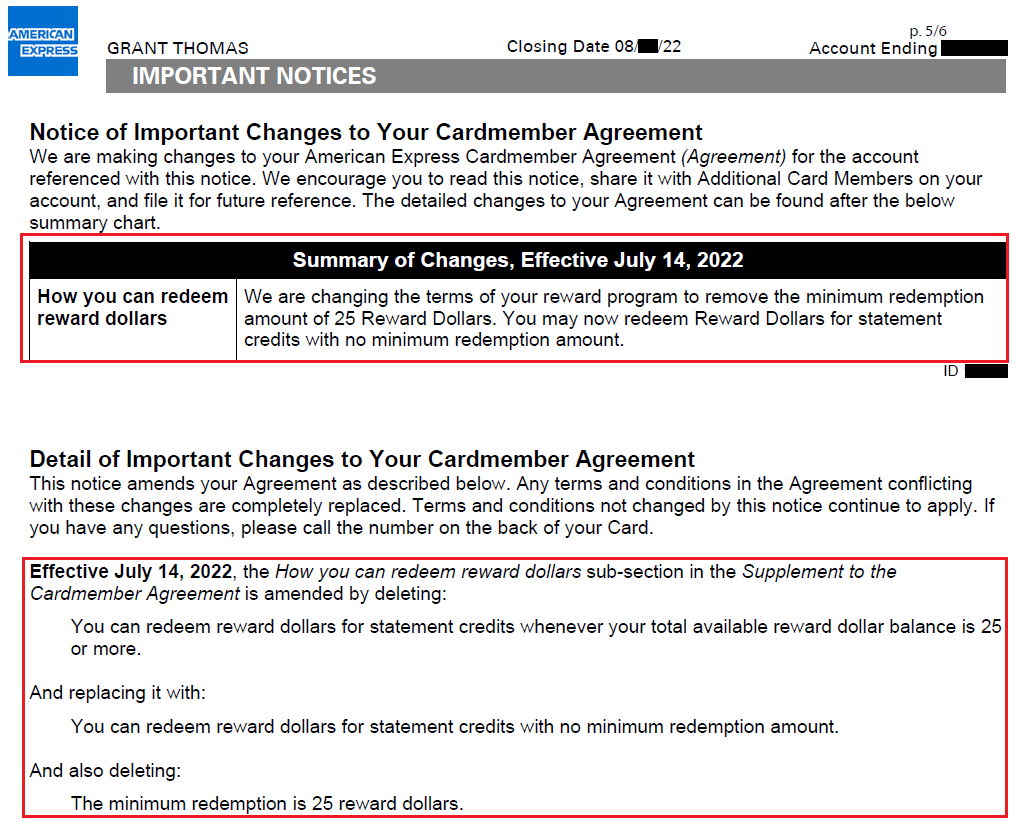

Good afternoon everyone, happy Friday! In news that probably only matters to me, there is a positive change on the American Express Old Blue Cash Credit Card (OBC). I was reviewing my recent credit card statement and saw that American Express removed the $25 minimum redemption amount, effective July 14, 2022. As far as I remember, this credit card has had the $25 redemption threshold since I initially got this credit card back in 2014. I decided to check it out and redeem my entire balance… all $15.07 of it :)