Good morning everyone, I hope you all had a great New Years celebration, but now it’s Monday morning and time to get back to reality. A few months ago, my friends Daniel, Esther and Michael started a blog: DEMflyers.com. (The ‘D’ is Daniel, the ‘E’ is Esther, the ‘M’ is Michael, and the ‘flyers’ is who they are.) They are very experienced travel hackers and members of the SF Travel Hackers Meetup Group. Like I always say, 3 travel hackers/bloggers is better than me 1, so I always look forward to reading their informative, educational, and entertaining posts (except for writing 94 letters to IHG, no one has time for that!)

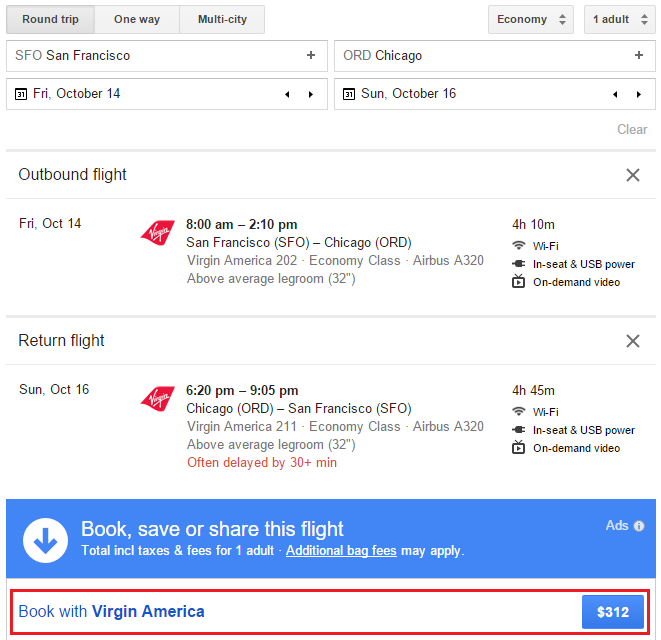

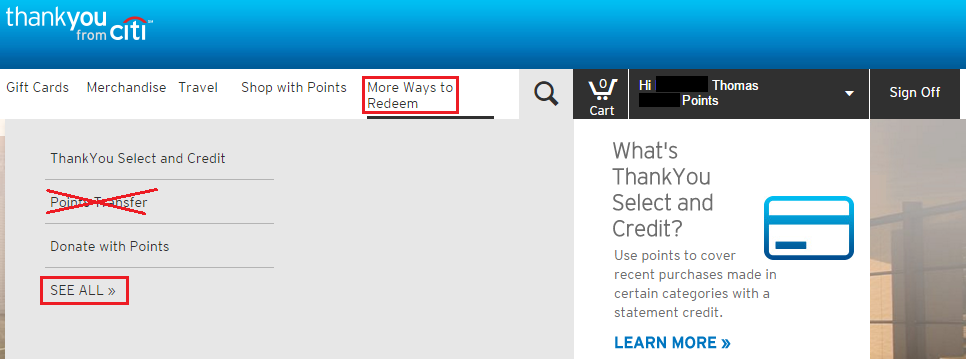

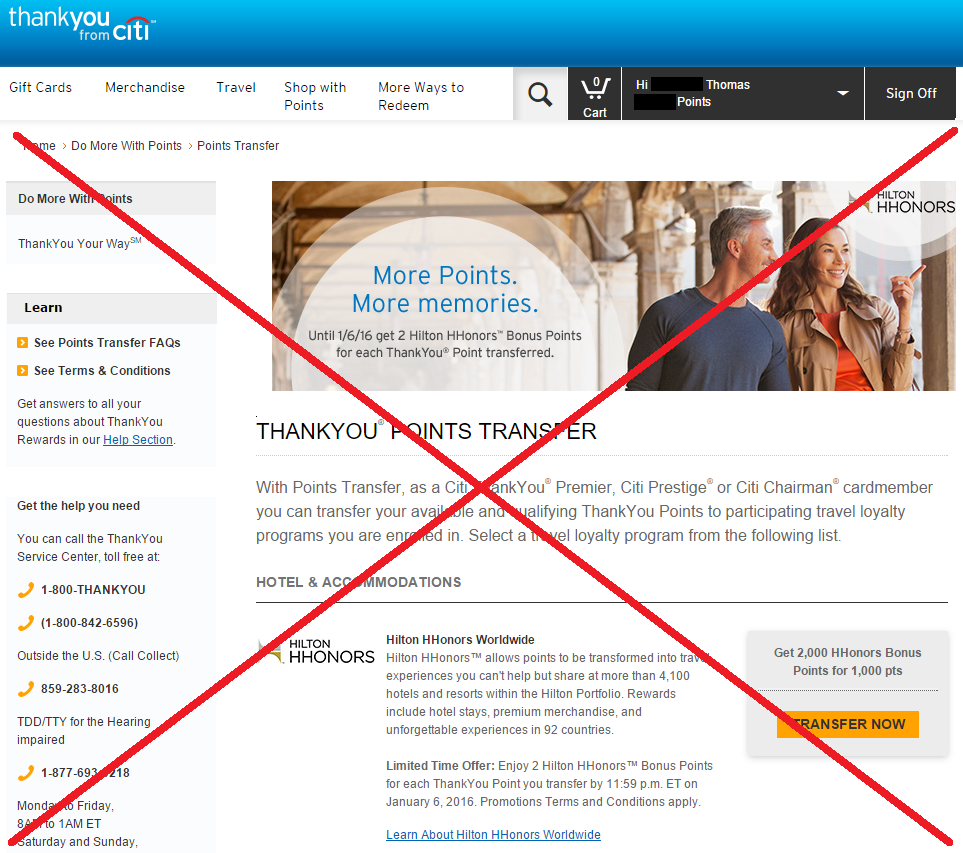

Anyway, a few days ago, I asked the DEMflyers team if they could help me with a math problem. How many Citi Thank You Points per year do I need to redeem to justify paying the $450 Citi Prestige annual fee vs. paying the $95 Citi Premier annual fee? Take it away Daniel…

The number one rule of churning is that you should never pay an annual fee. Go for a retention offer, downgrade, or cancel, but never pay an annual fee.

This is the conventional wisdom for two reasons: First, the fees add up. If you keep just 10 rewards credit cards a year but pay a $95 annual fee on each one, you’re paying nearly $1,000 in annual fees for benefits you probably don’t even use. Second, the value proposition is usually in the sign-up bonus, so you have no reason to keep the card after you’ve received the bonus. Continue reading →