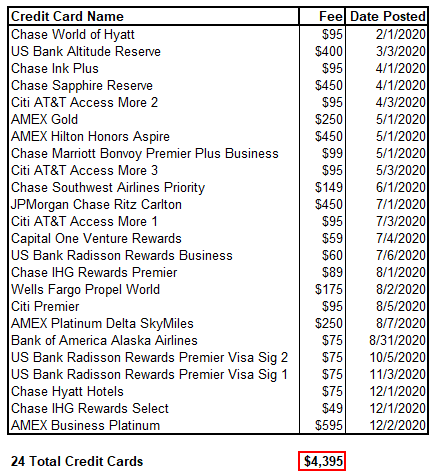

Good afternoon everyone, I hope your week is going well. I recently completed the minimum spending requirement for 4 different credit cards (My October 2020 Credit Card App-O-Rama Results) and wanted to share my best practices for new credit cards and sign up bonuses. I currently have 32 credit and charge cards open and have had 90 other cards since I started travel hacking in 2011. To the best of my knowledge, I have never missed a credit card sign up bonus by not completing the minimum spending requirement. Feel free to use all, some, or none of my best practices with your next credit card. For this post, I am going to use a fictitious credit card as an example to illustrate some of the pitfalls to avoid.

ABC Credit Card has a sign up bonus of 50,000 points after spending $3,000 in 3 months with a $95 annual fee. You apply for the credit card on January 1 and your application is pending. Your application gets approved on January 5 and your new credit card arrives on January 15. You activate your new credit card on January 18.

Credit Card Tidying and Organization

When your new credit card arrives, I recommend activating it immediately. Then set up online access to view and track your purchases. If you get paid monthly, you may want to change the bill due date to a date that is more convenient for you (unfortunately, this may not be possible until after the first statement closes). For simplicity, I like to have all my credit card statements close around the same date, so that I do not need to remember several different credit card due dates or statement closing dates.

If you are concerned about accidentally making a cash advance purchase, call the credit card company and ask to lower your cash advance limit to $0. If you were approved with a small credit limit and have other credit cards from the same credit card company, ask if they can transfer some of your credit limit over to your new credit card. If you want to receive your statements electronically, sign up for electronic statements (I will explain why below). Continue reading →