Good afternoon everyone, and I hope your new year is off to a great start! With 2025 officially in the books, it’s time to look back at the blog posts you found most helpful, interesting, and worth clicking on throughout the year. Below you’ll find the 10 most popular posts written in 2025, along with the 10 most popular posts written in previous years that continued to draw strong traffic. If you’re curious, you can also check out the most popular posts from 2016, 2017, 2018, 2019, 2020, 2021, 2022, 2023, and 2024.

2025’s Most Popular Blog Posts (Written During 2025)

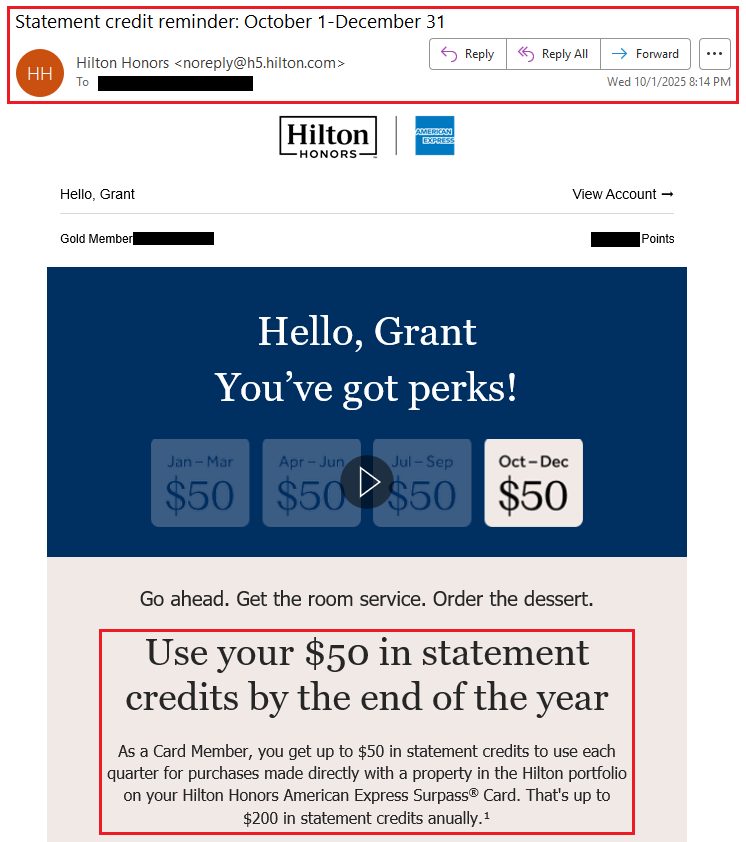

- No Upcoming Hilton Stay? Turn Your Credit Into a $50 Snack Shopping Spree (10/8/25) – I explain how to use your Hilton Credit even if I don’t have an upcoming hotel stay planned. Instead of letting the credit go to waste, I show how I used it for a $50 snack and convenience shopping spree. I did this at the end of Q3, at the end of Q4, and will probably do this again sometime in Q1 2026.

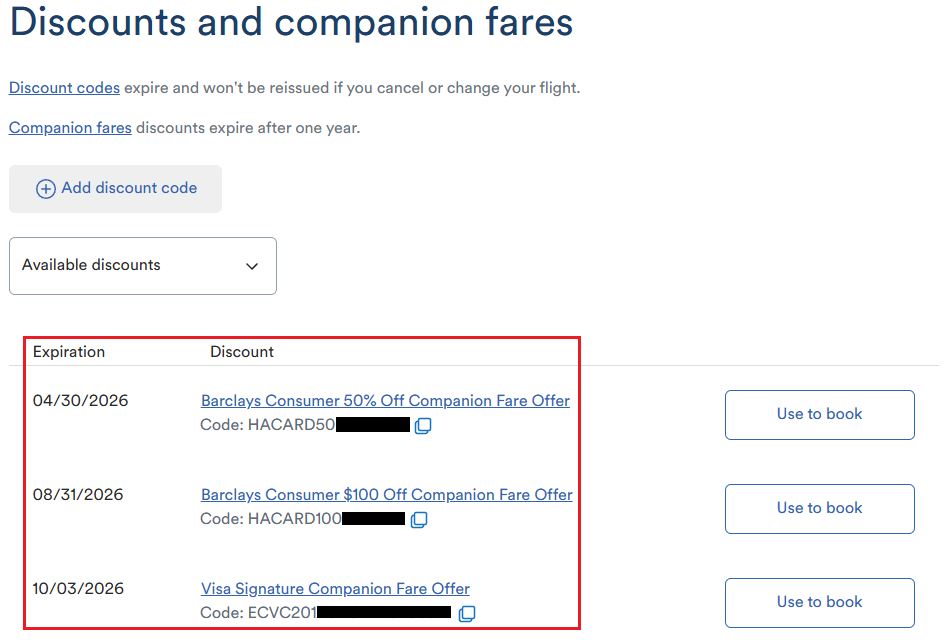

- How to Transfer, Combine, or Move Alaska Airlines and Hawaiian Airlines Miles (With Direct Links) (5/18/25) – I showed the process of transferring / combining Alaska Airlines Miles and Hawaiian Airlines Miles, including direct links to each option. This post is no longer relevant since the 2 programs have merged into Atmos Rewards.

- Should I Transfer All My Amex Points to Hawaiian Airlines? (5/19/25) – I analyzed whether it made sense to transfer all of my American Express Membership Rewards points to Hawaiian Airlines. I weighed the pros, cons, and risks before making what could be a one-way, irreversible decision. This post is no longer relevant since Hawaiian Airlines is no longer an AMEX transfer partner.