Good morning everyone. As you all probably know by now, the Chase Sapphire Reserve Credit Card will be adding 2 new benefits (Lyft Pink Membership & DoorDash’s DashPass with a $60 yearly credit) along with raising the annual fee from $450 to $550, beginning on January 12. Doctor of Credit has all the details on the key dates:

- Annual fee will increase to $550 for new users on January 12, 2020

- Annual fee will increase to $550 for existing users in April 2020

- Not possible to product change to the card until after January 12, 2020 (new $550 annual fee will be charged)

- Complimentary Lyft pink membership to be added on January 12, 2020

- $60 DoorDash credit to be added for 2020 and 2021 (this is is an annual credit that is valid from 1/12 – 12/31 each year)

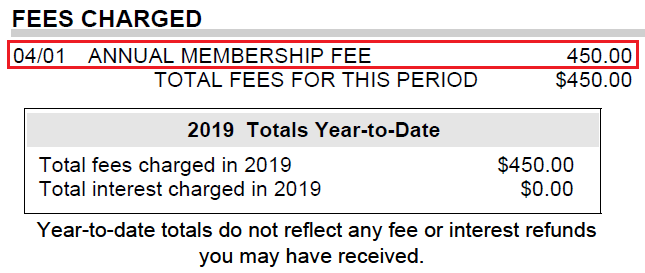

The first thing I wanted to do was take a look at my 2019 credit card statements and see when the $450 annual fee posted to my Chase Sapphire Reserve. It looks like my annual fee posted on April 1, 2019. The new $550 annual fee will increase in April 2020, but no specific date is listed. If I am really unlucky, the $550 annual fee will post on my April 2020 statement, but if I am really lucky, the $550 annual fee will post next year on my April 2021 statement. I should have my answer in 3 months…