Good afternoon everyone. Hot off the heals of the massive Southwest Airlines devaluation this morning, I found another devaluation on my recent US Bank Smartly Checking account statement. The main dagger is how to waive the monthly maintenance fee: “Having an eligible personal U.S. Bank credit card no longer waives the Monthly Maintenance Fee”. Here are the full details:

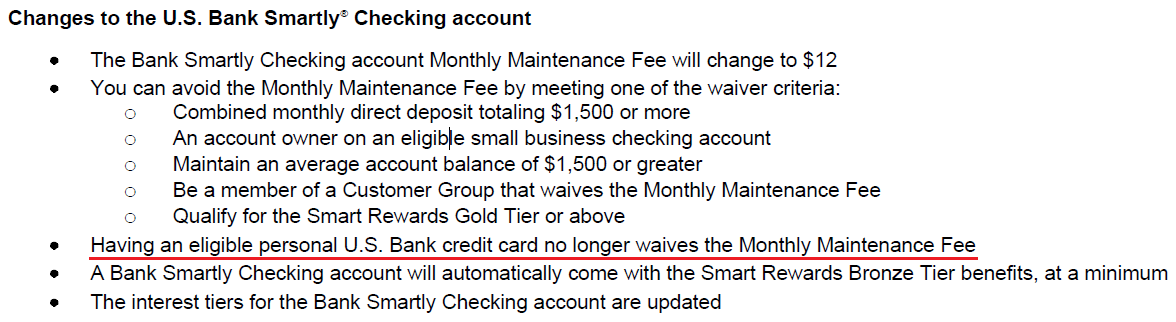

Changes to the U.S. Bank Smartly Checking account

-

- The Bank Smartly Checking account Monthly Maintenance Fee will change to $12

- You can avoid the Monthly Maintenance Fee by meeting one of the waiver criteria:

- Combined monthly direct deposit totaling $1,500 or more

- An account owner on an eligible small business checking account

- Maintain an average account balance of $1,500 or greater

- Be a member of a Customer Group that waives the Monthly Maintenance Fee

- Qualify for the Smart Rewards Gold Tier or above

- Having an eligible personal U.S. Bank credit card no longer waives the Monthly Maintenance Fee

- A Bank Smartly Checking account will automatically come with the Smart Rewards Bronze Tier benefits, at a minimum

- The interest tiers for the Bank Smartly Checking account are updated