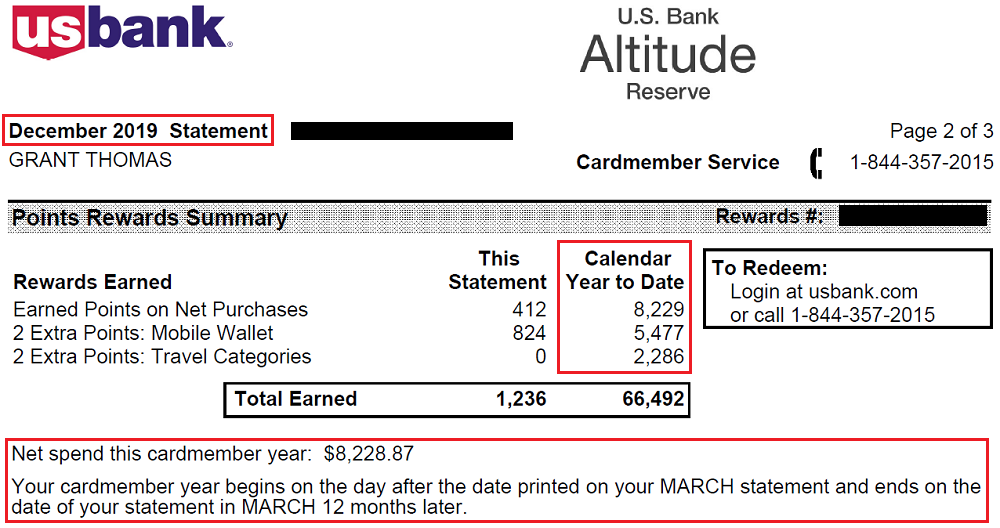

Good morning everyone, happy Friday! I was listening to the Frequent Miler On The Air podcast recently and they were discussing free night certificates. As I mentioned in my Ask Me Anything (AMA): Hotel Edition post, I have quite a few hotel credit cards that come with free night certificates. I wanted to compare the free night certificates and separate the standouts from the duds. I used Frequent Miler’s Reasonable Redemption Values (RRV) for the hotel point values. Some of these credit cards are available for new members, while some are no longer available (NLA), but you may be able to convert to them if you have the correct credit card.

I looked at the credit card’s annual fee and the category cap that the free night certificate is good for. I also included Radisson Rewards anniversary points, even though they are points and not free night certificates. I did not take into account any addition benefits other than the free night certificate (like elite status or the ability to earn an extra free night certificate).

This is how I read the chart: the Chase Marriott Bonvoy Premier Credit Card (NLA) has an $85 annual fee and comes with a free night certificate worth up to 25,000 Marriott Bonvoy Points. Each Marriott Bonvoy Point is worth 0.72 cents per point (CPP), so the free night certificate has a value of $180. When I subtract the $95 annual fee, the credit card provides $95 in value on top of the annual fee.

Hotel Credit Card Name

(NLA = No Longer Available) |

Annual

Fee |

Category

Cap |

RRV

CPP |

Free Night Value |

True Value

(FNV – AF) |

| Marriott Credit Cards |

|

|

|

|

|

| Chase Marriott Bonvoy Premier (NLA) |

$85.00 |

25,000 |

0.72 |

$180.00 |

$95.00 |

| Chase Marriott Bonvoy Boundless |

$99.00 |

35,000 |

0.72 |

$252.00 |

$153.00 |

| Chase Marriott Bonvoy Premier Plus Biz (NLA) |

$99.00 |

35,000 |

0.72 |

$252.00 |

$153.00 |

| American Express Marriott Bonvoy Biz |

$125.00 |

35,000 |

0.72 |

$252.00 |

$127.00 |

| American Express Marriott Bonvoy Brilliant |

$450.00 |

50,000 |

0.72 |

$360.00 |

-$90.00 |

| JPMorgan Chase Ritz Carlton (NLA) |

$450.00 |

50,000 |

0.72 |

$360.00 |

-$90.00 |

| Radisson Rewards Credit Cards |

|

|

|

|

|

| US Bank Radisson Rewards (NLA) |

$50.00 |

25,000 |

0.38 |

$95.00 |

$45.00 |

| US Bank Radisson Rewards Biz (NLA) |

$60.00 |

40,000 |

0.38 |

$152.00 |

$92.00 |

| US Bank Radisson Rewards Premier |

$75.00 |

40,000 |

0.38 |

$152.00 |

$77.00 |

| Hyatt Credit Cards |

|

|

|

|

|

| Chase Hyatt Hotels (NLA) |

$75.00 |

15,000 |

1.50 |

$225.00 |

$150.00 |

| Chase World of Hyatt |

$95.00 |

15,000 |

1.50 |

$225.00 |

$130.00 |

| IHG Credit Cards |

|

|

|

|

|

| Chase IHG Rewards Select (NLA) |

$49.00 |

40,000 |

0.57 |

$228.00 |

$179.00 |

| Chase IHG Rewards Premier |

$89.00 |

40,000 |

0.57 |

$228.00 |

$139.00 |

| Hilton Credit Cards |

|

|

|

|

|

| American Express Hilton Honors Aspire |

$450.00 |

95,000 |

0.45 |

$427.50 |

-$22.50 |

| American Express Hilton Honors Aspire |

$450.00 |

120,000 |

0.45 |

$540.00 |

$90.00 |

Continue reading →