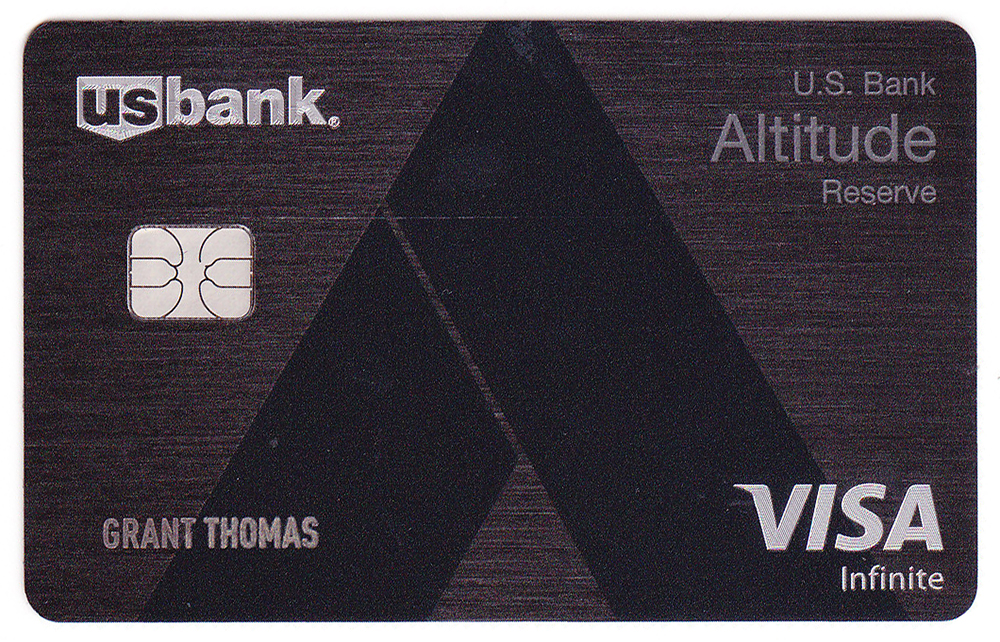

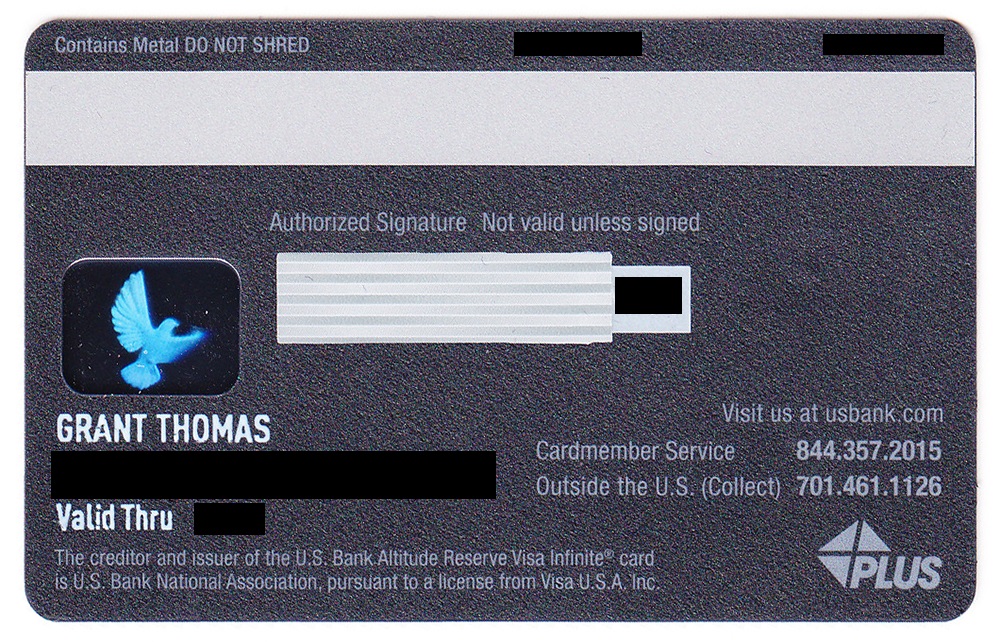

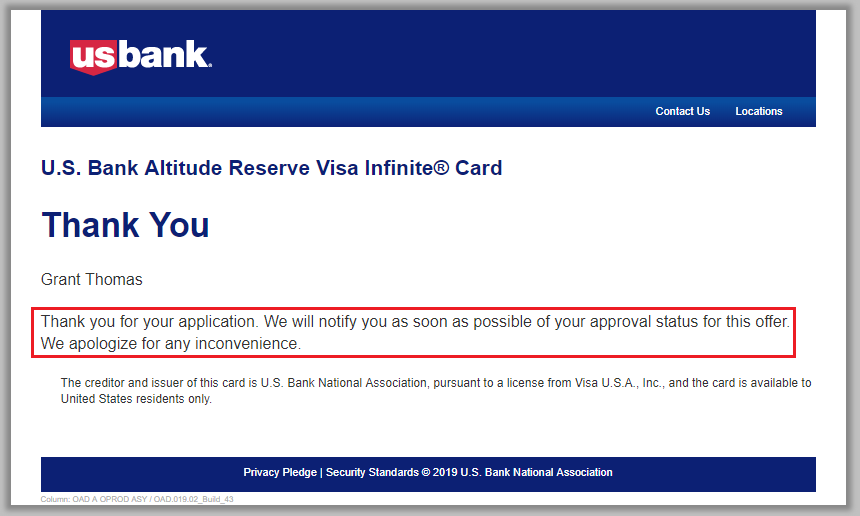

Good afternoon everyone. I hope you enjoyed reading my post from this morning: My March Madness App-O-Rama Results: 3 out of 4 Credit Cards Approved. In that post, I mentioned that I would be doing an unboxing of my new US Bank Altitude Reserve Visa Infinite Credit Card. This credit card has a sign up bonus of 50,000 FlexPoints (worth $750 in flights) after spending $4,500 in 3 months. This card has a $400 annual fee, but offers $325 in airline travel credits that mostly offset the annual fee. There are a few other credit card perks that I will go over in this post. But first, take a look at how beautiful this credit card is. The card is a thick metal, similar to the Chase Sapphire Reserve Credit Card. On the front of the credit card, it only shows your full name. On the back, it has your full name again along with all the other credit card information. Let me show you the rest of the items that came with this credit card.