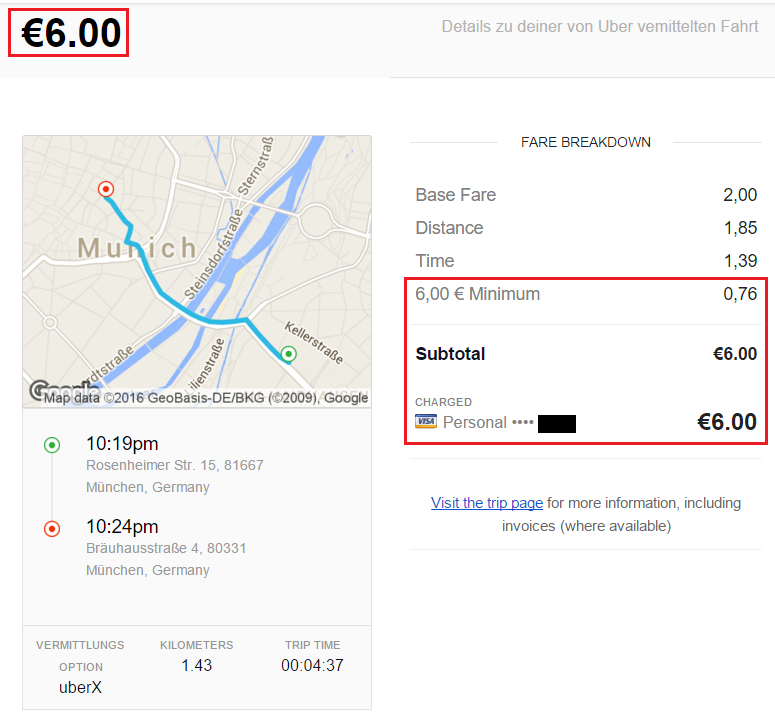

Good morning everyone, I’m here in Munich, Germany, today and flying to Venice, Italy, this evening. I’ve had a few chances to use Uber in Europe (UberX both times) and wanted to share my thoughts. Unfortunately, Uber is not as widespread as it is in the United States and is only available in a few European cities. I have only taken UberX rides in Nice, France, and Munich, Germany.

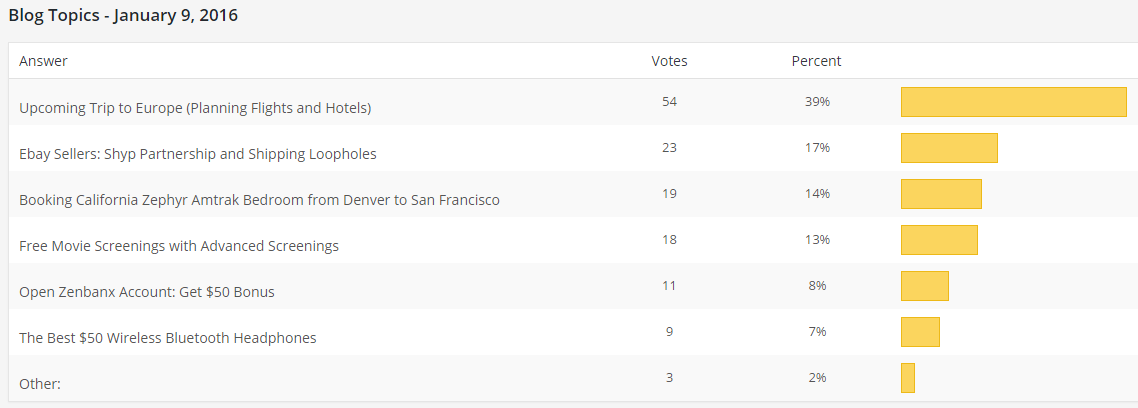

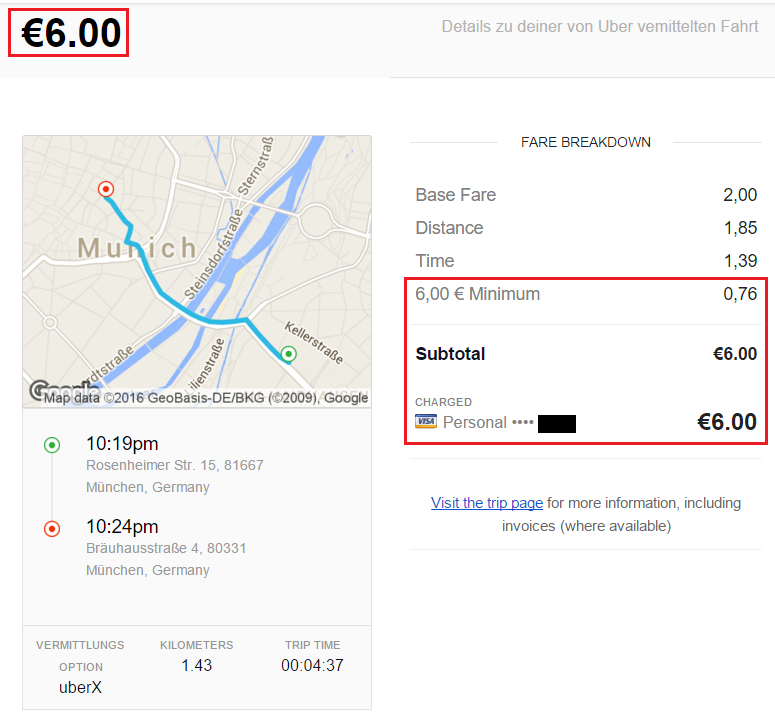

UberX is always cheaper than traditional taxis (excluding surge pricing) and it can sometimes be cheaper than public transportation (buses and trains). For short trips with multiple people, I would use UberX every chance I can. Unfortunately, you need WiFi/data to access the Uber app. I don’t have an international data plan, but I can connect to various free WiFi hotspots in airports, hotels, and cafes. As long as you can request an Uber pickup, you do not need WiFi/data for the duration of the trip. Your credit card will automatically be charged when your ride is over and you will receive an emailed receipt, like the one below.

Continue reading →