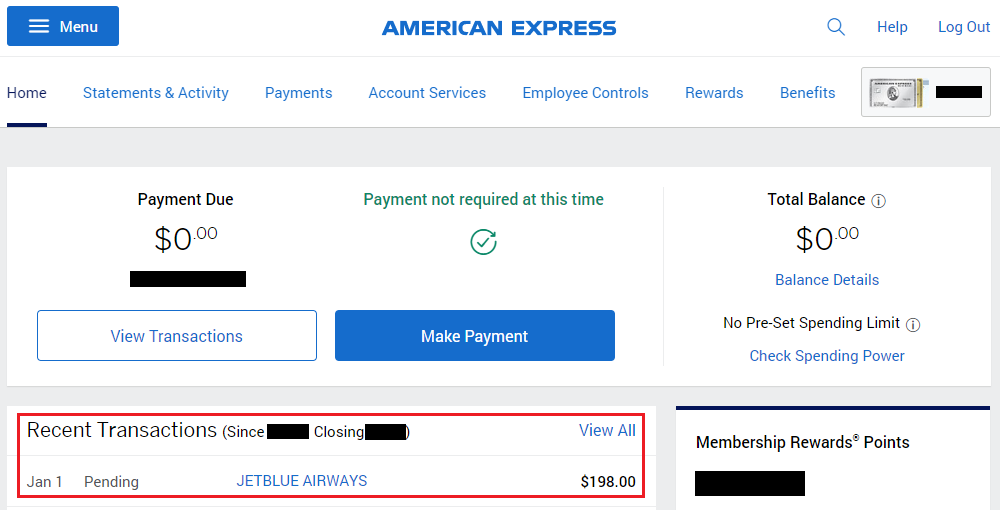

Good morning everyone, I hope your week is going well. As part of My 5 New Year’s Travel Resolutions for 2020, I said that I would “Use American Express Airline Fee Credits (Without Buying Airline GCs / eGCs).” So far in 2020, I am following through on my resolution. Last month, I used my JetBlue True Blue Points to book flights for Laura and I to fly from SFO to BOS. It is a 5.5 hour red eye flight, so I looked at how much the Even More Space seats cost and found out the seats I wanted were $99 each. Instead of purchasing those seats with cash in 2019, I decided to use the $200 airline fee credit that comes with my American Express Business Platinum Charge Card to cover the charges. I selected JetBlue as my airline for 2020 and paid for the 2 seats with my AMEX Business Platinum. The pending charge looked like a single $198 JetBlue purchase…