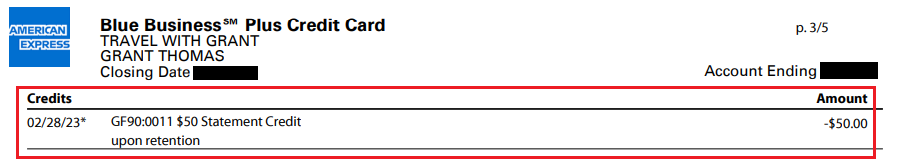

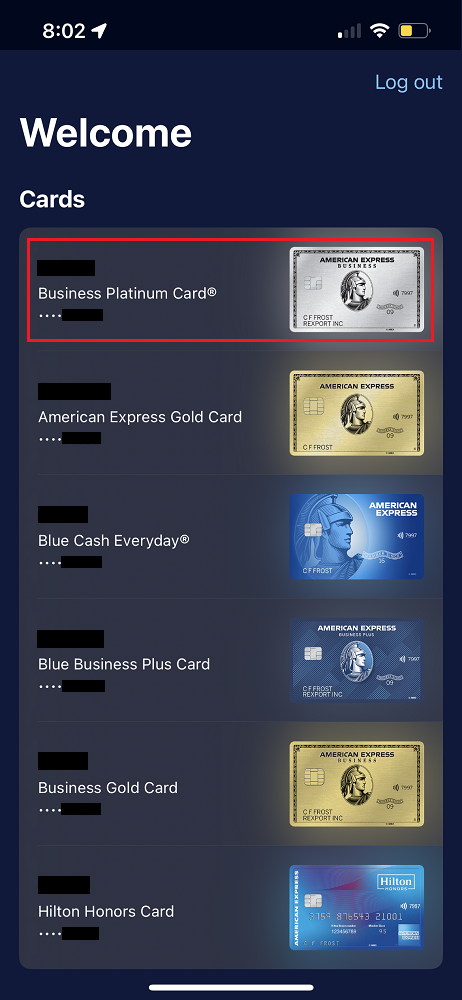

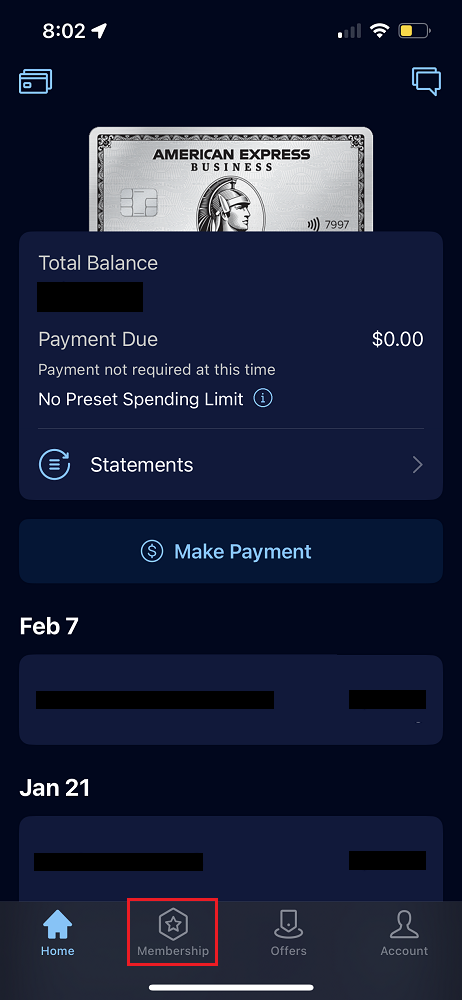

Good morning everyone, I hope your week is going well. Over the last few weeks, I made retention calls on 2 credit cards and I wanted to share my data points. I started with the American Express Blue Business Plus Credit Card. Even though this credit card doesn’t have an annual fee, I had heard others had success getting retention offers, so I decided to call and see if there were any offers. I started with the AMEX Chat, but the chat rep said I needed to call a specific department to talk about retention offers. On the phone, I explained to the rep that I have been using my American Express Business Platinum Card and American Express Business Gold Card a lot recently and haven’t been using my AMEX Blue Business Plus very much lately and I was considering closing the card. The rep checked the offers and said they could offer me a $50 statement credit with no spend. I asked if there were any other offers, but there were no better offers available, so I gladly accepted the offer. The $50 statement credit posted to my account a few days later.