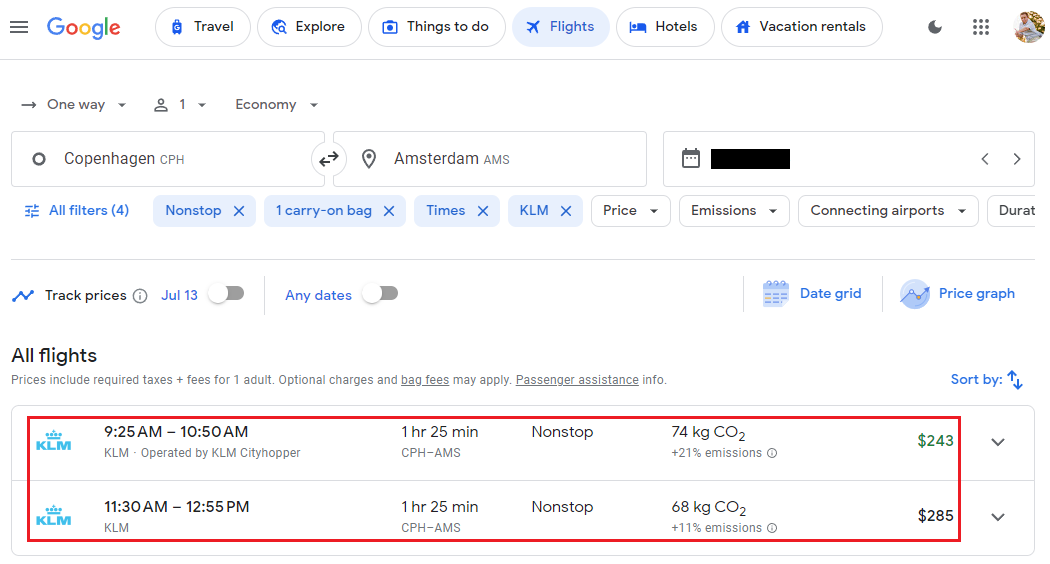

Good afternoon everyone. 2 weeks ago, my wife and I decided to book a last minute trip to Europe this summer with stops in Prague (PRG), Copenhagen (CPH), and Amsterdam (AMS). When I searched for flights from Copenhagen to Amsterdam (CPH-AMS), I found 2 morning flights on KLM that would work perfectly for our schedule. Unfortunately, the prices ($243-$285) were a little higher than we wanted to pay for the 1.5 hour flight. I used Point.me to search for these flights to see if they were bookable with miles. Strangely, the award prices were lower in business class than in economy. Let me show you what I found and how I booked the award ticket.