Good morning everyone. A few days ago, Frequent Miler wrote a post that Citi Thank You Points Transfers to JetBlue were getting better (1,000 : 1,000 transfers), so I wanted to check out transfer times from all the major credit card programs. I wrote a similar post about Transfer Times to KLM / Air France and Transfer Times to Singapore Airlines. I tested transfers from American Express Membership Rewards Points, Citi Thank You Points, and Chase Ultimate Rewards Points. I was going to try a transfer from Marriott Rewards to JetBlue, but the conversion was so bad, I couldn’t do it (see the screenshots below). JetBlue TrueBlue Points do not have a fixed value and they can range in value from 1 cent up to 2.5 cents, if you find the right redemption. In some cases, you are better off paying for JetBlue travel than redeeming JetBlue TrueBlue Points.

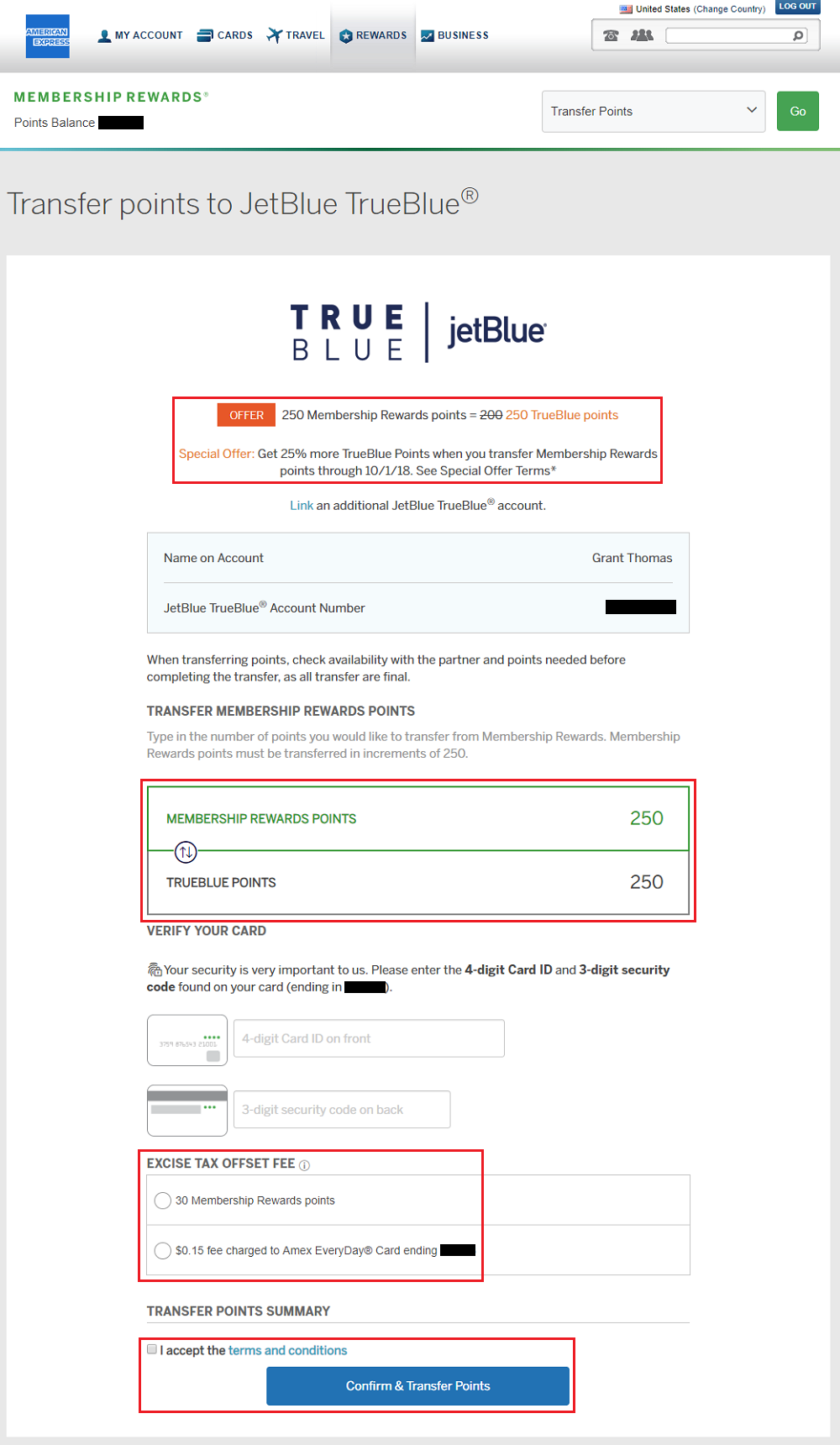

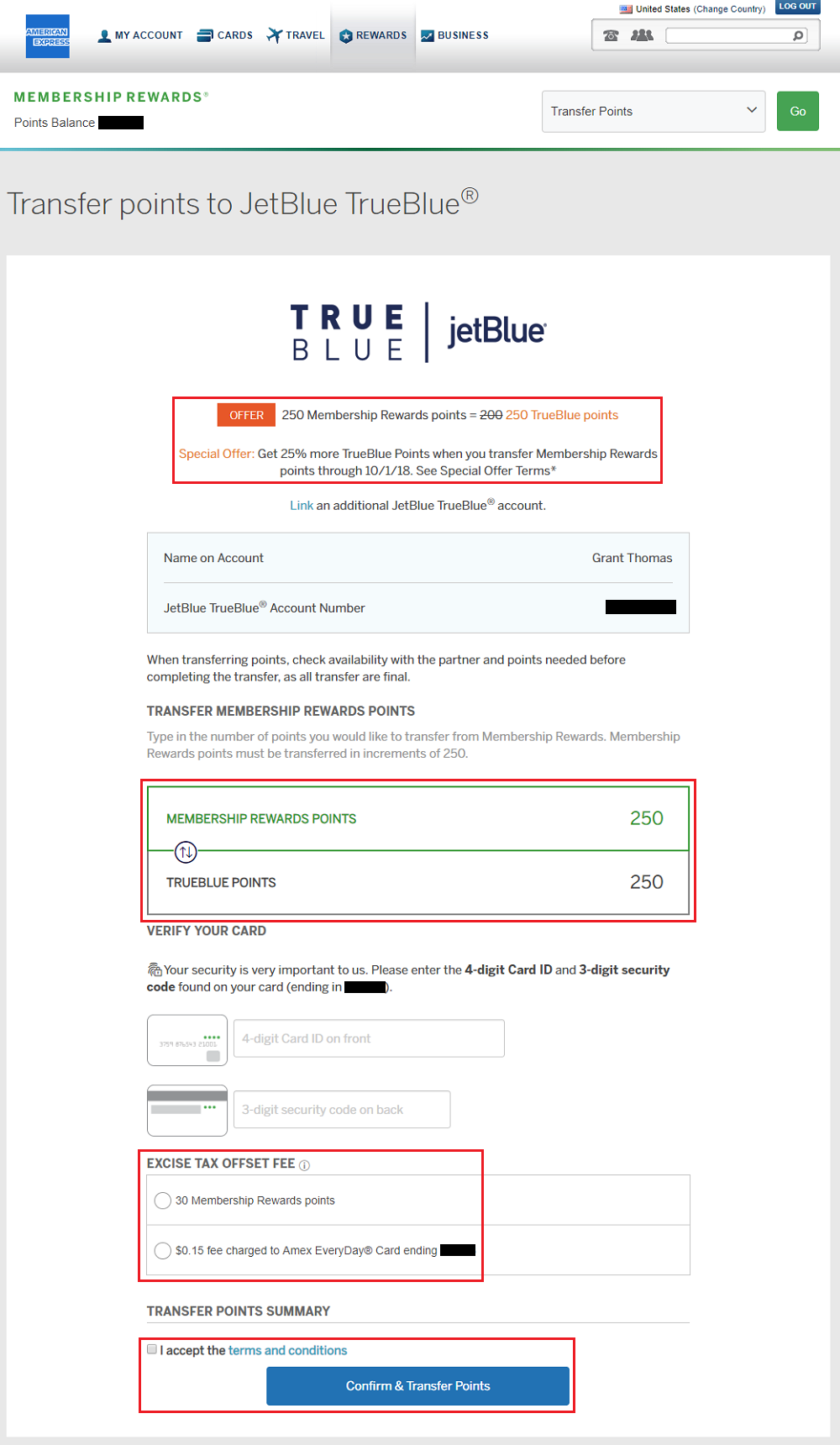

But with that said, sometimes it makes sense to transfer points into your JetBlue account. I started with a transfer from American Express Membership Rewards Points since you can transfer in 250 point increments. Unfortunately, since JetBlue is an American airline, American Express charges a fee for the transfer, either 30 Membership Rewards Points or 15 cents. The amount of the fee varies depending on the number of points you transfer.

Continue reading →